Square Enix 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

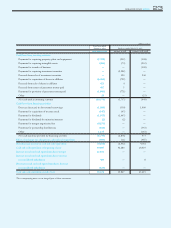

32 SQUARE ENIX 2004

Amount

Category Millions of Yen

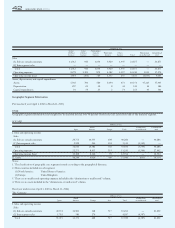

LIABILITIES

Current liabilities 13,489

Accounts payable-trade 1,717

Current portion of long-term debt 22

Accounts payable—other 2,808

Payable due to merger 4,153

Income taxes payable 4

Consumption tax payable 422

Accrued expenses 1,248

Advances received 594

Deposits received 83

Reserve for bonuses 463

Allowance for sales returns 893

Reserve for relocation-related costs 1,074

Other current liabilities 3

Long-term liabilities 359

Long-term debt 18

Long-term deposits received 39

Reserve for retirement benefits 301

Total Liabilities 13,848

Net worth 37,012

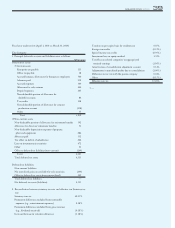

Notes to Consolidated Balance Sheets

Previous fiscal year (April 1, 2002 to March 31, 2003)

ENIX

1. Investment in non-cosolidated subsidiaries and affiliates

¥1,257 million

2. Number of shares of common stock outstanding 58,778,325 shares

3. Number of shares of treasury stock 36,716 shares

4. —

5. —

6. —

SQUARE

1. Investment in non-consolidated subsidiaries and affiliates

Investment securities ¥ 726 million

Investments and other assets ¥ 29 million

2.

Number of shares of common stock outstanding 60,192,791 shares

Number of shares of treasury stock 4,025 shares

3. —

4. Accounting for consumption tax

Accrued consumption tax is included in other current liabilities

5. Contingent liabilities for guarantees

(1) SQUARE has issued a joint-and-several guarantee for transactions

undertaken by affiliated company Digicube Co., Ltd., listed on the

Hercules market of Osaka Securities Exchange, with 7-Eleven Japan

Co., Ltd. As of March 31, 2003 there were no claims made under the

subject guarantee.

(2) SQUARE has issued a revolving guarantee to a maximum limit of

U.S.$15 million on behalf of a consolidated subsidiary SQUARE

ELECTRONICS ARTS L.L.C. in favor of SONY COMPUTER

ENTERTAINMENT AMERICA INC. As of March 31, 2003 there

were no claims made under the subject guarantee.

6. Overdraft Agreement and Commitment Line of Credit

SQUARE and a consolidated subsidiary SQUARE EUROPE LTD. has

contracted overdraft and line of credit with four of its principal bankers.

Under the agreement the four principal bankers will provide SQUARE

and SQUARE EUROPE LTD. with an overdraft limit and a commit-

ment line of credit to assist both companies in their working capital

needs. There was no balance outstanding under the overdraft account or

the commitment line of credit.

Limit of overdraft and commitment line of credit ¥24,389 million

(including 3 million euro)

Fiscal year under review (April 1, 2003 to March 31, 2004)

The Company

1. Investment in non-consolidated subsidiaries and affiliates

Investment securities ¥ 341 million

Investments and other assets ¥ 4 million

2. Number of shares of common stock outstanding 110,130,418 shares

3. Number of shares of treasury stock 99,539 shares

4. —

5. Contingent liabilities for guarantees

(1) —

(2) The Company has issued a revolving guarantee to a maximum limit

of U.S.$15 million on behalf of a consolidated subsidiary SQUARE

ELECTRONICS ARTS L.L.C. in favor of SONY COMPUTER

ENTERTAINMENT AMERICA INC. As of March 31, 2004 the

liability outstanding under the guarantee was U.S.$ 432,000 (¥45 mil-

lion).

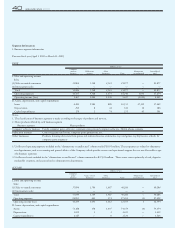

Notes to Consolidated Statements of Income

Previous fiscal year (April 1, 2002 to March 31, 2003)

ENIX

1. —

2. Selling, general and administrative expenses and Cost of sales include

research and development cost of ¥3,407 million.

3. —

4. —

5. Loss on disposal of property and equipment

Machinery and equipment ¥45 million

6. Loss on investment securities is due to the significant decline in market

prices of marketable securities.