Supercuts 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In March of 2011, the Company elected to honor and settle a portion of the Equity Put and acquired approximately 17 percent additional

equity interest in Provalliance for $57.3 million (approximately € 40.4 million), bringing the Company's total equity interest to approximately

47 percent.

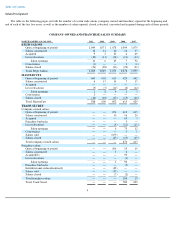

On February 16, 2009, the Company sold Trade Secret. The Company concluded, after a comprehensive review of its strategic and financial

options, to divest Trade Secret. The sale of Trade Secret included 655 company-owned salons and 57 franchise salons, all of which had

historically been reported within the Company's North America reportable segment. The Company recorded an impairment charge related to this

transaction of $183.3 million during the year ended June 30, 2009.

Industry Overview:

Management estimates that annual revenues of the hair care industry are approximately $50 to $56 billion in the United States and

approximately $150 to $170 billion worldwide. The Company estimates that it holds approximately two percent of the worldwide market. The

hair salon and hair restoration markets are each highly fragmented, with the vast majority of locations independently owned and operated.

However, the influence of salon chains on these markets, both franchise and company-owned, has increased substantially. Management believes

that salon chains will continue to have a significant influence on these markets and will continue to increase their presence. As the Company is

the principal consolidator of these chains in the hair care industry, it prevails as an established exit strategy for independent salon owners and

operators, which affords the Company numerous opportunities for continued selective acquisitions.

Salon Business Strategy:

The Company's goal is to provide high quality, affordable hair care services and products to a wide range of mass market consumers, which

enables the Company to expand in a controlled manner. The key elements of the Company's strategy to achieve these goals are taking advantage

of (1) growth opportunities, (2) economies of scale and (3) centralized control over salon operations in order to ensure (i) consistent, quality

services and (ii) a superior selection of high quality, professional products. Each of these elements is discussed below.

Salon Growth Opportunities. The Company's salon expansion strategy focuses on organic (new salon construction and same-store sales

growth of existing salons) and salon acquisition growth.

Organic Growth. The Company executes its organic growth strategy through a combination of new construction of company-

owned and franchise salons, as well as same-store sales increases. The square footage requirements related to opening new salons allow

the Company great flexibility in securing real estate for new salons as the Company has small or flexible square footage requirements for

its salons. The Company's long-term outlook for organic expansion remains strong. The Company has at least one salon in all major

cities in the U.S. and has penetrated every viable U.S. market with at least one concept. However, because the Company has a variety of

concepts, it can place several of its salons within any given market. Once customer visitations stabilize, the Company plans to continue to

expand in North America.

A key component to successful North American organic growth relates to site selection, as discussed in the following paragraphs.

Salon Site Selection. The Company's salons are located in high-traffic locations such as regional shopping malls, strip centers,

lifestyle centers, Walmart Supercenters, high-

street locations and department stores. The Company is an attractive tenant to landlords due

to its financial strength, successful salon operations and international recognition. In evaluating specific locations for both company-

owned and franchise salons, the Company seeks conveniently located, visible

5