Square Enix 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

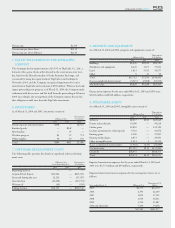

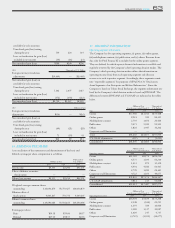

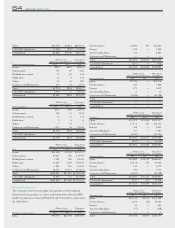

54 SQUARE ENIX 2004

Notes to Consolidated Financial Statements (U.S. GAAP)

SQUARE ENIX CO., LTD. and Consolidated Subsidiaries

1. BUSINESS AND ORGANIZATION

SQUARE ENIX CO., LTD. (the "Company") is a digital entertainment

content provider. The Company was formed in connection with the merg-

er of ENIX CORPORATION ("Enix") and SQUARE CO., LTD.

("Square") on April 1, 2003. The merger was consummated in the form of

statutory merger under the Japanese Commercial Code ("JCC"), with Enix

being the surviving entity.

The Company’s businesses consist of five segments: (i) games, (ii)

online games, (iii) mobilephone content, (iv) publication, and (v) others. (i)

Games: The Company develops interactive games designed for video game

console platforms and PCs, and publishes and distributes such games in

Japan, North America, Europe and Asia. (ii) Online Game: The Company

provides online game services including massively multi-players online

RPGs such as "FINAL FANTASY XI" in Japan and North America, and

"CROSS GATE" in Asia. (iii) Mobilephone Content: The Company’s

mobilephone content is delivered via third party telecommunication carri-

ers offers contents such as games, wallpaper, and ring tones. (iv)

Publication: Publishing of RPG strategy guide books, comic books and

manga magazines. (v) Others: The Company produces character goods

and toys.

As of March 31, 2004, the Company had ten consolidated subsidiaries,

one consortium and three non-consolidated subsidiaries. Three subsidiaries

were established in Japan, five in the United States, the United Kingdom,

and the People’s Republic of China.

SQUARE ENIX, INC., the wholly-owned U.S. subsidiary, publishes

video games, provides localization services to the Company translating

Japanese content into English, provides online game and mobilephone

content services, and markets middle-ware products to electronic device

manufacturers.

SQUARE ENIX LTD., the U.K. wholly-owned subsidiary, provides

localization services to the Company, translating Japanese content into

English, French, Germany, Italy, and Spanish. Marketing and distribution

of the translated content in the European market is carried out through

outside independent licensees.

The Chinese subsidiary, SQUARE ENIX WEBSTAR NETWORK

TECHNOLOGY (BEIJING) CO., LTD., is a joint venture company with

SOFTSTAR ENTERTAINMENT, INC., a Taiwan based video game

publisher, in which the Company holds a 60% interest stake. The venture

has been concentrated on the provision of online game services for CROSS

GATE in China since its incorporation.

2. TRANSLATION INTO U.S. DOLLARS

The accompanying consolidated financial statements are stated in Japanese

yen, the functional currency of the country in which the Company is incor-

porated and principally operates. The U.S. dollar amounts included herein

represents a translation using the mid price for telegraphic transfer of U.S.

dollars for yen quoted by The Bank of Tokyo Mitsubishi, Ltd as of March

31, 2004 of ¥105.69 to $1.00 and are included solely for the convenience of

the reader. The translation should not be construed as a representation

that the yen amounts have been, could have been, or could in the future be

converted into U.S. dollars at the above or any other rate.

3. SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

The Company and its domestic subsidiaries maintain their books and

records in conformity with generally accepted accounting principles and

practices in Japan ("JPNGAAP"), and its foreign subsidiaries in conformity

with those of the country of their domicile. The consolidated financial

statements presented herein have been prepared in a manner and reflect

certain adjustments that are necessary to conform with accounting princi-

ples generally accepted in the United States of America ("U.S.GAAP").

Such adjustments include principally accounting for business combinations,

goodwill and other intangible assets, and pensions.

Principles of Consolidation

The consolidated financial statements include the financial statements of

the Company and its wholly owned subsidiaries. All inter-company bal-

ances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with U.S.GAAP

requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and the disclosure of contingent

assets and liabilities at the dates of the financial statements and the report-

ed amounts of revenues and expenses during the reporting periods. The

most significant estimates and assumptions relate to the recoverability of

capitalized software development costs and other intangibles, inventories,

realization of deferred income taxes and the adequacy of allowances for

returns, price protection and doubtful accounts. Actual amounts could dif-

fer significantly from these estimates.

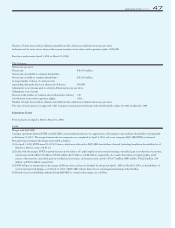

Concentration of Credit Risk

If the financial condition and operations of the Company’s customers dete-

riorate, the risk of collection could increase substantially. As of March 31,

2004 and 2003, the receivable balances from the Company’s five largest

customers amounted to approximately 40.4% and 60.7% of the Company’s

net receivable balance, respectively. For the years ended March 31, 2004

and 2003, the Company’s five largest customers accounted for 21.6% and

30.2% of net sales, respectively. The Company sets the credit limit to each

customer and monitors its solvency continuously.

Cash and Cash Equivalents

The Company considers all highly liquid instruments purchased with origi-

nal maturities of three months or less to be cash equivalents.

Fair Value of Financial Instruments

The carrying amount of cash and cash equivalents, accounts receivable,

accounts payable, accrued expenses and short term borrowings approxi-