Square Enix 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 SQUARE ENIX 2004

recognized for the differences between financial statement and tax bases of

assets and liabilities at currently enacted statutory tax rates for the years in

which the differences are expected to reverse. The effect on deferred taxes

of a change in tax rates is recognized in income in the period that includes

the enactment date. Valuation allowances are established when necessary to

reduce deferred tax assets to the amounts expected to be realized.

Accounting for Consumption Taxes

The Japanese consumption taxes received and consumption taxes paid are

not included in the accompanying consolidated statements of income. The

consumption taxes paid are set off against consumption taxes received and

the resultant balance due to Japanese tax authorities are presented in the

consolidated balance sheets as "accrued expenses and other current liabili-

ties".

Employee Benefit Plan

The Company and its domestic subsidiaries have defined benefit retire-

ment plans, which are accounted for in accordance with SFAS No.87 "

Employers’ Accounting for Pensions".

Revenue Recognition

The Company recognizes revenue in accordance with Statement of

Position ("SOP") No.97-2, "Software Revenue Recognition", which pro-

vides guidance on applying generally accepted accounting principles in rec-

ognizing revenue on software transactions and Staff Accounting Bulletin

("SAB") No.101, "Revenue Recognition in Financial Statements", as

amended by SAB No.104, "Revenue Recognition", which outline the basic

criteria that must be met to recognize revenue and provides guidance for

presentation of revenue and for disclosure related to revenue recognition

policies in financial statements. The Company recognizes revenue when

the price is fixed and determinable, when there is persuasive evidence of an

arrangement, upon fulfillment of its obligations under any such arrange-

ment and when determination that collection is probable.

Sales Returns and Allowances and Bad Debt Reserves

The Company’s software distribution arrangements with customers in

Japan do not give customers the right to return products; However, the

U.S. subsidiary, at its discretion, may accept product returns for stock bal-

ancing or defective products, sometimes negotiates accommodations to

customers, including price discounts, credits and product returns, when

demand for specific products falls below expectations, and accepts returns

and grants price protection in connection with its publishing arrangements.

The U.S. subsidiary estimates potential future product returns, price pro-

tection and sales incentives related to the current period product revenue.

The U.S. subsidiary analyzes historical returns, current sell-through of dis-

tributor and retailer inventory of its products, current trends in the soft-

ware games business segment and the overall economy, changes in cus-

tomer demand and acceptance of its products and other related factors

when evaluating the adequacy of the sales returns and price protection

allowances. In addition, the U.S. subsidiary monitors and manages the vol-

ume of sales to retailers and distributors and monitors their inventories as

substantial overstocking in the distribution channel can result in high

returns or the requirement for substantial price protection in subsequent

periods. Similarly, significant judgment is required to estimate the

allowance for doubtful accounts in any period. The Company and the U.S.

subsidiary analyze customer concentrations, customer credit-worthiness

and current economic trends when evaluating the adequacy of the

allowance for doubtful accounts.

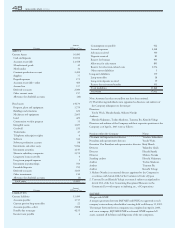

Shipping and Handling Charges

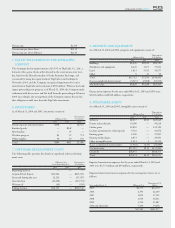

Outbound shipping and handling charges of approximately ¥545 million

and ¥350 million for the year ended March 31, 2004 and 2003, respective-

ly, are included in selling, general and administrative expenses.

Advertising Expenditures

The Company recognizes advertising expense as it is incurred except for

cooperative advertising. Cooperative advertising obligations are accrued

and amortized at the same time the related revenues are recognized. Total

advertising expense was approximately ¥ 5,119 million and ¥1,288 million

for the year ended March 31, 2004 and 2003, respectively.

Line of Credit

As of March 31, 2004, the Company had an unused line of credit with a

bank in the amount of ¥ 24,500 million at various rates expiring in 2005.

No guarantee is provided for such line-of-credit.

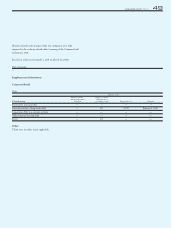

Recently Issued Accounting Pronouncements

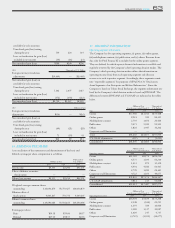

In June 2002, the Financial Accounting Standards Board ("FASB") issued

SFAS No.146, "Accounting for Costs Associated with Exit or Disposal

Activities". SFAS No.146 addresses financial accounting and reporting for

costs associated with exit or disposal activities and nullifies Emerging Issues

Task Force ("EITF") Issue No.94-3, "Liability Recognition for Certain

Employee Termination Benefits and Other Costs to Exit an Activity

(Including Certain Costs Incurred in a Restructuring)". This statement

requires recognition of a liability for a cost associated with an exit or dis-

posal activity when the liability is incurred, as opposed to when the entity

commits to an exit plan under EITF No.94-3. The provision of this

Statement is effective for exit or disposal activities that are initiated after

December 31, 2002, with early application encouraged. The adoption of

SFAS No.146 has not had a material effect on the Company’s consolidated

financial statements.

In 2002, the FASB issued SFAS No.132, which was revised in

December 2003 ("SFAS No.132R"), "Employer’s Disclosure about

Pensions and Other Postretirement Benefits". SFAS No.132R revises and

prescribes employer’s disclosures about pension plans and other postretire-

ment benefit plans; It does not change the measurement or recognition of

those plans. SFAS No.132R retains the disclosure requirements contained

in the original SFAS No.132. It also requires additional disclosers about