Square Enix 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 SQUARE ENIX 2004

into Japanese yen using period-end exchange rates for assets and liabilities

at the balance sheet date and average prevailing exchange rates for the peri-

od for revenue and expense accounts. Adjustments resulting from transla-

tion are included in other comprehensive income (loss). Realized and unre-

alized transaction gains and losses are included in income in the period in

which they occur.

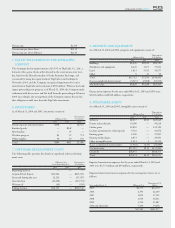

4. BUSINESS COMBINATIONS

Acquisition of SQUARE

On April 1st, 2003, the Company acquired entire outstanding shares of

SQUARE CO., LTD., a video game developer in Japan, in the form of a

statutory merger. The purpose of the merger was to enhance the ability to

provide high quality digital contents in the rapidly changing digital enter-

tainment industry. The aggregate purchase price, including assumption of

liabilities and issuance of 51,167,293 shares of common stock was ¥117,131

million. The value of the Company’s common stock issued in connection

with this acquisition has been based on the market price of the Company’s

common stock shortly before and after the date such proposed transaction

was agreed and announced. The acquisition has been accounted for as a

purchase business combination in accordance with SFAS No.141 and,

accordingly, the result of operations and financial position of the acquired

business are included in the Company’s consolidated financial statement

from the date of acquisition. The balance of the purchase price in excess of

the fair value of the assets acquired and the liabilities assumed at the date of

acquisition was recorded as goodwill totaling ¥35,624 million, none of

which is expected to be deductible for tax purposes. The amount of pur-

chased in-process research and development assets was ¥12,728 million. Of

this, ¥4,862 million was charged to cost of sales during the year ended

March 31, 2004.

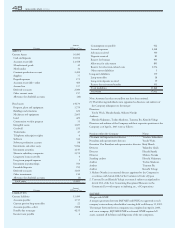

The following table sets forth the components of the purchase price of the

Square acquisition:

Thousands of

Millions of Yen U.S. Dollars

Cost of the acquisition:

Value of stock issued ¥100,807 $953,798

Liabilities assumed 16,324 154,452

Total ¥117,131 $1,108,250

Allocation of purchase price:

Current assets ¥49,973 $472,828

Non-current assets 8,012 75,807

Trademarks (indefinite useful life) 10,300 97,454

Licensing agreement (indefinite useful life) 9,710 91,872

Existing online game (useful life of 12 years) 12,850 121,581

Existing off-line games and other

(useful life ranging from 1 to 5 years) 3,130 29,614

Goodwill 35,624 337,061

Net deferred tax liabilities (12,468) (117,967)

Total ¥117,131 $1,108,250

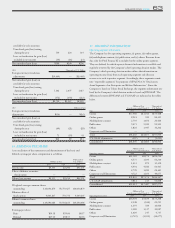

Acquisition of UIEvolution

On March 24, 2004, the Company acquired all of the outstanding pre-

ferred and common stock of UIEvolution, Inc. ("UIEvolution"), a Seattle-

based middleware development company for approximately $58million.

The purpose of acquisition was to acquire core technology that could pro-

vide the Company with more flexibility to produce digital contents for var-

ious type of platform, by way of which, the Company expects to enhance its

cutting edge under rapidly changing internet circumstances. This transac-

tion has been accounted for as a purchase and included in the Company’s

operations since the date of acquisition. The balance of the purchase price

in excess of the fair value of the assets acquired and the liabilities assumed

at the date of acquisition was recorded as goodwill totaling ¥3,331 million,

none of which is expected to be deductible for tax purposes. The

Company’s consolidated results of operations reflected UIEvolution’s

operating activities for the period from March 24, 2004 (the date of acqui-

sition) to March 31, 2004.

The following table sets forth the components of the purchase price of the

UIEvolution acquisition:

Thousands of

Millions of Yen U.S. Dollars

Cost of the acquisition:

Cash, net of cash acquired ¥6,091 $57,640

Total ¥6,091 $57,640

Allocation of purchase price:

Property and equipment ¥10 $94

Existing technology (useful life of 5 years) 2,853 26,994

Trade name and trade marks

(useful life of 5 years) 401 3,794

Customer contracts (useful life of 2 years) 243 2,299

Goodwill 3,331 31,516

Net other liabilities (747) (7,057)

Total ¥6,091 $57,640

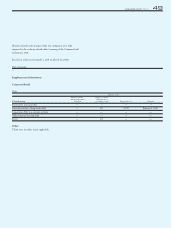

Unaudited Pro Forma Information

The unaudited pro forma data below for the year ended March 31, 2003 is

presented as if the acquisitions of Square and UIEvolution had taken place

on April 1st, 2002. The unaudited pro forma financial information is based

on management’s estimates and assumptions and does not purport to rep-

resent the results that actually would have occurred if the acquisitions had,

in fact, been completed on the dates assumed, or which may result in the

future. Pro forma data for the year ended March 31, 2004 is not presented

as it would not differ materially from reported results.

The year ended March 31, 2003

Millions of Yen

(Except share data)

Total revenue ¥62,380

Income before income taxes ¥2,794