Shutterfly 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

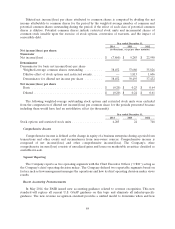

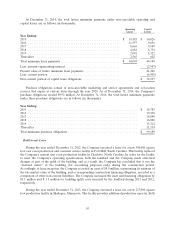

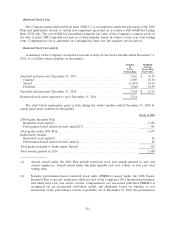

Purchased Intangible Assets

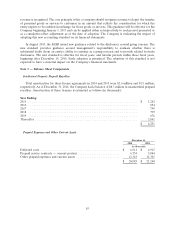

Eastman Kodak Gallery Assets

On March 1, 2012, the Company entered into an agreement with Kodak for the proposed sale of

certain assets of its Kodak Gallery online photo services business for $23.8 million through a court-

supervised auction process. On April 30, 2012, the transaction was approved by the bankruptcy court and

on May 2, 2012 the transaction closed. The Company paid $19.0 million at close and the remaining

$4.8 million at the end of the transition period, which was during 2012. This acquisition was accounted for

as an asset acquisition and as such the Company has capitalized transaction costs of approximately

$0.6 million, for a total purchase price of $24.4 million. The purchase price was allocated to a single asset,

customer list, which will be amortized over its estimated useful life of four years.

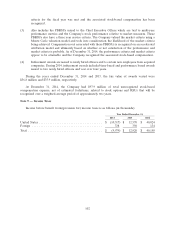

Note 7 — Commitments and Contingencies

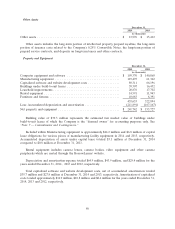

Leases

The Company leases office and production space under various non-cancelable operating leases that

expire no later than January 2023. Rent expense was $7.2 million, $5.8 million and $4.8 million, for the

years ended December 31, 2014, 2013 and 2012, respectively.

Rent expense is recorded on a straight-line basis over the lease term. When a lease provides for fixed

escalations of the minimum rental payments, the difference between the straight-line rent charged to

expense, and the amount payable under the lease is recognized as deferred rent.

The Company has non-cancelable operating leases for certain production equipment with terms

ranging from four to five years. As of December 31, 2014, the total outstanding obligation under all

equipment operating leases was $22.1 million.

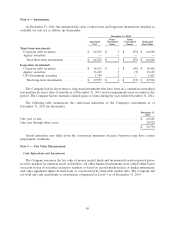

The Company also has production equipment under capital lease. During the year ended

December 31, 2014, the Company modified certain existing equipment lease agreements which resulted in

the leases being reclassified from operating to capital leases. The Company also entered into new

equipment leases with terms which resulted in capital lease treatment.

94