Shutterfly 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

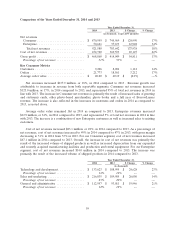

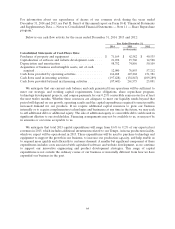

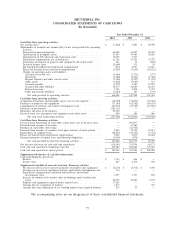

Contractual Obligations

The following are contractual obligations at December 31, 2014, associated with lease obligations and

other arrangements:

Less Than More Than

Total 1 Year 1-3 Years 3-5 Years 5 Years

(in thousands)

Contractual Obligations

Convertible Senior Notes, including

interest ................... $ 302,625 $ 750 $ 1,500 $ 300,375 $ —

Capital lease obligations ........ 44,149 10,026 19,445 14,076 602

Operating lease obligations(1) .... 44,095 14,585 20,223 6,722 2,565

Build-to-suit lease obligations(2) . . 63,108 4,798 12,312 12,871 33,127

Purchase obligations(3) ......... 99,189 18,383 38,078 31,394 11,334

Total contractual obligations ..... $ 553,166 $ 48,542 $ 91,558 $ 365,438 $ 47,628

(1) Includes office space in Redwood City and Santa Clara, California, and Tempe, Arizona and certain

production facilities under non-cancelable operating leases. We also have various non-cancelable

operating leases for certain production equipment.

(2) Includes the estimated timing and amount of payments for rent for our newly leased production

facility spaces in Fort Mill, South Carolina, Shakopee, Minnesota and Tempe, Arizona. See Part II,

Item 8 of this annual report on Form 10-K ‘‘Financial Statements and Supplementary Data — Notes

to Consolidated Financial Statements — Note 7 — Commitments and Contingencies’’ for further

discussion.

(3) Includes co-location agreements with third-party hosting facilities that expire in 2020 as well as

minimums under marketing agreements.

Other than the obligations, liabilities and commitments described above, we have no significant

unconditional purchase obligations or similar instruments. We are not a guarantor of any other entities’

debt or other financial obligations.

Off-Balance Sheet Arrangements

We do not have any relationships with unconsolidated entities or financial partnerships, such as

entities often referred to as structured finance or special purpose entities, which would have been

established for the purpose of facilitating off-balance sheet arrangements or other contractually narrow or

limited purposes. In addition, we do not have any undisclosed borrowings or debt and we have not entered

into any synthetic leases. We are, therefore, not materially exposed to any financing, liquidity, market or

credit risk that could arise if we had engaged in such relationships.

Recent Accounting Pronouncements

In May 2014, the FASB issued new accounting guidance related to revenue recognition. This new

standard will replace all current U.S. GAAP guidance on this topic and eliminate all industry-specific

guidance. The new revenue recognition standard provides a unified model to determine when and how

revenue is recognized. The core principle is that a company should recognize revenue to depict the transfer

of promised goods or services to customers in an amount that reflects the consideration for which the

69