Shutterfly 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

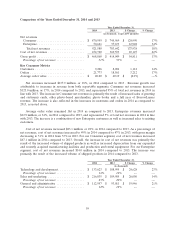

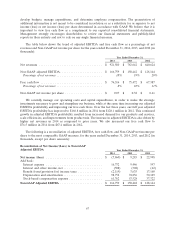

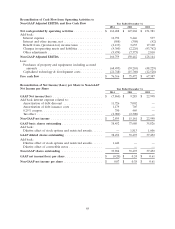

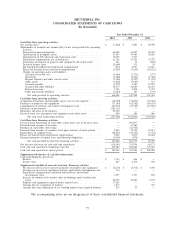

Reconciliation of Cash Flow from Operating Activities to

Non-GAAP Adjusted EBITDA and Free Cash Flow Year Ended December 31,

2014 2013 2012

Net cash provided by operating activities ................ $ 166,488 $ 147,268 $ 151,381

Add back:

Interest expense ................................ 16,732 9,446 597

Interest and other income, net ...................... (508) (308) (42)

Benefit from /(provision for) income taxes ............. (2,119) 3,635 17,160

Changes in operating assets and liabilities .............. (4,360) (2,226) (43,762)

Other adjustments ............................... (9,474) (7,373) 2,810

Non-GAAP Adjusted EBITDA ........................ 166,759 150,442 128,144

Less:

Purchases of property and equipment, including accrued

amounts .................................... (68,495) (59,210) (48,229)

Capitalized technology & development costs ............ (21,748) (15,760) (12,528)

Free cash flow ................................... $ 76,516 $ 75,472 $ 67,387

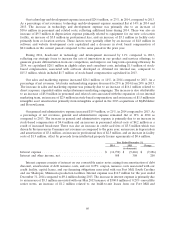

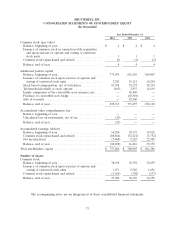

Reconciliation of Net Income/(Loss) per Share to Non-GAAP

Net Income per Share Year Ended December 31,

2014 2013 2012

GAAP Net income/(loss) ............................ $ (7,860) $ 9,285 $ 22,998

Add back interest expense related to:

Amortization of debt discount ...................... 11,726 7,002 —

Amortization of debt issuance costs .................. 1,179 705 —

0.25% coupon .................................. 750 469 —

Tax effect ..................................... (2,900) (2,300) —

Non-GAAP net income ............................. $ 2,895 $ 15,161 $ 22,998

GAAP basic shares outstanding ....................... 38,452 37,680 35,826

Add back:

Dilutive effect of stock options and restricted awards ...... — 1,813 1,606

GAAP diluted shares outstanding ..................... 38,452 39,493 37,432

Add back:

Dilutive effect of stock options and restricted awards ...... 1,442 — —

Dilutive effect of convertible notes ...................———

Non-GAAP shares outstanding ....................... 39,894 39,493 37,432

GAAP net income/(loss) per share ..................... $ (0.20) $ 0.24 $ 0.61

Non-GAAP net income per share ...................... $ 0.07 $ 0.38 $ 0.61

68