Square Enix 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 SQUARE ENIX 2004

ENIX

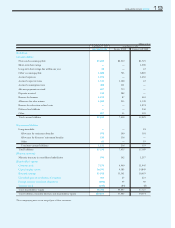

(a) Investments securities

Held-to-maturity securities:

Amortized cost method, amortized on a straight-line basis

Other investments securities, securities for which fair values are avail-

able:

Market value, determined by the quoted market price as of the balance

sheet date, with unrealized gains and losses reported as a separate com-

ponent of shareholders’ equity at a net-of-tax amount, and the cost of

sales determined by the moving-average method

Other investments securities, securities for which fair values are unavail-

able:

Stated at cost, determined by the moving-average method

(b) Inventories

Manufactured goods:

Stated at cost, determined by the monthly average method

Merchandise:

Stated at cost, determined by the monthly average method

Unfinished goods:

Stated at cost determined by the monthly average method

Supplies:

Stated at the last purchase price

SQUARE

(a) Investments securities

Held-to-maturity securities:

—

Other investment securities, securities for which fair values are avail-

able:

Market value, determined by the quoted market price as of the balance

sheet date, with unrealized gains and losses reported as a separate com-

ponent of shareholders’ equity at a net-of-tax amount, and the cost of

sales determined by the average method

Other investments securities, securities for which fair values are unavail-

able:

Stated at cost determined by the average method

(b) Inventories

Manufactured goods:

Stated at the lower of cost or market, determined by the moving-aver-

age method

Merchandise:

Stated at the lower of cost or market, determined by the moving-aver-

age method. Merchandise held by SQUARE SOFT, INC. and

SQUARE ELECTRONIC ARTS L.L.C. are stated at the lower of cost

or market determined by the first-in first-out method

Content production account:

Stated at cost

Supplies:

Principally stated at cost, determined by the moving-average method

Fiscal year under review (April 1, 2003 to March 31, 2004)

The Company

(a) Investments securities

Held-to-maturity securities:

Amortized cost method, amortized on a straight-line basis

Other investment securities, securities for which fair values are avail-

able:

Market value, determined by the quoted market price as of the balance

sheet date, with unrealized gains and losses reported as a separate com-

ponent of shareholders’ equity at a net-of-tax amount, and the cost of

sales determined by the moving-average method

Other investment securities, securities for which fair value are unavail-

able:

Stated at cost determined by the average method

(b) Inventories

Manufactured goods, merchandise:

Stated at cost, determined by the monthly average method

Content production account:

Stated at cost, determined by the identified cost method

Supplies:

Stated at the last purchase price

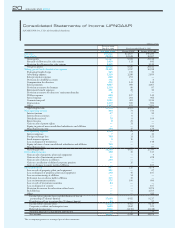

(2) Method for depreciation and amortizion of major assets

Previous fiscal year (April 1, 2002 to March 31, 2003)

ENIX

(a) Property, plant and equipment

Property, plant and equipment are depreciated using the declining-balance

method. Assets with a purchase price equal to or more than ¥100,000 and

less than ¥200,000 are depreciated on a straight-line basis over a period of

three years. Estimated useful lives of major assets is as follows:

Buildings 50 years

Machinery and equipment 4-6 years

(b) Intangible assets

In-house software is amortized by the straight-line method based on an

estimated useful life of five years.

SQUARE

(a) Property, plant and equipment

Property, plant and equipment are depreciated using the declining-bal-

ance method. Estimated useful lives of major assets is as follows:

Buildings and structures 3-18 years

Machinery and equipment 3-20 years

(b) Intangible assets

In-house software used by SQUARE and its domestic consolidated sub-

sidiaries is amortized by the straight-line method based on an estimated