Square Enix 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SQUARE ENIX 2004 17

lion copies of KINGDOM HEARTS during the year. In this Fiscal Year,

the Company released a number of new titles in North America. In the

previous fiscal year, the Company dissolved the sales joint venture with

ELECTRONIC ARTS, INC. in the United States, and established is own

distribution channel through consolidated subsidiary SQUARE ENIX,

INC. (which changed its name from SQUARE ENIX U.S.A., INC. on July

1, 2004) during this Fiscal Year.

In the Games (Online) business, the Company launched the PC ver-

sion of FINAL FANTASY XI in October 2003 and started PlayOnline ser-

vices. In March 2004, the PlayStation 2 version of FINAL FANTASY XI

was shipped preinstalled on hard disk drives, recording sales of more than

¥2,000 million combining both the packaged version and membership fees.

As a result, sales in North America totaled ¥15,618 million, an increase of

¥4,031 million.

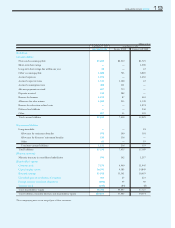

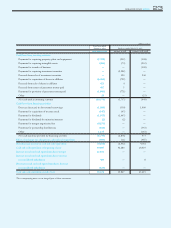

Overseas Sales (Europe)

(Millions of yen)

Former Former SimpleTotal for Fiscal 2004 Change

ENIX SQUARE Fiscal 2003

Europe — 2,695 2,695 2,121 (574)

Title sales volume in Europe was 2.74 million units compared with 2.7 mil-

lion in the previous fiscal year. In this Fiscal Year, the Company released a

total of five titles, comprising two titles for the PlayStation 2 (FINAL

FANTASY X-2 and UNLIMITED SAGA), two titles for the Game Boy

Advance (FINAL FANTASY TACTICS ADVANCE and SWORD of

MANA), and one title for the GameCube (FINAL FANTASY CRYSTAL

CHRONICLES).

In the previous fiscal year, the former SQUARE released two titles for

the PlayStation 2 (FINAL FANTASY X and KINGDOM HEARTS) in

Europe, as well as two titles for the PlayStation (FINAL FANTASY

ANTHOLOGY and FINAL FANTASY ORIGINS). In Europe, the

Company licenses sales to leading publishers, and sales volume was largely

unchanged from the previous fiscal year. Royalties that the Company

receives are different in value based on contractual conditions. Therefore,

in this Fiscal Year, sales in Europe increased ¥574 million to ¥2,121 million

compared with the previous fiscal year.

Overseas Sales (Asia and Others)

(Millions of yen)

Former Former SimpleTotal for Fiscal 2004 Change

ENIX SQUARE Fiscal 2003

Asia and Others — 142 142 972 830

In Asia and other regions, SQUARE ENIX WEBSTAR NETWORK

TECHNOLOGY (BEIJING) CO., LTD., a joint venture in China, was

added to the scope of consolidation in this Fiscal Year. Therefore, sales in

Asia and other regions increased ¥830 million to ¥972 million.

4.

Strategic Outlook, Issues Facing Management and Future Direction

In its long-term management strategy, the Group believes that an impor-

tant management issue is achieving growth over the long term while main-

taining profitability through the creation of advanced and high-quality

content. In fiscal 2005, the Company will focus efforts on broadening its

existing franchise in the Games (Offline) business and strengthening net-

work-related operations.

Targets for fiscal 2005 are as follows:

(Millions of yen)

Fiscal 2004 Results Fiscal 2005 Targets Change

Net Sales 63,202 76,000 12,798

Operating Income 19,398 21,500 2,102

Ordinary Income 18,248 21,500 3,252

Net Income 10,993 11,500 507

The Company believes that achieving growth backed by strong profitabili-

ty is an important management task. As a result, the Company will contin-

ue to invest as necessary in future growth, targeting a consolidated operat-

ing income margin of 25-30% based on Japanese accounting standards.

The Company is formulating a business plan to achieve this target in

fiscal 2005, and plans to make forward-looking investment in overseas busi-

ness development, mainly in network-related operations, and in new titles

to maintain targeted profit margins.

5. Dividend Policy

The Company positions the return of profits to its shareholders as an

important management policy and aims to continuously distribute stable

dividends while striving to improve profitability and strengthen the finan-

cial foundation.

Retained earnings are used for investment to increase corporate value,

such as the capital investment and research and development expenditure

necessary to fortify and expand existing businesses as well as develop new

businesses.

6. Risk Factors

The following risks may adversely affect the business performance of the

Company. Forward-looking statements by management are based on infor-

mation currently available at the time of the creation of this annual report.

1. The Company’s ability to respond to changes in customer preferences

and the pace of technological change in the digital content market;

2. The Company’s ability to attract qualified personnel to carry out its

growth strategies through overseas business development and the cre-

ation of new content; and

3. Exchange rate fluctuations.