Shutterfly 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.acquisition of entities accounted for using the purchase method of accounting are estimated by

management based on the fair value of assets received. Intangible assets are amortized on a straight-line

basis over the estimated useful lives which range from one to sixteen years, and the amortization is

allocated between cost of net revenues and operating expenses. Goodwill and intangible assets with

indefinite lives are not subject to amortization, but are tested for impairment on an annual basis during the

fourth quarter or whenever events or changes in circumstances indicate the carrying amount of these assets

may not be recoverable.

For the Company’s annual goodwill impairment analysis, the Company operates under two reporting

units. The Company tests goodwill for impairment by first comparing the book value of net assets to the

fair value of the reporting units. If the fair value is determined to be less than the book value or qualitative

factors indicate that it is more likely than not that goodwill is impaired, a second step is performed to

compute the amount of impairment as the difference between the estimated fair value of goodwill and the

carrying value. The Company estimates the fair value of the reporting units using a combination of the

income approach (discounted cash flows) and the market approach. Forecasts of future cash flows are

based on our best estimate of future net sales and operating expenses, based primarily on expected

reporting unit expansion, pricing, market segment share, and general economic conditions.

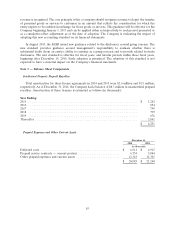

Intellectual Property Prepaid Royalties

The Company has patent license agreements with various third parties. The Company has accounted

for these agreements as prepaid royalties that are amortized over the remaining life of the patents.

Amortization expense is recorded on a straight-line basis as a component of cost of revenue. The current

portion of the prepaid royalty is recorded as a component of prepaid expenses and the long term portion is

recorded in other assets.

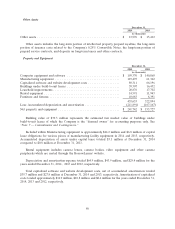

Lease Obligations

The Company categorizes leases at their inception as either operating or capital leases. On certain of

our lease agreements, the Company may receive rent holidays and other incentives. The Company

recognizes lease costs on a straight-line basis without regard to deferred payment terms, such as rent

holidays that defer the commencement date of required payments. Additionally, incentives the Company

receives for leases categorized as operating leases are treated as a reduction of our costs over the term of

the agreement.

The Company establishes assets and liabilities for the estimated construction costs incurred under

build-to-suit lease arrangements to the extent the Company is involved in the construction of structural

improvements or takes construction risk prior to commencement of a lease. Upon occupancy of facilities

under build-to-suit leases, the Company assesses whether these arrangements qualify for sales recognition

under the sale-leaseback accounting guidance. If the Company continues to be the deemed owner, the

facilities are accounted for as financing leases.

Revenue Recognition

The Company recognizes revenue from Consumer and Enterprise product sales, net of applicable

sales tax, upon shipment of fulfilled orders, when persuasive evidence of an arrangement exists, the selling

price is fixed or determinable and collection of resulting receivables is reasonably assured. Customers place

Consumer product orders through the Company’s websites and pay primarily using credit cards. Enterprise

customers are invoiced upon fulfillment. Shipping charged to customers is recognized as revenue at the

time of shipment.

81