Square Enix 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 SQUARE ENIX 2004

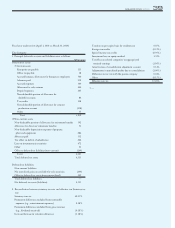

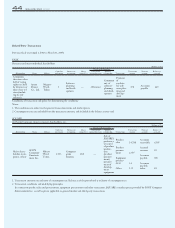

4. Redemption schedule of other marketable securities with a maturity date

or those to be held to maturity as of March 31, 2003

Not applicable

Fiscal year under review (April 1, 2003 to March 31, 2004)

The Company

1. Marketable securities held for trading purposes

None

2. Held-to-maturity securities with market value

Millions of Yen

March 31, 2004

Type Unrealized

Book value Market value gain (loss)

Securities with (1) Government

market value bonds 2,000 2,000 0

exceeding book Sub-total 2,000 2,000 0

value

Total 2,000 2,000 0

3. Other investment securities with market value

Millions of Yen

March 31, 2003

Type Unrealized

Acquisition cost Book value gain (loss)

Securities with (1) Stocks 179 797 617

book value (2) Bonds

exceeding ①Government,

acquisition cost municipal

bonds, etc. — — —

②Corporate bonds — — —

③Other — — —

(3) Others — — —

Sub-total 179 797 617

Securities with (1) Stocks 76 71 (4)

acquisition cost (2) Bonds

exceeding book ①Government,

value municipal

bonds, etc. — — —

②Corporate bonds — — —

③Other — — —

(3) Others — — —

Sub-total 76 71 (4)

Total 256 869 613

Note: An impairment loss of ¥222 million was incurred in the fiscal year

ended March 31, 2004, in connection with the Company’s other mar-

ketable securities with market value. Impairment loss on securities is

charged to income when the market price at the end of the fiscal year falls

not less than 50% of the acquisition cost. Impairment loss on securities is

charged to income when the market price at the end of the fiscal year falls

between 30% and 50% of the acquisition cost after considering such fac-

tors as the significance and amount of securities and the potential for

recovery.

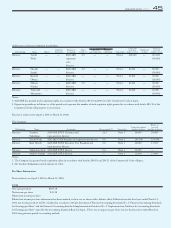

4. Information regarding other investment securities sold during the fiscal

year ended March31, 2004

Millions of Yen

Proceeds from sale Total gain from sale Total loss from sale

156 59 84

5. Marketable securities whose fair values are not readily determinable as of

March 31, 2004

Millions of Yen

March 31, 2004

Book value

(1) Other marketable securities

Unlisted securities (excluding OTC securities) 165

6. Redemption schedule of other marketable securities with a maturity date

or those to be held to maturity

None

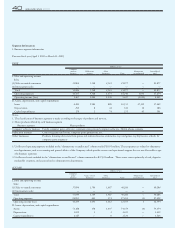

Derivative Transactions

Previous fiscal year (April 1, 2002 to March 31, 2003)

ENIX

The ENIX Group does not engage in derivative transactions.

SQUARE

The SQUARE Group does not engage in derivative transactions.

Fiscal year under review (April 1, 2003 to March 31, 2004)

The Company

The Square Enix Group does not engage in derivative transactions.

Retirement Benefits

Previous fiscal year (April 1, 2002 to March 31, 2003)

ENIX

1. Overview of retirement benefit plan applied

Until the fiscal year ended March 31, 2002, ENIX had a defined benefit

plan comprising of a tax qualified pension plan and a lump-sum retirement

payment plan. ENIX’s domestic consolidated subsidiaries applied a lump-

sum retirement payment plan for the corresponding period. In the fiscal

year ended March 31, 2003, ENIX terminated its tax qualified pension plan

and applied a lump-sum payment plan only in line with its domestic con-

solidated subsidiaries. In addition, ENIX and its domestic consolidated

subsidiaries applied the conventional method in the calculation of retire-

ment benefit obligation as described in, “4. Summary of Significant

Accouting Policies”, “(3) Accounting for allowances and reserves”.