Square Enix 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

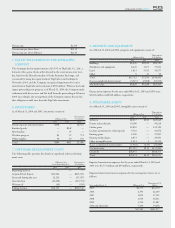

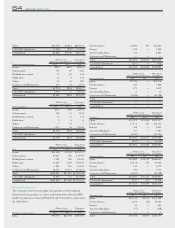

SQUARE ENIX 2004 61

acquired company 675 — 6,392

Acturial (gain) loss (94) 19 (890)

Benefit paid (32) (4) (306)

Benefit obligation at end of year ¥983 ¥199 $9,308

Funded status (983) (199) (9,308)

Unrecognized actuarial loss (76) 19 (719)

Unrecognized FAS87 transition

obligation 24 26 228

Net amount recognized ¥(1,035) ¥(154) $(9,799)

Amount recognized in the balance sheet is:

Accrued pension costs (1,035) (154) (9,799)

Net amount recognized ¥(1,035) ¥(154) $(9,799)

Accumulated benefit obligation

at end of year ¥513 ¥141 $4,8566

Actuarial assumption:

Discount rate 1.611% 0.930% 1.611%

Assumed rate of increase in

compensation level 4.370% 2.730% 4.370%

The future benefit payments for the plan are expected as follows:

Thousands of U.S.

Millions of Yen Dollars

Year ending March 31,

2005 ¥65 $623

2006 70 669

2007 72 688

2008 71 674

2009 67 635

2010-2014 248 2,354

Retirement Benefit to Directors and Statutory Auditors

In order to prepare for the payment of retirement benefit to the

Company’s directors and statutory auditors in the future, the Company

internally funds a retirement allowance. The Board of Directors deter-

mined the certain formulae for calculation of retirement benefits, pursuant

to which, the benefits are calculated based on a certaion fixed amount mul-

tiplied by the number of years of office and the coefficient predetermined

by the Board according to the title of directors. The JCC requires share-

holders’ approval before it is paid, and the Company accrues retirement

allowance according to such formulae until the benefits are approved by

the shareholders for payment. The balance of ¥110 million and ¥136 mil-

lion in 2004 and 2003, respectively, is presented as "other long-term liabili-

ties" in the consolidated balance sheets. Charges to income for the direc-

tors’ and corporate auditors’ retirement plans were ¥6 million and ¥7 mil-

lion in 2004 and 2003, respectively.

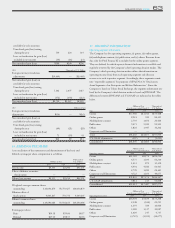

14. INCOME TAXES

Domestic and foreign income (loss) before income taxes are as follows:

Millions of Yen Thousands of

Years Ended March 31 U.S. Dollars

2004 2003 2004

Domestic ¥4,577 ¥4,290 $43,309

Foreign 3,031 (45) 28,678

Total ¥7,608 ¥4,245 $71,987

Income tax expense is as follows:

Millions of Yen Thousands of

Years Ended March 31 U.S. Dollars

2004 2003 2004

Current: ¥3,600 ¥3,162 $34,065

Domestic 1,723 3,162 16,302

Foreign 1,877 — 17,763

Deferred: ¥(1,168) ¥(1,240) $(11,052)

Domestic (1,234) (1,240) (11,678)

Foreign 66 — 626

Total ¥2,432 ¥1,922 $23,013

The differences between the provision for income taxes and the income

taxes computed using Japan statutory tax rate to pretax income as a per-

centage of pretax income are as follows:

Years Ended March 31

2004 2003

Statutory tax rate (%) 42.05 42.05

Tax rate difference from foreign

consolidated affiliates (2.29) —

Effect of tax rate change (0.22) 0.57

Accumulated earnings tax — 1.86

Investment tax credit (2.19) —

Reversal of valuation allowance on

deferred tax assets (3.50) —

Others (1.88) 0.81

Income tax expense (%) 31.97 45.29

The components of the deferred tax assets and liabilities as of March 31,

2004 and 2003 consists of the following:

Thousands of

Millions of Yen U.S. Dollars

2004 2003 2004

Deferred tax assets:

Software development costs — ¥1,147 —

Accrued paid absence ¥108 72 $1,025

Accrued pension costs 416 58 3,942

Income tax payable 115 — 1,089

Prepaid expenses 205 — 1,941