Supercuts 2011 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

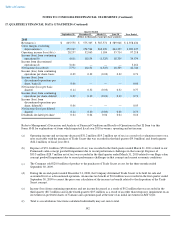

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

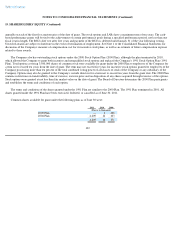

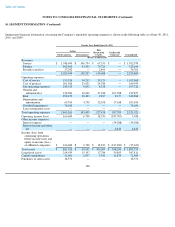

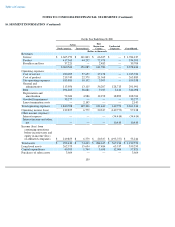

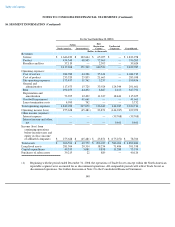

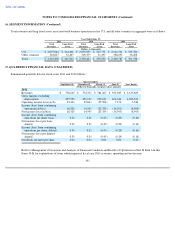

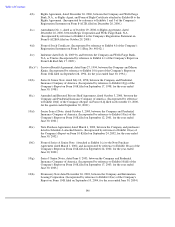

17. QUARTERLY FINANCIAL DATA (UNAUDITED) (Continued)

142

Quarter Ended

September 30

December 31

March 31

June 30

Year Ended

(Dollars in thousands, except per share amounts)

2010

Revenues(c)

$

605,550

$

575,365

$

587,571

$

589,948

$

2,358,434

Gross margin, excluding

depreciation(c)

259,967

254,564

260,199

264,397

1,039,127

Operating income (loss)(b)(c)

28,257

32,063

1,184

35,714

97,218

Income (loss) from continuing

operations(b)

4,611

18,154

(1,525

)

18,339

39,579

Income from discontinued

operations(d)

3,161

—

—

—

3,161

Net income (loss)(b)(d)

7,772

18,154

(1,525

)

18,339

42,740

Income (loss) from continuing

operations per share, basic

0.09

0.32

(0.03

)

0.32

0.71

Income (loss) from

discontinued operations per

share, basic(d)

0.06

—

—

—

0.06

Net income (loss) per basic

share(f)

0.14

0.32

(0.03

)

0.32

0.77

Income (loss) from continuing

operations per share, diluted

0.09

0.30

(0.03

)

0.30

0.71

Income (loss) from

discontinued operations per

share, diluted(f)

0.06

—

—

—

0.05

Net income (loss) per diluted

share(f)

0.14

0.30

(0.03

)

0.30

0.75

Dividends declared per share

0.04

0.04

0.04

0.04

0.16

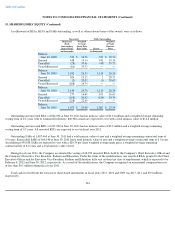

Refer to Management's Discussion and Analysis of Financial Condition and Results of Operations in Part II, Item 6 in this

Form 10-K for explanations of items which impacted fiscal year 2010 revenues, operating and net income.

(a) Operating income and net income decreased $31.2 million ($19.2 million net of tax) as a result of a valuation reserve on a

note receivable with the purchase of Trade Secret that was recorded in the third quarter ($9.0 million) and fourth quarter

($22.2 million) of fiscal year 2011.

(b) Expense of $74.1 million ($50.8 million net of tax) was recorded in the third quarter ended March 31, 2011 related to our

Promenade salon concept goodwill impairment due to recent performance challenges in that concept. Expense of

$35.3 million ($28.7 million net of tax) was recorded in the third quarter ended March 31, 2010 related to our Regis salon

concept goodwill impairment due to recent performance challenges in that concept and current economic conditions.

(c) The Company sold $20.0 million of product to the purchaser of Trade Secret at cost for the three months ended

September 30, 2009.

(d) During the second quarter ended December 31, 2008, the Company determined Trade Secret to be held for sale and

accounted for it as a discontinued operation. An income tax benefit of $3.0 million was recorded in the first quarter ended

September 30, 2009 to correct the prior year calculation of the income tax benefit related to the disposition of the Trade

Secret concept.

(e) Income (loss) from continuing operations and net income decreased as a result of $9.2 million that was recorded in the

third quarter ($8.7 million) and in the fourth quarter ($0.5 million) as a result of an other than temporary impairment on an

investment in preferred shares of Yamano and a premium paid at the time of an initial investment in MY Style.

(f)

Total is a recalculation; line items calculated individually may not sum to total.