Shutterfly 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Inventories

Inventories are stated at the lower of cost on a first-in, first-out basis or net realizable value. The value

of inventories is reduced by estimates for excess and obsolete inventories. The estimate for excess and

obsolete inventories is based upon management’s review of utilization of inventories in light of projected

sales, current market conditions and market trends. Inventories are primarily raw materials and consist

principally of paper, photo book covers and packaging supplies.

Deferred Costs

Deferred costs are the incremental costs directly associated with flash deal promotions through group

buying websites. These costs are paid and deferred at the time of the flash deal, and recognized when the

redeemed products are shipped. Amortization of deferred costs is included in sales and marketing expense

in the accompanying consolidated statements of operations.

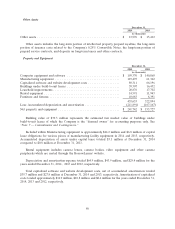

Property and Equipment

Property and equipment are stated at historical cost, less accumulated depreciation and amortization.

Depreciation and amortization are computed using the straight-line method over the estimated lives of the

assets, generally three to five years, and are allocated between cost of net revenues and operating expenses.

Rental assets are depreciated over their estimated useful lives, generally five to six years as component of

cost of net revenues, to an estimated net realizable value. Leasehold improvements are amortized over

their estimated useful lives, or the lease term if shorter, generally three to ten years. Upon retirement or

sale, the cost and related accumulated depreciation are removed from the balance sheet and the resulting

gain or loss is reflected in operating expenses, except for rental assets, which are recognized in cost of net

revenues. Major additions and improvements are capitalized, while replacements, maintenance and repairs

that do not extend the life of the asset are charged to expense as incurred.

Software and Website Development Costs

The Company capitalizes eligible costs associated with website development and software developed

or obtained for internal use. Accordingly, the Company expenses all costs that relate to the planning and

post implementation phases. Payroll and payroll related costs and stock-based compensation incurred in

the development phase are capitalized and amortized over the product’s estimated useful life, generally

three years. Costs associated with minor enhancements and maintenance for the Company’s websites are

expensed as incurred.

Long-Lived Assets

The Company reviews long-lived assets for impairment whenever events or changes in circumstances

indicate that the carrying amount of an asset may not be recoverable. Recoverability is measured by

comparison of the carrying amount to the future net cash flows which the assets are expected to generate.

If such assets are considered to be impaired, the impairment to be recognized is measured by the amount

by which the carrying amount of the assets exceeds the projected discounted future cash flows arising from

the asset using a discount rate determined by management to be commensurate with the risk inherent to

the Company’s current business model.

Goodwill and Intangible Assets

Goodwill represents the excess of the purchase price over the fair value of the net tangible and

identifiable intangible assets acquired in a business combination. Intangible assets resulting from the

80