Shutterfly 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

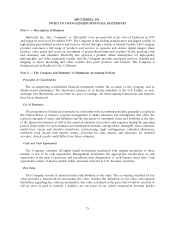

revenue is recognized. The core principle is that a company should recognize revenue to depict the transfer

of promised goods or services to customers in an amount that reflects the consideration for which the

entity expects to be entitled in exchange for those goods or services. This guidance will be effective for the

Company beginning January 1, 2017 and can be applied either retrospectively to each period presented or

as a cumulative-effect adjustment as of the date of adoption. The Company is evaluating the impact of

adopting this new accounting standard on its financial statements.

In August 2014, the FASB issued new guidance related to the disclosures around going concern. The

new standard provides guidance around management’s responsibility to evaluate whether there is

substantial doubt about an entity’s ability to continue as a going concern and to provide related footnote

disclosures. The new standard is effective for fiscal years, and interim periods within those fiscal years,

beginning after December 15, 2016. Early adoption is permitted. The adoption of this standard is not

expected to have a material impact on the Company’s financial statements.

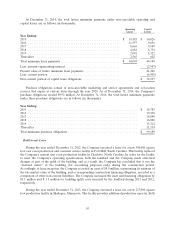

Note 3 — Balance Sheet Components

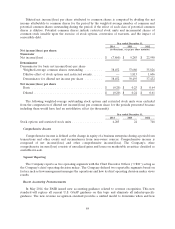

Intellectual Property Prepaid Royalties

Total amortization for these license agreements in 2014 and 2013 were $1.6 million and $1.5 million,

respectively. As of December 31, 2014, the Company had a balance of $8.3 million in unamortized prepaid

royalties. Amortization of these licenses is estimated as follows (in thousands):

Year Ending:

2015 .............................................................. $ 1,262

2016 .............................................................. 854

2017 .............................................................. 799

2018 .............................................................. 799

2019 .............................................................. 676

Thereafter .......................................................... 3,861

$ 8,251

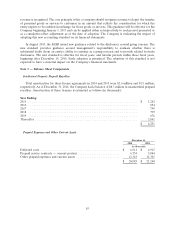

Prepaid Expenses and Other Current Assets

December 31,

2014 2013

(in thousands)

Deferred costs ............................................. $ 6,911 $ 4,915

Prepaid service contracts — current portion ........................ 6,754 5,044

Other prepaid expenses and current assets ......................... 11,318 11,301

$ 24,983 $ 21,260

85