Square Enix 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SQUARE ENIX 2004 39

Fiscal year under review (April 1, 2003 to March 31, 2004)

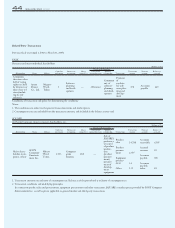

The Company

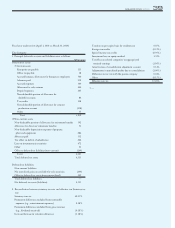

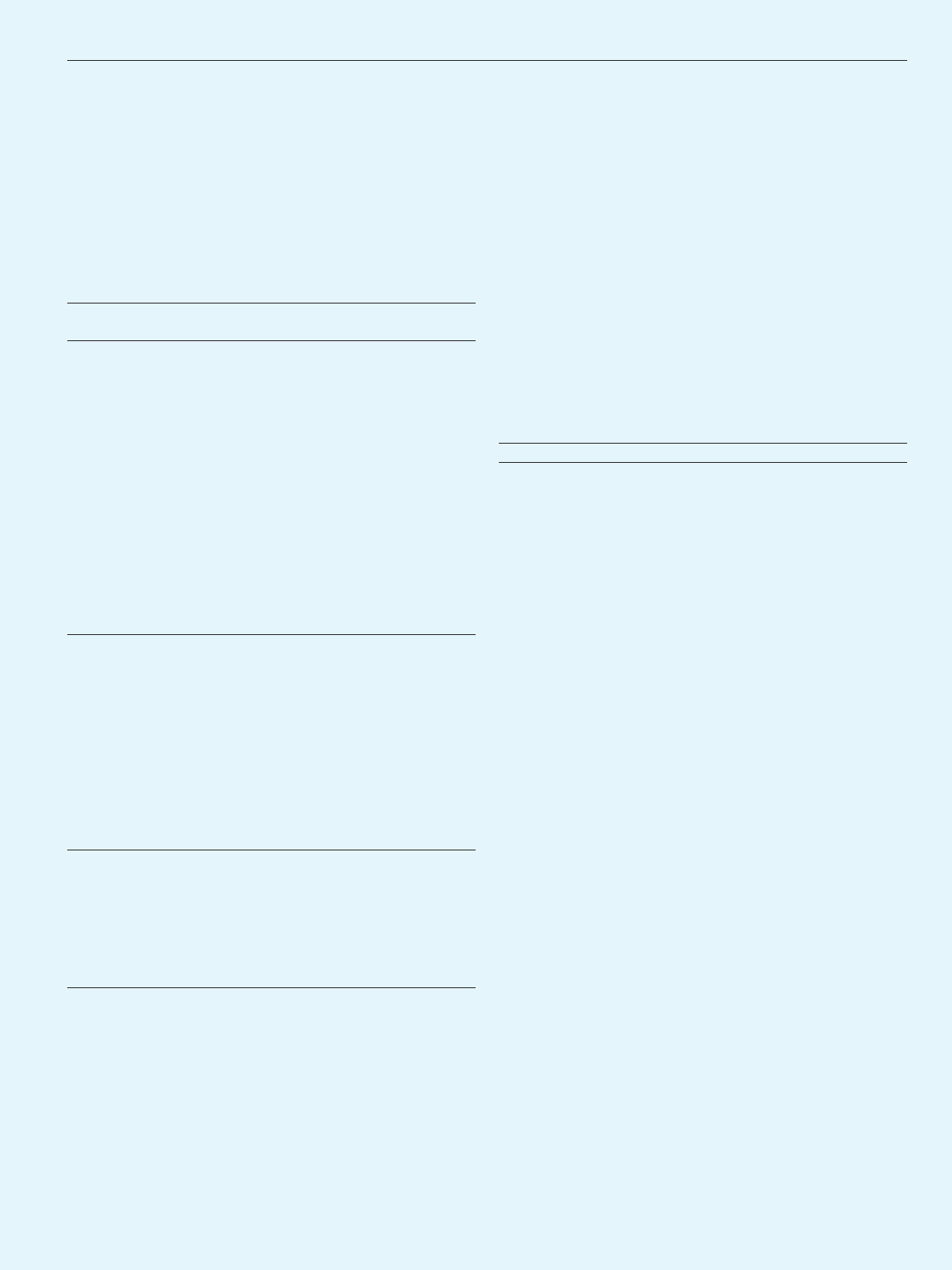

1. Principal deferred tax assets and liabilities were as follows:

Millions of Yen

Deferred tax assets

①Current assets

Enterprise tax payable 115

Office tax payable 18

Accrued bonuses, allowances for bonuses to employees 500

Advances paid 252

Accrued expenses 309

Allowance for sales returns 466

Prepaid expenses 205

Non-deductible portion of allowance for

doubtful accounts 86

Tax credits 118

Non-deductible portion of allowance for content

production account (258)

Other 35

Total 1,850

②Non-current assets

Non-deductible portion of allowance for retirement benefits 392

Allowance for directors’retirement benefits 53

Non-deductible depreciation expense of property,

plant and equipment 684

Advances paid 552

Tax effect on deficit of subsidiaries 666

Loss on investments in securities 472

Other 91

Offset to deferred tax liabilities (non-current) (249)

Total 2,665

Total deferred tax assets 4,515

Deferred tax liabilities

Non-current liabilities

Net unrealized gains on available-for-sale securities (249)

Offset to deferred tax assets (non-current fixed) 249

Total deferred tax liabilities —

Net deferred tax assets (liabilities) 4,515

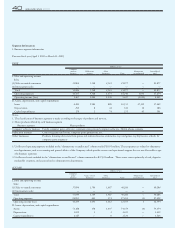

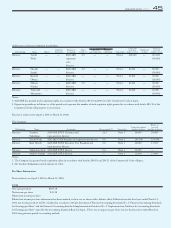

2. Reconciliation between statutory tax rate and effective tax Statutory tax

rate

Statutory tax rate 42.05%

Permanent differences excluded from nontaxable

expenses (e.g., entertainment expenses) 0.18%

Permanent differences excluded from gross revenue

(e.g., dividends received) (0.18%)

Increase/decrease in valuation allowance (3.18%)

Taxation on per capita basis for residents tax 0.07%

Foreign tax credits (0.33%)

Special income tax credits (0.95%)

Investment loss on equity method 1.76%

Tax effect on related companies’ unappropriated

retained earnings (1.36%)

Amortization of consolidation adjustment account 0.34%

Adjustments in unrealized profits due to consolidation (1.00%)

Difference in tax rate with the parent company 0.01%

Other (0.15%)

Effective tax rate 37.26%

3. —