Square Enix 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

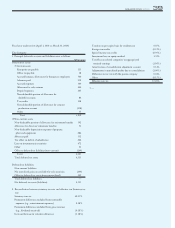

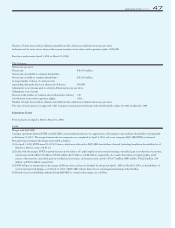

38 SQUARE ENIX 2004

Product development costs 550

Non-deductible portion of amortization expense

of software 8

Offset to deferred tax liabilities (non-current) (15)

Total 632

Total deferred tax assets 1,573

Deferred tax liabilities

Non-current liabilities

Net unrealized gains on available-for-sale securities (15)

Offset to deferred tax assets (non-current) 15

Total deferred tax liabilities —

Net deferred tax assets (liabilities) 1,573

2. Reconciliation between statutory tax rate and effective tax rate

Statutory tax rate 42.05%

Retainage tax 1.77

Permanent differences (e.g., entertainment expenses) 0.19

Taxation on per capita basis for residents tax 0.23

Reduction in year-end deferred tax assets due to change

in tax rates 0.54

Other 0.27

Effective tax rate 45.05

3. According to the amendment of the local tax law on March 31, 2003, the

effective statutory tax rate was changed primarily from 42.05% to

40.50% for the calculation of deferred tax assets and liabilities for tem-

porary differences that are expected to reverse in the year beginning

April 1, 2004 and thereafter. As a result, deferred tax assets, net of

deferred tax liabilities, decreased by ¥25 million, deferred income taxes

increased by ¥26 million, and unrealized gain on revaluation of securities

increased by ¥0 million.

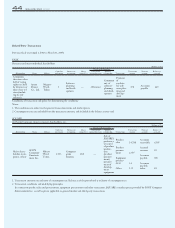

SQUARE

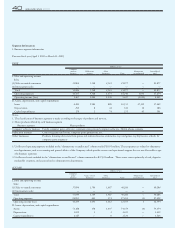

1. Significant components of deferred tax assets and liabilities are as fol-

lows:

Millions of Yen

Deferred tax assets (current)

Allowance for sales returns 641

Accrued bonuses, reserve for bonuses 989

Inventories 21

Tax effect on unrealized profit for inventories 28

Prepaid expenses 108

Allowance for relocation-related costs 451

Loss carried forward 699

Non-deductible portion of foreign tax 192

Other 145

Total 3,278

Deferred tax liabilities (current)

Tax effect on retained earnings of investments in affiliates (246)

Other (20)

Total (266)

Net deferred tax assets (current) 3,011

Deferred tax assets (non-current)

Investment securities 381

Inventories 252

Depreciation expenses 833

Retirement benefit expenses 122

R&D expenses 580

Allowance for doubtful accounts 1,070

Others 117

Valuation allowance (557)

Total 2,800

Deferred tax liabilities (non-current)

Net unrealized gains on available-for-sale securities (152)

Total (152)

Net Deferred tax assets (non-current) 2,648

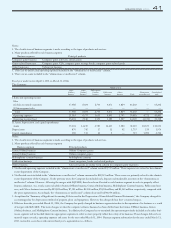

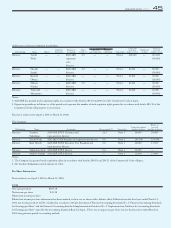

2. Reconciliation between statutory tax rate and effective tax rate

Statutory tax rate (Adjustments) 42.05%

Permanent differences excluded from nontaxable expenses

(e.g., entertainment expenses) 0.32%

Permanent differences excluded from gross revenue

(e.g., dividends received etc.) (0.62%)

Increase/decrease in valuation allowance (103.94%)

Prior year adjustment of net unrealized gains

on available-for-sale securities (1.13%)

Taxation on per capita basis for residents tax 0.10%

Reduction in year-end deferred tax assets due

to change in tax rates (1.37%)

Minority interest in LLC and partnership (3.11%)

Adjustments in revenue recognition due to consolidation 1.35%

Adjustments in unrealized profits due to consolidation 5.16%

Difference in tax rate with the parent company (1.64%)

Other 0.04%

Effective tax rate (62.79%)

3. According to the amendment of the local tax law at March 31,2003, the

effective statutory tax rate was changed to 40.50% for the calculation of

deferred tax assets and liabilities for temporary differences that are

expected to reverse in the year beginning April 1, 2004 and thereafter.

As a result, deferred tax assets, net of deferred tax liabilities, decreased by

¥120 million, deferred income taxes increased by ¥125 million, and unre-

alized gain on revaluation of securities increased by ¥5 million.