Supercuts 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

scheduled to expire on December 31, 2011. Partially offsetting the impact of the employment credits was the pre-tax non-cash

goodwill impairment charge of $74.1 million, recorded during the three months ended March 31, 2011, which is only partially

deductible for tax purposes.

RESULTS OF OPERATIONS

Beginning with the period ended December 31, 2008 the operations of Trade Secret concept within the North American reportable segment

were accounted for as discontinued operations. All periods presented will reflect Trade Secret as a discontinued operation. The following

discussion of results of operations will reflect results from continuing operations. Discontinued operations will be discussed at the end of this

section.

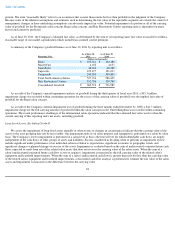

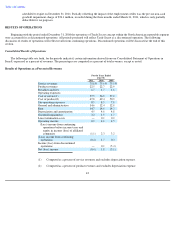

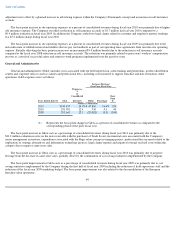

Consolidated Results of Operations

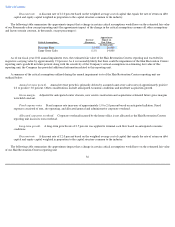

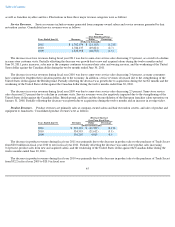

The following table sets forth, for the periods indicated, certain information derived from our Consolidated Statement of Operations in

Item 8, expressed as a percent of revenues. The percentages are computed as a percent of total revenues, except as noted.

Results of Operations as a Percent of Revenues

42

For the Years Ended

June 30,

2011 2010 2009

Service revenues

75.8

%

75.6

%

75.5

%

Product revenues

22.5

22.7

22.9

Royalties and fees

1.7

1.7

1.6

Operating expenses:

Cost of service(1)

57.5

56.9

57.0

Cost of product(2)

47.8

49.4

50.9

Site operating expenses

8.5

8.5

7.8

General and administrative

14.6

12.4

12.0

Rent

14.7

14.6

14.3

Depreciation and amortization

4.5

4.6

4.8

Goodwill impairment

3.2

1.5

1.7

Lease termination costs

—

0.1

0.2

Operating income

0.2

4.1

4.5

(Loss) income from continuing

operations before income taxes and

equity in income (loss) of affiliated

companies

(1.1

)

2.3

3.2

(Loss) income from continuing

operations

(0.4

)

1.7

0.3

Income (loss) from discontinued

operations

—

0.1

(5.4

)

Net (loss) income

(0.4

)

1.8

(5.1

)

(1) Computed as a percent of service revenues and excludes depreciation expense.

(2)

Computed as a percent of product revenues and excludes depreciation expense.