Shutterfly 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

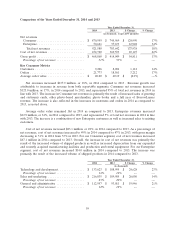

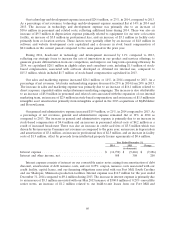

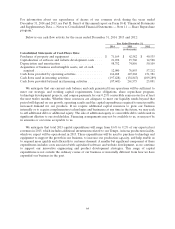

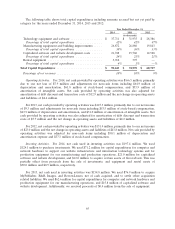

The following table shows total capital expenditures including amounts accrued but not yet paid by

category for the years ended December 31, 2014, 2013 and 2012:

Year Ended December 31,

2014 2013 2012

(in thousands)

Technology equipment and software .................. $ 37,711 $ 31,935 $ 28,386

Percentage of total capital expenditures ............... 42% 42% 47%

Manufacturing equipment and building improvements ..... 26,872 26,880 19,843

Percentage of total capital expenditures ............... 30% 36% 33%

Capitalized software and website development costs ...... 21,748 15,760 12,528

Percentage of total capital expenditures ............... 24% 21% 21%

Rental equipment ............................... 3,912 395 —

Percentage of total capital expenditures ............... 4% 1% —%

Total Capital Expenditures .......................... $ 90,243 $ 74,970 $ 60,757

Percentage of net revenues .......................... 10% 10% 9%

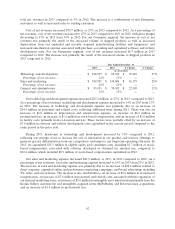

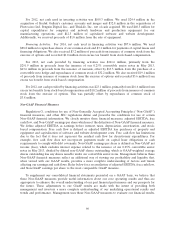

Operating Activities. For 2014, net cash provided by operating activities was $166.5 million, primarily

due to our net loss of $7.9 million and adjustments for non-cash items including $64.9 million of

depreciation and amortization, $61.8 million of stock-based compensation, and $33.9 million of

amortization of intangible assets. Net cash provided by operating activities was also adjusted for

amortization of debt discount and transaction costs of $12.9 million and the net change in operating assets

and liabilities of $4.4 million.

For 2013, net cash provided by operating activities was $147.3 million, primarily due to our net income

of $9.3 million and adjustments for non-cash items including $53.5 million of stock-based compensation,

$43.9 million of depreciation and amortization, and $31.0 million of amortization of intangible assets. Net

cash provided by operating activities was also adjusted for amortization of debt discount and transaction

costs of $7.7 million and the net change in operating assets and liabilities of $2.2 million.

For 2012, net cash provided by operating activities was $151.4 million, primarily due to our net income

of $23.0 million and the net change in operating assets and liabilities of $43.8 million. Net cash provided by

operating activities was adjusted for non-cash items including $50.1 million of depreciation and

amortization expense and $37.3 million of stock-based compensation.

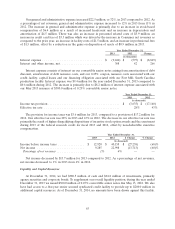

Investing Activities. For 2014, net cash used in investing activities was $197.4 million. We used

$124.1 million to purchase investments. We used $71.2 million for capital expenditures for computer and

network hardware to support our website infrastructure and information technology systems and for

production equipment for our manufacturing and production operations, $21.0 million for capitalized

software and website development, and $12.0 million to acquire certain assets of Groovebook. This was

partially offset from proceeds from the sale of investments, and equipment and rental assets of

$30.0 million and $0.9 million, respectively.

For 2013, net cash used in investing activities was $154.8 million. We used $76.9 million to acquire

MyPublisher, R&R Images, and BorrowLenses, net of cash acquired, and to settle other acquisition

related liabilities. We used $62.6 million for capital expenditures for computer and network hardware and

production equipment for our manufacturing operations, and $15.8 million of capitalized software and

website development. Additionally, we received proceeds of $0.4 million from the sale of equipment.

65