Supercuts 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

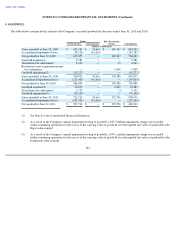

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

comprehensive income in one continuous statement, referred to as the statement of comprehensive income, or in two separate, but consecutive

statements. The new guidance eliminates the current option to report other comprehensive income and its components in the statement of

changes in equity. While the new guidance changes the presentation of comprehensive income, there are no changes to the components that are

recognized in net income or other comprehensive income under current accounting guidance. This new guidance is effective for fiscal years and

interim periods beginning after December 15, 2011. The adoption of the guidance on July 1, 2012 will not have an impact on the Company's

financial position, results of operations or cash flows.

Fair Value Measurement

In April 2011, the FASB issued guidance to achieve common fair value measurement and disclosure requirements between GAAP and

International Financial Reporting Standards. This new guidance amends current fair value measurement and disclosure guidance to include

increased transparency around valuation inputs and investment categorization. This new guidance is effective for fiscal years and interim periods

beginning after December 15, 2011. The adoption of the guidance on July 1, 2012 will not have an impact on the Company's consolidated

financial position, results of operations or cash flows.

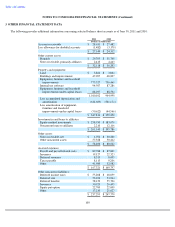

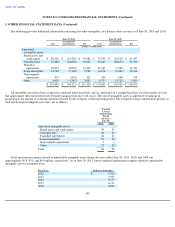

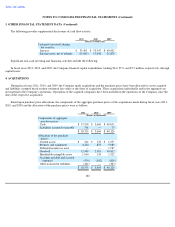

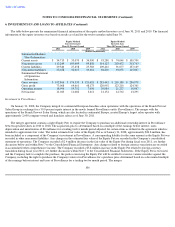

2. DISCONTINUED OPERATIONS

On February 16, 2009, the Company sold its Trade Secret salon concept (Trade Secret). The Company concluded, after a comprehensive

review of strategic and financial options, to divest Trade Secret. The sale of Trade Secret included 655 company-owned salons and 57 franchise

salons, all of which had historically been reported within the Company's North America reportable segment. The sale of Trade Secret included

Cameron Capital I, Inc. (CCI). CCI owned and operated PureBeauty and BeautyFirst salons which were acquired by the Company on

February 20, 2008.

The Company concluded that Trade Secret qualified as held for sale as of December 31, 2008, under accounting for the impairment or

disposal of long-lived asset guidance, and is presented as discontinued operations in the Consolidated Statements of Operations for all periods

presented. The operations and cash flows of Trade Secret have been eliminated from ongoing operations of the Company and there will be no

significant continuing involvement in the operations after disposal pursuant to guidance in determining whether to report discontinued

operations. The agreement included a provision that the Company would supply product to the purchaser of Trade Secret and provide certain

administrative services for a transition period. Under this agreement, the Company recognized $20.0 and $32.2 million of product revenues on

the supply of product sold to the purchaser of Trade Secret and $1.9 and $2.9 million of other income related to the administrative services

during the years ended June 30, 2010 and 2009, respectively. The agreement was substantially complete as of September 30, 2009.

Beginning within the second quarter of fiscal year 2010, the Company has an agreement in which the Company provides warehouse

services to the purchaser of Trade Secret. Under the warehouse services agreement, the Company recognized $2.7 and $3.0 million of other

income related to warehouse services during the twelve months ended June 30, 2011 and 2010, respectively.

97