Shutterfly 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

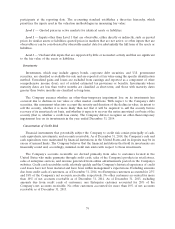

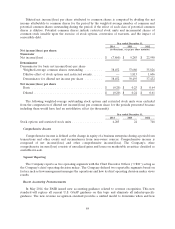

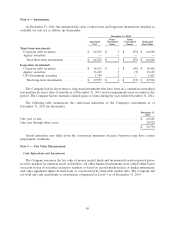

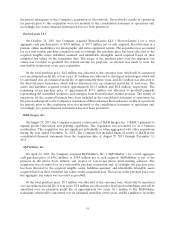

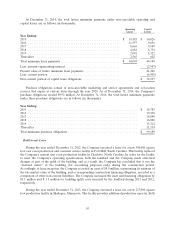

Note 4 — Investments

At December 31, 2014, the estimated fair value of short-term and long-term investments classified as

available for sale are as follows (in thousands):

December 31, 2014

Gross Gross

Amortized Unrealized Unrealized Estimated

Cost Gains Losses Fair Value

Short-term investments

Corporate debt securities ................ $ 64,922 $ 3 $ (59) $ 64,866

Agency securities ......................————

Total short-term investments ............ $ 64,922 $ 3 $ (59) $ 64,866

Long-term investments

Corporate debt securities ................ $ 14,511 $ 1 $ (30) $ 14,482

Agency securities ...................... 13,649 3 (7) 13,645

US Government securities ............... 1,799 2 — 1,801

Total long-term investments ............ $ 29,959 $ 6 $ (37) $ 29,928

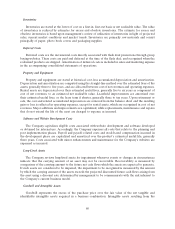

The Company had no short-term or long-term investments that have been in a continuous unrealized

loss position for more than 12 months as of December 31, 2014 and no impairments were recorded in the

period. The Company had no material realized gains or losses during the year ended December 31, 2014.

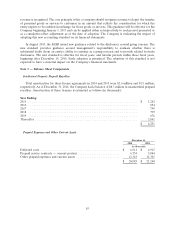

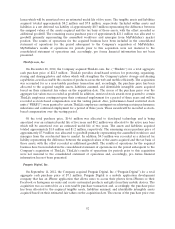

The following table summarizes the contractual maturities of the Company’s investments as of

December 31, 2014 (in thousands):

December 31,

2014

One year or less ...................................................... $ 64,866

One year through three years ............................................ 29,928

$ 94,794

Actual maturities may differ from the contractual maturities because borrowers may have certain

prepayment conditions.

Note 5 — Fair Value Measurement

Cash Equivalents and Investments

The Company measures the fair value of money market funds and investments based on quoted prices

in active markets for identical assets or liabilities. All other financial instruments were valued either based

on recent trades of securities in inactive markets or based on quoted market prices of similar instruments

and other significant inputs derived from or corroborated by observable market data. The Company did

not hold any cash equivalents or investments categorized as Level 3 as of December 31, 2014.

89