Square Enix 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SQUARE ENIX 2004 57

the assets, obligations, cash flows and net periodic benefit cost of defined

benefit pension plans and other postretirement benefit plans.

Stock-Based Compensation

The Company accounts for its incentive stock option plans using intrinsic

value method in accordance with Accounting Principles Board Opinion

No.25, "Accounting for Stock Issued to Employees" ("APB25"). Under

APB25, generally no compensation expenses are recorded when the terms

of the award are fixed and the exercise price of the stock option equals or

exceeds the fair value of the underlying stock on the date of grant.

In fiscal 2003, the Company adopted the disclosure provisions of SFAS

No.148 "Accounting for Stock-Based Compensation-Transaction and

Disclosure-an Amendment of FASB Statement No. 123", which provides

alternative methods of transition for a voluntary change to the fair value

based method of accounting for stock-based employee compensation.

In June 2002, the stockholders of the Company approved the

Company’s Stock Option Plan, pursuant to which officers, directors,

employees of the Company may purchase up to an aggregate of 487,400

shares of common stock. In addition, the Company took over Square’s

stock option plan as a result of the merger, pursuant to which, the direc-

tors, officers and employees of former Square may purchase up to an

aggregate of 3,330,895 shares of common stock of the Company. As of

March 31, 2004 and 2003, the plans had outstanding stock options for an

aggregate of 3,262,645 and 487,400 shares of the Company’s common

stock, respectively.

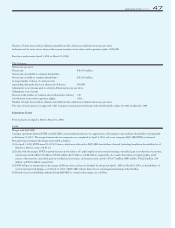

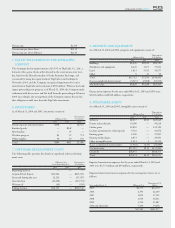

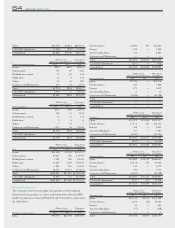

The following table summarizes the activity in options under the plans:

Number of shares Weighted Average

(In thousands) Exercise Price

Options outstanding - April 1, 2002 357.7 ¥2,215.15

Granted - exercise price equal to fair value 312.5 2,313.00

Granted - exercise less than fair value — —

Exercised — —

Forfeited 182.8 2,543.48

Options outstanding - March 31,2003 487.4 ¥2,374.92

Increase in option as a result of the merger

with SQUARE on April 1, 2003 3,330.895 3,084.84

Granted - exercise price equal to fair value — —

Granted - exercise price equal to fair value — —

Exercise less than fair value 184.8 2,313.00

Forfeited 370.85 2,984.04

Options outstanding - March 31, 2004 3,262.645 ¥3,001.17

At March 31, 2004 and 2003, the number of options exercisable was

719,038 and 185,945, respectively, and their related weighted average exer-

cise prices were ¥3,001.17 and ¥2,374.92, respectively.

Had compensation cost for the Company’s stock option plan been

determined based on the fair value at the grant date for awards in 2004 and

2003, consistent with the provisions of SFAS No.123, the Company’s net

income and the net income per share would have been reduced to the pro

forma amounts indicated below.

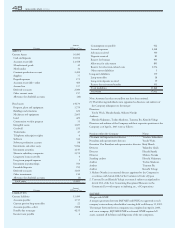

Millions of Yen Thousands of

(Except share data) U.S. Dollars

Years Ended March 31, (Except share data)

2004 2003 2004

Net income :

As reported ¥4,355 ¥2,296 $41,205

Deduct: Total stock-based

employee compensation

expense determined under

fair value based method

for all awards — 45 —

Pro forma net income ¥4,355 ¥2,251 $41,205

Earnings per share:

As reported - Basic ¥39.58 ¥39.06 $0.37

Pro forma - Basic — 38.28 —

As reported - Diluted ¥37.99 ¥38.57 $0.36

Pro forma - Diluted — 37.80 —

The pro forma disclosures shown are not representative of the effects on

net income and the net income per share in future years.

The fair value of the Company’s stock options used to compute pro

forma net income and the net income per share disclosures is the estimated

present value at the grant date using the Black-Scholes option-pricing

model. The weighted average fair values of options granted were ¥146.27

for the year ended March 31, 2003. The following weighted average

assumptions for 2003 were used to value grants: expected volatility of 44.65

percent; risk-free interest rate of 0.029 percent; and expected holding peri-

od of 0.68 years.

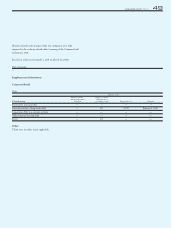

Earnings Per Share

Basic earnings per share ("EPS") are computed by dividing the net income

(loss) applicable to common stockholders for the year by the weighted

average number of common shares outstanding during the year. Diluted

EPS is computed by dividing the net income (loss) applicable to common

stockholders for the year by the weighted average number of common and

common stock equivalents, which include common shares issuable upon

the exercise of stock options outstanding during the year. Common stock

equivalents are excluded from the computation if their effect is antidilutive.

Comprehensive Income (Loss)

Comprehensive income (loss) represents change in net assets of a business

enterprise during a period from transactions and other events and circum-

stances from non-owner sources. Comprehensive income (loss) of the

Company includes net income adjusted for the change in foreign currency

translation adjustments and the change in net unrealized gain (loss) from

investments.

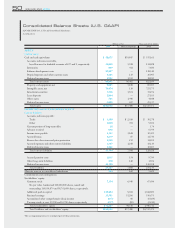

Foreign Currency Translation and Transactions

The functional currency for the Company’s foreign operations is the

applicable local currency. Accounts of foreign operations are translated