Supercuts 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

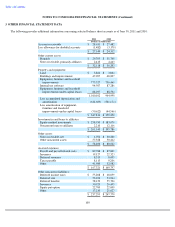

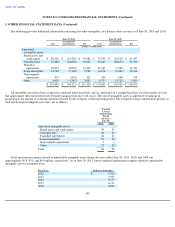

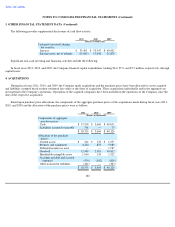

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

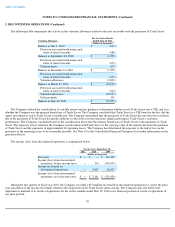

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

balance, the nonaccrual status of financing receivables by class of financing receivables, and impaired financing receivables by class of financing

receivables. Additionally, the guidance requires, among other things, new disclosures on the credit quality indicators of financing receivables at

the end of the reporting period by class of financing receivables and the aging of past due financing receivables at the end of the reporting period

by class of financing receivables. The Company is in compliance with the new disclosure requirements.

Disclosures about Fair Value of Financial Instruments

In January 2010, the FASB issued guidance to amend the disclosure requirements related to recurring and nonrecurring fair value

measurements. The guidance requires new disclosures on the transfers of assets and liabilities between Level 1 (unadjusted quoted prices in

active market for identical assets or liabilities) and Level 2 (significant other observable inputs) of the fair value measurement hierarchy,

including the reasons and the timing of the transfers. Additionally, the guidance requires a roll forward of activities on purchases, sales, issuance,

and settlements of the assets and liabilities measured using significant unobservable inputs (Level 3 fair value measurements).

The Company adopted the new disclosure guidance on January 1, 2010 and the disclosure on the roll forward activities for Level 3 fair

value measurements will be adopted by the Company on July 1, 2011.

Multiple

-Deliverable Revenue Arrangements

In October 2009, the FASB issued guidance on the accounting for multiple-deliverable revenue arrangements. The guidance removes the

criterion that entities must use objective and reliable evidence of fair value in separately accounting for deliverables and provides entities with a

hierarchy of evidence that must be considered when allocating arrangement consideration. The new guidance also requires entities to allocate

arrangement consideration to the separate units of accounting based on the deliverables' relative selling price. The adoption of the new guidance

on July 1, 2010, for multiple-deliverable revenue arrangements, did not have a material effect on the Company's financial position, results of

operations, or cash flows.

Amendments to Accounting for Variable Interest Entities

In June 2009, the FASB issued guidance on the accounting for variable interest entities (VIE). The guidance requires a qualitative approach

to identifying a controlling financial interest in a VIE and requires ongoing assessment of whether an entity is a VIE and whether an entity is a

primary beneficiary of a VIE. This guidance requires enhanced disclosures that will provide users of financial statements with more transparent

information about an enterprise's involvement in a VIE. The adoption of the new guidance on July 1, 2010, for variable interest entities, did not

have a material effect on the Company's financial position, results of operations, and cash flows.

Accounting Standards Recently Issued But Not Yet Adopted by the Company:

Comprehensive Income

In June 2011, the FASB issued guidance on the presentation of comprehensive income. Specifically, the new guidance allows an entity to

present components of net income and other

96