Square Enix 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

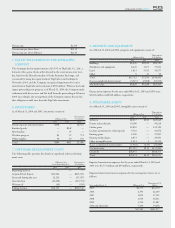

62 SQUARE ENIX 2004

Accrued bonus 500 27 4,773

Reserve for sales return and

price protection 553 — 5,237

Accrued expense and other 381 371 3,608

Investment securities 472 8 4,475

Investment tax credit 118 — 1,126

Net operating loss carryforward

in consolidated subsidiary 666 — 6,307

Other 34 2 253

Gross deferred tax assets 3,568 1,685 33,776

Deferred tax liabilities:

Software development costs ¥453 — $4,291

Fixed assets 13,767 — 130,264

Valuation gain on investment securities 249 15 2,362

Gross deferred tax liabilities 14,469 15 136,917

Net deferred tax (liabilities) assets ¥(10,901) ¥1,670 $(103,141)

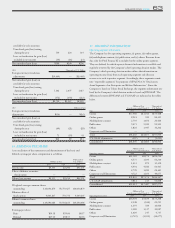

On April 1, 2003, the acquisition of Square took place in the form of a

qualified non-taxable merger. Accordingly, the tax attributes to produce

future tax deduction in the amount of ¥9,867 million were transferred,

without limitation, to the Company. It included pre-merger net operating

loss carryforwards (NOLs) and the deductible temporary difference that

arose from a past write-off of a depreciable motion picture film in the

amount of ¥1,661 million and ¥2,211 million, respectively. Transferred

pre-merger NOLs were fully utilized in the year ended March 31, 2004.

At March 31, 2004, the U.S. subsidiary has NOLs and research and

development credits for federal income tax purposes of approximately

$16.3 million and $0.3 million, respectively expiring beginning in 2017.

Utilization of these net operating loss and credits carryforwards has certain

limitations.

The total amount of undistributed earnings of foreign subsidiaries for

income tax purposes was approximately ¥5,128 million and ¥4,547 million

for the years ended March 31, 2004 and 2003, respectively. It is the

Company’s intention to reinvest undistributed earnings of its foreign sub-

sidiaries and thereby indefinitely postpone their remittance. Accordingly,

no provision has been made for the Japanese income taxes which may

become payable if undistributed earnings of foreign subsidiaries were paid

as dividends to the Company.

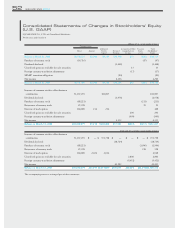

15. STOCKHOLDERS’ EQUITY

Merger

On April 1, 2003, the Company issued 51,167,293 shares of common stock

in exchange for shares of former Square as a result of the statutory merger.

The merger was accounted for using "pooling of interest method of

accounting" for JCC purposes, and accordingly, the stockholders’ equity of

liquidated Square was combined with that of the Company. The Company

made cash payments to stockholders of former Square in the total amount

of ¥4,153 million in lieu of dividend for the final year of Square ended

March 31, 2003.

Dividend

The JCC requires that dividends declared shall be paid out of retained

earnings of the Company at the end of each fiscal year, and such retained

earnings available for dividend shall be calculated in accordance with relat-

ed JCC requirements and JPNGAAP. Since the merger with Square was

accounted for using "pooling of interest method of accounting" for JCC

purposes, a certain portion of additional paid in capital in the amount of ¥

11,524 million under purchase method of accounting presented in the

accompanying consolidated balance sheet as of March 31, 2004 constitutes

retained earnings available for dividend transferred from Square for JCC

purposes.

JCC, as amended effective October 1, 2001, provides that earnings in

an amount equal to at least 10% of appropriations of retained earnings that

are paid in cash shall be appropriated as a legal reserve until an aggregated

amount of additional paid-in capital and legal reserve equals 25% of stated

capital. The Company has already met this requirement, and accordingly,

it no longer needs to take reserve for future appropriation of retained earn-

ings in cash.

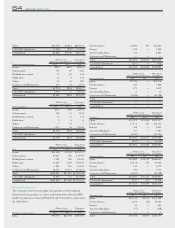

Comprehensive Income

Accumulated other comprehensive (loss) income as of March 31, 2004 and

2003 is as follows:

Thousands of

Millions of Yen U.S. Dollars

2004 2003 2004

Foreign currency translation adjustments:

Balance, beginning of year ¥43 ¥59 $408

Aggregate adjustment for the year

resulting from translation of foreign

currency financial statements (999) (16) (9,459)

Balance, end of year ¥(956) ¥43 $(9,051)

Net unrealized gains on available-for-sale securities::

Balance, beginning of year ¥23 ¥10 $221

Net increase 296 13 2,805

Balance, end of year ¥319 ¥23 $3,026

Total accumulated other comprehensive income::

Balance, beginning of year ¥66 ¥69 $630

Adjustments for the year (703) (3) (6,654)

Balance, end of year ¥(637) ¥66 $(6,024)

Tax effects allocated to each component of other comprehensive income

(loss) and adjustments are as follows:

Millions of Yen

Tax Benefit Net of Tax

2004 Pretax Amount (Expense) Amount

Foreign currency translation

adjustments ¥(999) — ¥(999)

Net unrealized gain (loss) on