Shutterfly 2014 Annual Report Download - page 99

Download and view the complete annual report

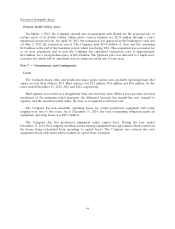

Please find page 99 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Amounts repaid under the Facility may be reborrowed. The revolving loan facility matures on the fifth

anniversary of its closing and is payable in full upon maturity. The Company intends to use the new Facility

from time to time for general corporate purposes, working capital and potential acquisitions.

The Company incurred $0.5 million of Credit Facility origination costs during the twelve months

ended December 31, 2013, related to the amendment and extension of the agreement. These costs have

been capitalized within prepaid expenses for the current portion and other assets for the non-current

portion. These fees are being amortized over the remaining term of the Credit Facility as a component of

interest expense.

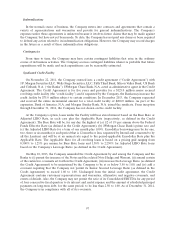

Legal Matters

The Company is subject to the various legal proceedings and claims discussed below as well as certain

other legal proceedings and claims that have not been fully resolved and that have arisen in the ordinary

course of business. Although adverse decisions (or settlements) may occur in one or more of these cases, it

is not possible to estimate the possible loss or losses from each of these cases. The final resolution of these

lawsuits, individually or in the aggregate, is not expected to have a material adverse effect on the

Company’s business, financial position or results of operations. Cases that previously were disclosed may

no longer be described because of rulings in the case, settlements, changes in our business or other

developments rendering them, in our judgment, no longer material to our business, financial position or

results of operations.

The State of Delaware v. Shutterfly, Inc.

On May 1, 2014, the State of Delaware filed a complaint against Shutterfly for alleged violations of the

Delaware False Claims and Reporting Act, 6 Del C. § 1203(b)(2). The complaint asserts that Shutterfly

failed to report and remit to Delaware cash equal to the balances on unused gift cards under the Delaware

Escheats Law, 12 Del. C. § 1101 et seq. The Company believes the suit is without merit.

In all cases, at each reporting period, the Company evaluates whether or not a potential loss amount

or a potential range of loss is probable and reasonably estimable under the provisions of the authoritative

guidance that addresses accounting for contingencies. In such cases, the Company accrues for the amount,

or if a range, the Company accrues the low end of the range as a component of legal expense. The

Company monitors developments in these legal matters that could affect the estimate the Company had

previously accrued. There are no amounts accrued which the Company believes would be material to its

financial position and results of operations.

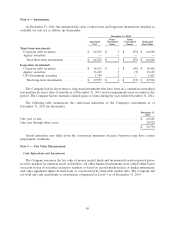

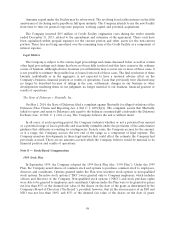

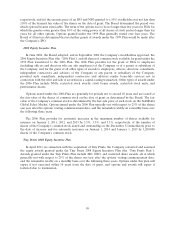

Note 8 — Stock-Based Compensation

1999 Stock Plan

In September 1999, the Company adopted the 1999 Stock Plan (the ‘‘1999 Plan’’). Under the 1999

Plan, the Company issued shares of common stock and options to purchase common stock to employees,

directors and consultants. Options granted under the Plan were incentive stock options or non-qualified

stock options. Incentive stock options (‘‘ISO’’) were granted only to Company employees, which includes

officers and directors of the Company. Non-qualified stock options (‘‘NSO’’) and stock purchase rights

were able to be granted to employees and consultants. Options under the Plan were to be granted at prices

not less than 85% of the deemed fair value of the shares on the date of the grant as determined by the

Company’s Board of Directors (‘‘the Board’’), provided, however, that (i) the exercise price of an ISO and

NSO was not less than 100% and 85% of the deemed fair value of the shares on the date of grant,

98