Supercuts 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

6. INVESTMENTS IN AND LOANS TO AFFILIATES (Continued)

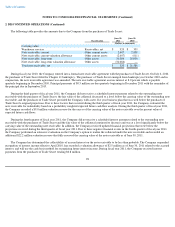

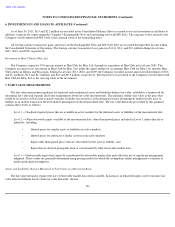

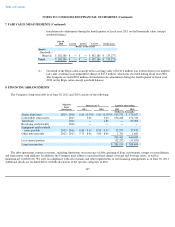

The tables below contain details related to the Company's investment in Provalliance for the twelve months ended June 30, 2011, 2010, and

2009:

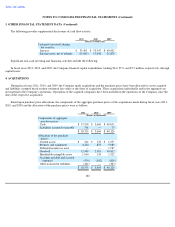

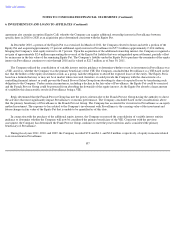

Impact on Consolidated Balance Sheet

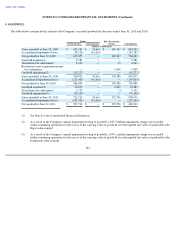

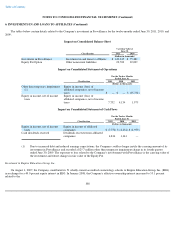

Impact on Consolidated Statement of Operations

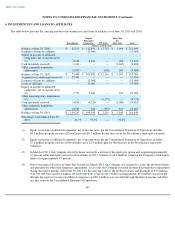

Impact on Consolidated Statement of Cash Flows

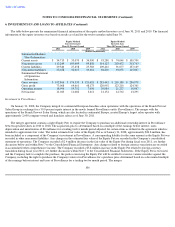

Investment in Empire Education Group, Inc.

On August 1, 2007, the Company contributed its 51 wholly-owned accredited cosmetology schools to Empire Education Group, Inc. (EEG)

in exchange for a 49.0 percent equity interest in EEG. In January 2008, the Company's effective ownership interest increased to 55.1 percent

related to the

108

Carrying Value at

June 30,

Classification

2011

2010

(Dollars in thousands)

Investment in Provalliance

Investment in and loans to affiliates

$

149,245

$

75,481

Equity Put Option

Other noncurrent liabilities

22,700

22,009

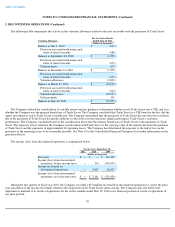

For the Twelve Months

Ended June 30,

Classification

2011

2010

2009

(Dollars in thousands)

Other than temporary impairment

(1)

Equity in income (loss) of

affiliated companies, net of income

taxes

$

—

$

—

$

(

25,732

)

Equity in income, net of income

taxes

Equity in income (loss) of

affiliated companies, net of income

taxes

7,752

4,134

1,979

For the Twelve Months

Ended June 30,

Classification

2011

2010

2009

(Dollars in thousands)

Equity in income, net of income

taxes

Equity in income of affiliated

companies

$

(7,752

)

$

(4,134

)

$

(1,979

)

Cash dividends received

Dividends received from affiliated

companies

4,814

1,141

—

(1) Due to increased debt and reduced earnings expectations, the Company could no longer justify the carrying amount of its

investment in Provalliance and recorded a $25.7 million other than temporary impairment charge in its fourth quarter

ended June 30, 2009. The exposure to loss related to the Company's involvement with Provalliance is the carrying value of

the investment and future changes in fair value of the Equity Put.