Shutterfly 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

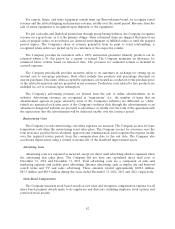

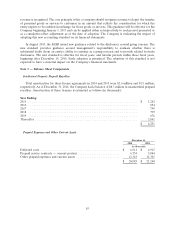

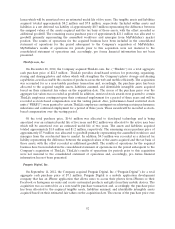

The following table summarizes, by major security type, the Company’s cash equivalents and

investments that are measured at fair value on a recurring basis and are categorized using the fair value

hierarchy (in thousands):

Total Estimated Fair Value as of

December 31, December 31,

2014 2013

Level 1 Securities:

Money market funds ...................................... $ 34,480 $ —

Level 2 Securities:

Agency securities ........................................ 13,645 —

Corporate debt securities .................................. 79,348 —

US Government securities .................................. 1,801 —

Total cash equivalents and investments .......................... $ 129,274 $ —

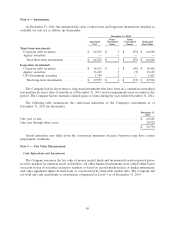

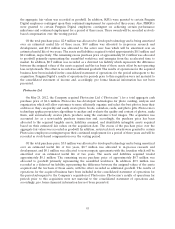

Convertible Senior Notes

As of December 31, 2014, the fair value of the convertible senior notes, which was determined based

on inputs that are observable in the market or that could be derived from, or corroborated with, observable

market data, including our stock price, interest rates and credit spread (Level 2) were as follows (in

thousands):

Total Estimated Fair Value as of

December 31, December 31,

2014 2013

Convertible senior notes ..................................... $ 251,973 $ 237,066

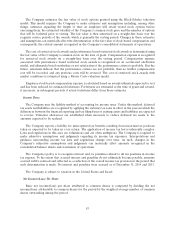

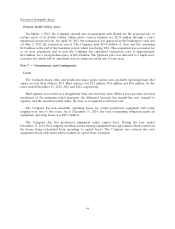

Note 6 — Acquisitions

Business Combinations

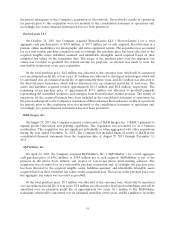

Dot Copy, Inc. (‘‘Groovebook’’)

On October 31, 2014, the Company acquired certain assets of Dot Copy, Inc. (‘‘Groovebook’’) for a

total aggregate purchase price of $13.7 million, consisting of an upfront cash purchase amount and a future

performance-based earn-out subject to achieving certain financial metrics. Groovebook is a mobile photo

book app subscription service that sends customers a keepsake book of their mobile photos each month.

The acquisition was accounted for as a purchase transaction and, accordingly, the purchase price has been

allocated to the acquired tangible assets, liabilities assumed, and identifiable intangible assets acquired

based on their estimated fair values on the acquisition date. The excess of the purchase price over the

aggregate fair values was recorded as goodwill.

Of the total purchase price, $0.6 million was allocated to the customer base, which will be amortized

over an estimated useful life of two years, $0.5 million was allocated to the Groovebook tradename, which

will be amortized over an estimated useful life of three years, $0.4 million was allocated to Groovebook

patents, which will be amortized over an estimated useful life of two years and $0.2 million was allocated to

developed technologies, which will be amortized over an estimated useful life of one year. The remaining

excess purchase price of approximately $12.0 million was allocated to goodwill primarily representing

manufacturing and production synergies and synergies from Groovebooks’ market position. The results of

operations for the acquired business have been included in the consolidated statement of operations for

90