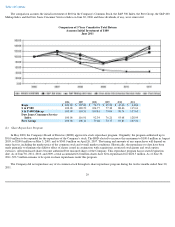

Supercuts 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

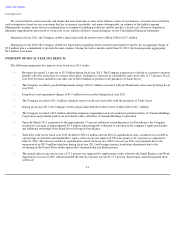

goodwill balance (the approximate impact of the change in the critical assumptions assumes all other assumptions and factors remain constant, in

thousands, except percentages):

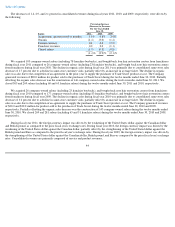

As of our fiscal year 2011 annual impairment test, the estimated fair value of the Regis salon concept exceeded its respective carrying value

by approximately 18.0 percent. As it is reasonably likely that there could be impairment of the Regis salon concept's goodwill in future periods

along with the sensitivity of the Company's critical assumptions in estimating fair value of this reporting unit, the Company has provided

additional information related to this reporting unit.

A summary of the critical assumptions utilized during the annual impairment tests of the Regis salon concept are outlined below:

Annual revenue growth. Annual revenue growth is primarily driven by assumed same-store sales rates of approximately negative

1.0 to positive 3.0 percent. Other considerations include anticipated economic conditions and moderate acquisition growth.

Gross margin. Adjusted for anticipated salon closures, new salon construction and acquisitions estimated future gross margins

were held constant.

Fixed expense rates. Fixed expense rate increases of approximately 1.0 to 2.0 percent based on anticipated inflation. Fixed

expenses consisted of rent, site operating, and allocated general and administrative corporate overhead.

Allocated corporate overhead. Corporate overhead incurred by the home office based on the number of Regis salons as a percent

of total company-owned salons.

Long-term growth. A long-term growth rate of 2.5 percent was applied to terminal cash flow based on anticipated economic

conditions.

Discount rate. A discount rate of 12.0 percent based on the weighted average cost of capital that equals the rate of return on debt

capital and equity capital weighted in proportion to the capital structure common to the industry.

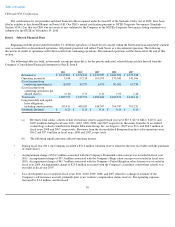

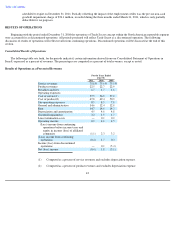

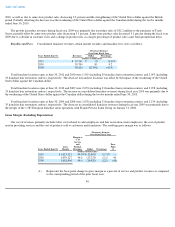

The following table summarizes the approximate impact that a change in certain critical assumptions would have on the estimated fair value

of our Regis salon concept goodwill balance (the approximate impact of the change in the critical assumptions assumes all other assumptions and

factors remain constant, in thousands, except percentages):

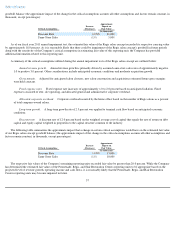

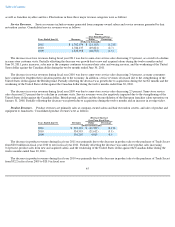

The respective fair values of the Company's remaining reporting units exceeded fair value by greater than 20.0 percent. While the Company

has determined the estimated fair values of the Promenade, Regis, and Hair Restoration Centers reporting units to be appropriate based on the

projected level of revenue growth, operating income and cash flows, it is reasonably likely that the Promenade, Regis, and Hair Restoration

Centers reporting units may become impaired in future

37

Critical Assumptions

Increase

(Decrease)

Approximate

Impact on

Fair Value

(In thousands)

Discount Rate

1.0

%

$

21,000

Same

-

Store Sales

(1.0

)

5,000

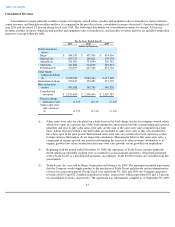

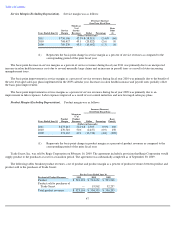

Critical Assumptions

Increase

(Decrease)

Approximate

Impact on

Fair Value

(In thousands)

Discount Rate

1.0

%

$

13,000

Same

-

Store Sales

(1.0

)

10,000