Square Enix 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SQUARE ENIX 2004 27

useful life of five years. For all other intangible fixed assets, trademarks

are amortized by the straight-line method based on an estimated useful

life of ten years, and goodwill is amortized by the straight-line method

over a period of five years.

Fiscal year under review (April 1, 2003 to March 31, 2004)

The Company

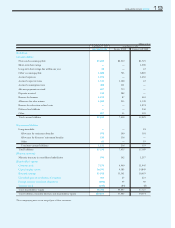

(a) Property, plant and equipment

Property, plant and equipment owned by the Company and its domestic

consolidated subsidiaries are depreciated using the declining-balance

method. Estimated useful lives of major assets is as follows:

Buildings and structures 3-50 years

Machinery and equipment 3-20 years

(Change in accounting policy)

Previously, assets with a purchase price equal to or more than ¥100,000

and less than ¥200,000 were depreciated on a straight-line basis over a

period of three years. In order to unify the accounting policy as a result

of the merger and to further strengthen the financial position, from the

fiscal year under review, assets acquired that are deemed to have an

immaterial impact on the Company’s consolidated financial position are

expensed at the time of purchase. The result of this change on the

Company’s consolidated operating income, recurring profit, and

income before income taxes for the previous fiscal year is considered

immaterial.

(b) Intangible assets

In-house software used by the Company and its domestic consolidated

subsidiaries is amortized by the straight-line method based on an esti-

mated useful life of five years. For all other intangible fixed assets,

trademarks are amortized by the straight-line method based on an esti-

mated useful life of ten years, and goodwill is amortized by the straight-

line method over a period of five years.

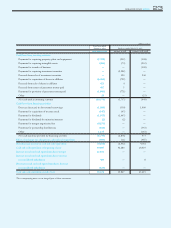

(3) Accounting for allowances and reserves

Previous fiscal year (April 1, 2002 to March 31, 2003)

ENIX

(a) Allowance for doubtful accounts

An allowance for doubtful accounts is provided for possible losses aris-

ing from default on accounts receivable. The allowance is made up of

two components: the estimated credit loss for doubtful receivables

based on an individual assessment of each account, and a general reserve

calculated based on historical default rates.

(b) Reserve for bonuses

A reserve for bonuses is provided for payments to employees of ENIX

and its domestic consolidated subsidiaries at the amount expected to be

paid in respect of the calculation period ended on the balance sheet

date.

(c) Allowance for retirement benefits

To cover projected employees’ retirement benefits of ENIX and its

domestic consolidated subsidiaries, an allowance is provided at an esti-

mated amount that would be required to be paid if all eligible employ-

ees voluntarily terminated their employment as of the end of the fiscal

year projected at the beginning of each fiscal year.

(d) Allowance for sales returns

An allowance is provided for losses due to the return of published mate-

rials, at an amount calculated based on historic experience.

(e) Allowance for directors’ retirement benefits

An allowance for directors’ retirement benefits is provided to adequate-

ly cover the costs of directors’ retirement benefits, which are accounted

for on an accrual basis in accordance with internal policy.

(f) —

SQUARE

(a) Allowance for doubtful accounts

An allowance for doubtful accounts provides for possible losses arising

from default on accounts and loans receivable. The allowance is made

up of two components: the estimated credit loss for doubtful receivables

based on an individual assessment of each account, and a general reserve

calculated based on historical default rates.

(b) Reserve for bonuses

A reserve for bonuses provides for payments to employees of SQUARE

and its consolidated subsidiaries at the amount expected to be paid in

respects of the calculation period ended on the balance sheet date.

(c) Allowance for retirement benefits

To cover projected employees’ retirement benefits of SQUARE and its

domestic consolidated subsidiaries, SQUARE provides an estimated

amount of benefit obligation to cover projected retirement benefit

obligations for employees at the balance sheet date.

(d) Allowance for sales returns

An allowance is provided for losses due to the return of game software,

at an estimated amount of future losses assessed by each game title and

historic experience.

(e) Allowance for directors’ retirement benefits

An allowance for directors’ retirement benefits is provided to adequate-

ly cover the costs of directors’ retirement benefits, which are accounted

for on an accrual basis in accordance with internal policy.

As of March 31, 2003, SQUARE ceased to operate as a going concern

due to merger with Enix. As a result, the amount and date payable as

retirement benefits to employees and directors of SQUARE was fixed

and recorded as other accounts payable as of the balance sheet date

(Refer 5. Accounting Procedures 1. Consolidated Financial Statements-

Subsequent Events)

(f) Reserve for relocation-related costs

A reserve is provided for costs due to the head office relocation, at an

estimated amount as of the balance sheet date.