Supercuts 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

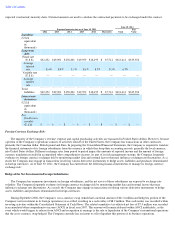

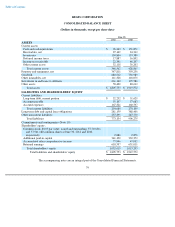

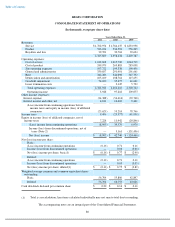

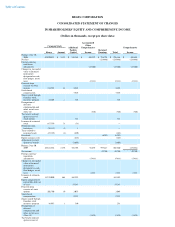

The accompanying notes are an integral part of the Consolidated Financial Statements.

81

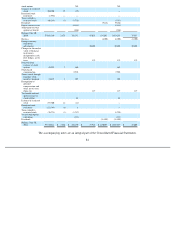

stock options

262

262

Issuance of restricted

stock

304,200

15

(15

)

—

Restricted stock

forfeitures

(1,976

)

—

—

—

Taxes related to

restricted stock

(66,161

)

(3

)

(1,710

)

(1,713

)

Dividends

(9,146

)

(9,146

)

Equity issuance costs

(8,154

)

(8,154

)

Adjustment to stock

option tax benefit

(264

)

(264

)

Balance, June 30,

2010

57,561,180

2,878

332,372

47,032

631,011

1,013,293

37,917

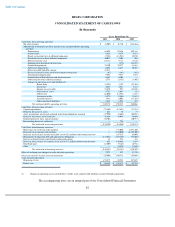

Net loss

(8,905

)

(8,905

)

(8,905

)

Foreign currency

translation

adjustments

30,405

30,405

30,405

Changes in fair market

value of financial

instruments

designated as cash

flow hedges, net of

taxes

132

132

132

Proceeds from

exercise of stock

options

45,933

2

680

682

Stock-based

compensation

9,596

9,596

Shares issued through

franchise stock

incentive program

24,472

1

397

398

Recognition of

deferred

compensation and

other, net of taxes

(Note 14)

377

377

377

Tax benefit realized

upon exercise of

stock options

67

67

Issuance of restricted

stock

277,300

14

(14

)

—

Restricted stock

forfeitures

(121,343

)

(6

)

6

—

Taxes related to

restricted stock

(76,731

)

(3

)

(1,787

)

(1,790

)

Vested stock option

expirations

(127

)

(127

)

Dividends

(11,509

)

(11,509

)

Balance, June 30,

2011

57,710,811

$

2,886

$

341,190

$

77,946

$

610,597

$

1,032,619

$

22,009