Square Enix 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SQUARE ENIX 2004 31

In the previous year, “Increase (decrease) in accounts payable-other”

included in “Other” was ¥535 million. In the current year, “Foreign

exchange gain (loss)” included in “Other” was ¥61 million.

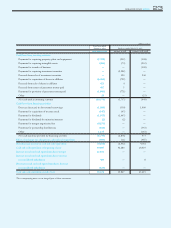

Cash flows from financing activities:

“Payments for partnership distributions”, which was included in “Other” in

the previous year, is presented separately in the current year as the amount

became material. In addition, “Repayments of long-term debt”, which was

presented separately in the previous year, is included in “Other” as the

amount became immaterial.

In the previous year, “Payments for partnership distributions” included

in “Other” was ¥151 million. In the current year, “Repayments of long-

term debt” included in “Other” was ¥22 million.

Fiscal year under review (April 1, 2003 to March 31, 2004)

The Company

—

Additional Information

Previous fiscal year (April 1, 2002 to March 31, 2003)

ENIX

—

SQUARE

—

Fiscal year under review (April 1, 2003 to March 31, 2004)

The Company

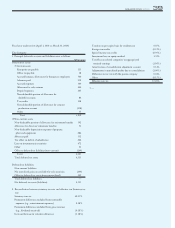

(Accounting treatment for costs related to the planning and development

of game contents paid to third party)

Until the year ended March 31, 2003, the Company had expensed the costs

related to the planning and development of game contents when paid to

third party. Effective from the year ended March 31, 2004, as a result of an

effort to strengthen the decision-making process in connection to the

development of game software and to implement more stringent selection

criteria, such costs incurred during the development stage are capitalized as

“Content production account” and charged to cost of sales at the time of

sale of related game products.

For the year ended March 31, 2004, “Content production account”

includes such capitalized costs in the amount of ¥3,763 million.

(Accounting for business combination)

On April 1, 2003, SQUARE and ENIX merged and formed SQUARE

ENIX. The merger was effected through the issue of 51,167,293 common

shares and allocated on the basis of one SQUARE common share for every

0.85 ENIX common shares. The merger was cosummated on an equal

footing by combining the entire control over net assets and management

activities prior to the merger, and sharing both the benefits and risks of

post merger equally. In addition, it was not determinable as to which entity

was the acquirer. Therefore, this business combination was accounted for

using the pooling-of-interests method.

Details of post-merger assets and liabilities are provided in the following

pages.

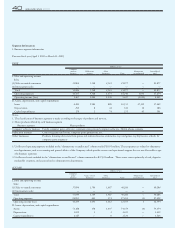

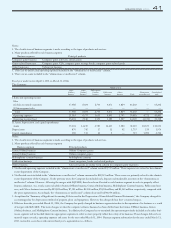

* SQUARE Assets and Liabilities Transferred due to Merger

Amount

Category Millions of Yen

ASSETS

Current Assets 36,490

Cash and deposits 16,931

Accounts receivable-trade 11,438

Finishedgoods 45

Merchandise 11

Contents production account 3,402

Suppliers 77

Prepaid expenses 375

Accounts receivable-other 483

Income tax receivable 537

Deferred tax assets 2,980

Other current assets 217

Allowance for doubtful accounts (10)

Fixed assets 14,370

Property and equipment 3,759

Buildings and structures 621

Machinery and equipment 2,663

Land 421

Construction in progress 53

Intangible assets 1,027

Goodwill 250

Trademarks 45

Telephone rights 6

Software 636

Software production account 88

Investments and other assets 9,584

Investment securities 1,345

Investment in subsidiaries 3,376

Long-term loans receivable 4

Long-term prepaid expenses 5

Investment in consortiums 560

Leasehold deposits 590

Deferred tax assets 3,383

Other investments 316

Allowance for doubtful accounts (0)

Total assets 50,860