Square Enix 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SQUARE ENIX 2004 37

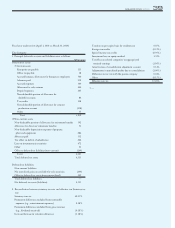

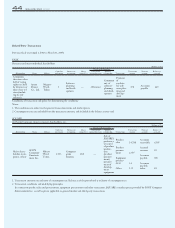

2. Retirement benefit obligation

Millions of Yen

As of March 31, 2003

A. Projected benefit obligation (100)

B. Fair value of plan assets —

C. Unfunded projected benefit obligation (A+B) (100)

D. Unrecognized transition amount —

E. Unrecognized actuarial difference —

F. Unrecognized prior service cost —

G. Net balance sheet amount (C+D+E+F) (100)

H. Prepaid pension cost —

I. Allowance for retirement benefits (G-H) (100)

3. Retirement benefit expenses

Millions of Yen

Year ended March 31, 2003

A. Service cost 23

B. Retirement benefit expenses 23

SQUARE

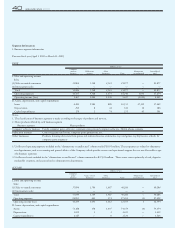

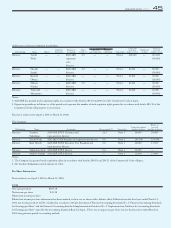

1. Overview of retirement benefit plan applied

SQUARE and its domestic consolidated subsidiaries applied a lump-sum

retirement payment plan with regard to its retirement benefit obligation.

Previously, SQUARE and its domestic consolidated subsidiaries applied a

lump-sum retirement payment plan and tax qualified pension plan. On

March 31, 2002, SQUARE and its domestic consolidated subsidiaries ter-

minated its tax qualified pension plan and pension trust agreement. In

addition, certain of SQUARE’s overseas subsidiaries maintain defined con-

tribution retirement pension plans.

2. Retirement benefit obligation

Millions of Yen

March 31, 2003

Retirement benefit obligation 301

Fair value of plan assets —

Unrecognized transition amount —

Allowance for retirement benefits 301

3. Retirement benefit expenses

Millions of Yen

Year ended March 31, 2003

Service cost 72

Amortization of transition amount —

Loss on termination —

Retirement benefit expenses 72

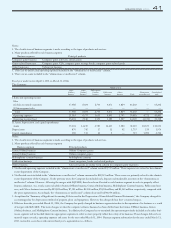

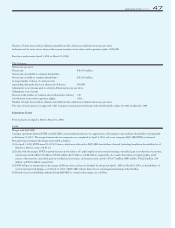

Fiscal year under review (April 1, 2003 to March 31, 2004)

The Company

1. Overview of retirement benefit plan applied

The Company and its domestic consolidated subsidiaries applied a lump-

sum retirement payment plan with regard to its retirement benefit obliga-

tion. The projected benefits are allocated to periods of service on a

straight-line basis. Its domestic consolidated subsidiaries apply the conven-

tional method in the calculation of retirement benefit obligations. In addi-

tion, certain of the Company’s overseas subsidiaries maintain defined con-

tribution retirement pension plans.

2. Retirement benefit obligation

Millions of Yen

March 31, 2004

Retirement benefit obligation 988

Unrecognized actuarial difference (10)

Allowance for retirement benefits 978

3. Retirement benefit expenses

Millions of Yen

Year ended March 31, 2004

Service cost 602

Interest cost 12

Retirement benefit expenses 615

Service cost includes a deficit of ¥388 million due to the change in calcula-

tion of retirement benefit obligation from the conventional method to the

basic method.

4. Assumptions used in accounting for retirement benefit obligation

Periodic allocation method for projected benefits Straight-line basis

Discount rate 1.611%

Years over which net actuarial gains and losses are amortized 1 year

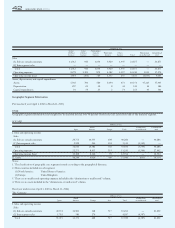

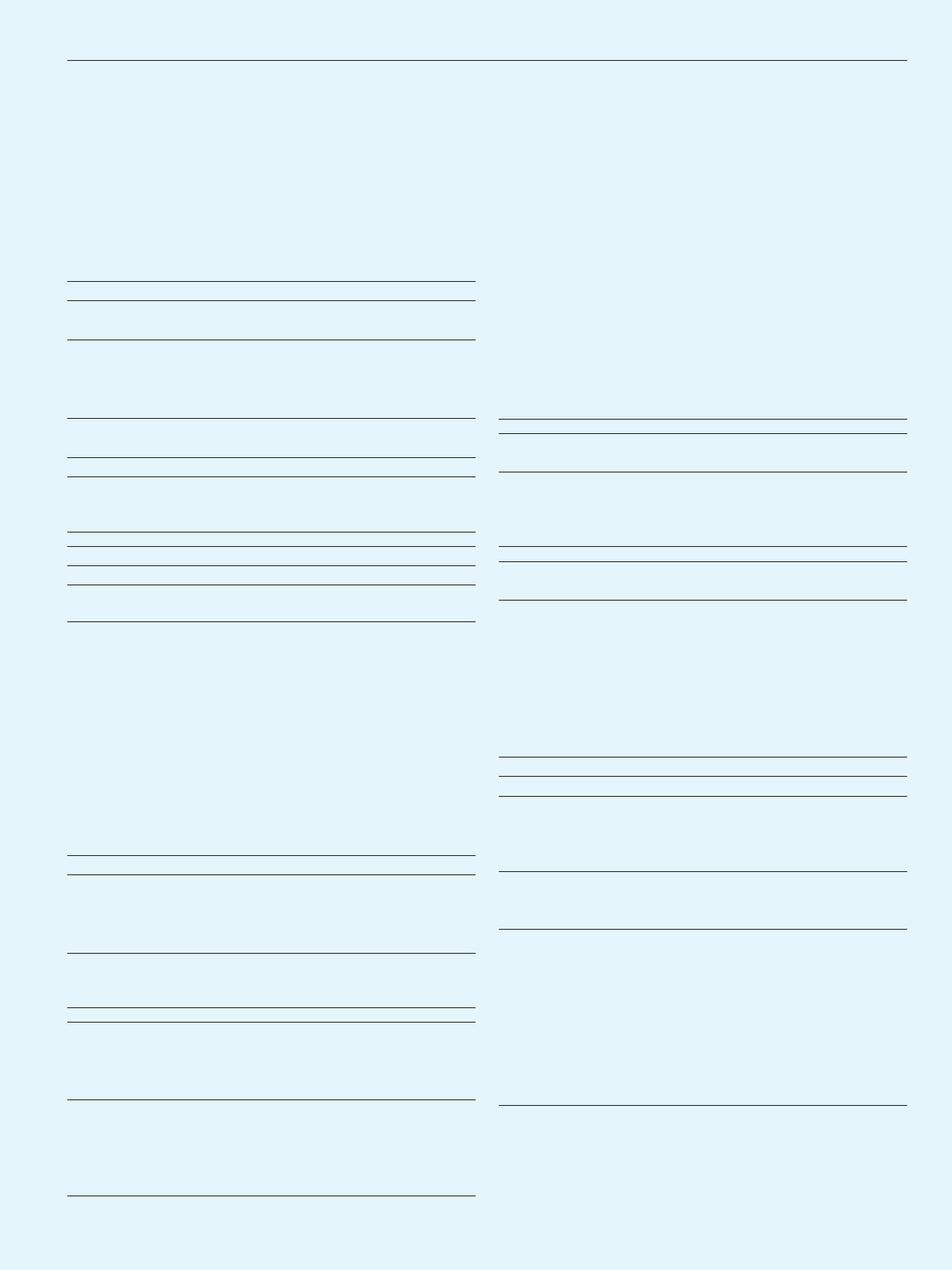

Income Taxes

ENIX

1. Significant components of deferred tax assets and liabilities are as fol-

lows:

Millions of Yen

Deferred tax assets

①Current assets

Enterprise tax payable 279

Non-deductible portion of reserve for bonuses 27

Office tax payable 3

Product development costs 597

Non-deductible portion of allowance for

doubtful accounts 0

Accrued expenses 33

Total 941

②Non-current assets

Non-deductible portion of allowance for retirement

benefits 33

Allowance for directors’ retirement benefits 55

Non-deductible depreciation expense of property, plant

and equipment 0