Supercuts 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

7. FAIR VALUE MEASUREMENTS (Continued)

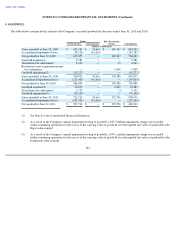

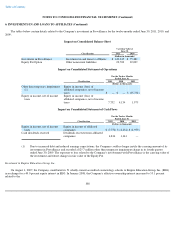

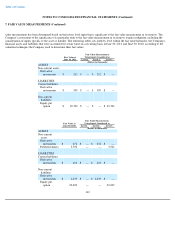

Changes in Financial Instruments Measured at Level 3 Fair Value on a Recurring Basis

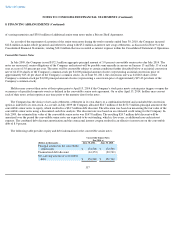

The following tables present the changes during the twelve ended June 30, 2011 and 2010 in our Level 3 financial instruments that are

measured at fair value on a recurring basis.

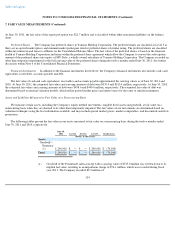

The following methods and assumptions were used to estimate the fair value of each class of financial instrument:

Derivative instruments. The Company's derivative instrument assets and liabilities consist of cash flow hedges represented by interest

rate swaps and forward foreign currency contracts. The instruments are classified as Level 2 as the fair value is obtained using observable inputs

available for similar liabilities in active markets at the measurement date that are reviewed by the Company. See breakout by type of contract

and reconciliation to the balance sheet line item that each contract is classified within Note 9 of the Consolidated Financial Statements.

Equity put option. The Company's merger of the European franchise salon operations with the operations of the Franck Provost Salon

Group on January 31, 2008 contained an equity put and an equity call. In March 2011, a portion of the equity put option was settled. See further

discussion within Note 6 to the Consolidated Financial Statements. The equity put option is valued using binomial lattice models that incorporate

assumptions including the business enterprise value at that date and future estimates of volatility and earnings before interest, taxes, and

depreciation and amortization multiples.

113

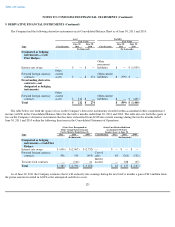

Changes in Financial Instruments

Measured at Level 3 Fair Value

Classified as

Preferred Shares

Equity Put Option

(Dollars in thousands)

Balance at July 1, 2010

$

3,502

$

22,009

Total realized and

unrealized gains

(losses):

Included in other

comprehensive income

(loss)

433

3,847

Included in equity in

income (loss) of

affiliated companies

—

(

2,442

)

Transfer out of Level 3

—

(

714

)

Other than temporary

impairment

(3,935

)

—

Balance at June 30, 2011

$

—

$

22,700

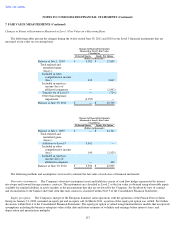

Changes in Financial Instruments

Measured at Level 3 Fair Value

Classified as

Preferred Shares Equity Put Option

(Dollars in thousands)

Balance at July 1, 2009

$

—

$

24,161

Total realized and

unrealized gains

(losses):

Additions to Level 3

3,362

—

Included in other

comprehensive income

(loss)

140

(2,620

)

Included in equity in

income (loss) of

affiliated companies

—

468

Balance at June 30, 2010

$

3,502

$

22,009