Shutterfly 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the period subsequent to the Company’s acquisition of Groovebook. Groovebook’s results of operations

for periods prior to this acquisition were not material to the consolidated statement of operations and,

accordingly, pro forma financial information has not been presented.

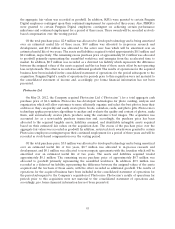

BorrowLenses LLC

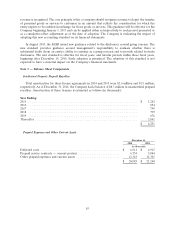

On October 24, 2013, the Company acquired BorrowLenses LLC (‘‘BorrowLenses’’) for a total

aggregate cash purchase price of $36.8 million, or $35.7 million net of cash acquired. BorrowLenses is a

premier online marketplace for photographic and video equipment rentals. The acquisition was accounted

for as a non-taxable purchase transaction and, accordingly, the purchase price has been allocated to the

acquired tangible assets, liabilities assumed, and identifiable intangible assets acquired based on their

estimated fair values on the acquisition date. The excess of the purchase price over the aggregate fair

values was recorded as goodwill. For federal income tax purposes, an election was made to treat the

non-taxable transaction as an asset acquisition.

Of the total purchase price, $4.2 million was allocated to the customer base, which will be amortized

over an estimated useful life of four years, $1.0 million was allocated to developed technologies, which will

be amortized over an estimated useful life of approximately three years, and $1.6 million was allocated to

the BorrowLenses tradename, which will be amortized over an estimated useful life of four years. The

assets and liabilities acquired totaled approximately $13.3 million and $0.8 million, respectively. The

remaining excess purchase price of approximately $17.6 million was allocated to goodwill primarily

representing the assembled workforce and synergies from BorrowLenses’ market position. The results of

operations for the acquired business have been included in the consolidated statement of operations for

the period subsequent to the Company’s acquisition of BorrowLenses. BorrowLenses’ results of operations

for periods prior to this acquisition were not material to the consolidated statement of operations and,

accordingly, pro forma financial information has not been presented.

R&R Images, Inc.

On August 29, 2013, the Company acquired certain assets of R&R Images, Inc. (‘‘R&R’’) primarily to

expand product innovation and printing capabilities. The acquisition was accounted for as a business

combination. This acquisition was not significant individually or when aggregated with other acquisitions

during the year ended December 31, 2013. The Company has included financial results of R&R in the

consolidated financial statements from the acquisition date of August 29, 2013 through December 31,

2013.

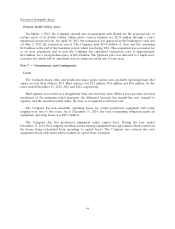

MyPublisher, Inc.

On April 29, 2013, the Company acquired MyPublisher, Inc. (‘‘MyPublisher’’) for a total aggregate

cash purchase price of $40.2 million, or $38.4 million net of cash acquired. MyPublisher is one of the

pioneers in the photo book industry and creator of easy-to-use photo book making software. The

acquisition was accounted for as a non-taxable purchase transaction and, accordingly, the purchase price

has been allocated to the acquired tangible assets, liabilities assumed, and identifiable intangible assets

acquired based on their estimated fair values on the acquisition date. The excess of the purchase price over

the aggregate fair values was recorded as goodwill.

Of the total purchase price, $9.5 million was allocated to the customer base, which will be amortized

over an estimated useful life of four years, $7.8 million was allocated to developed technologies and will be

amortized over an estimated useful life of approximately two years, $1.3 million to the MyPublisher

tradename, which will be amortized over an estimated useful life of two years, and $0.1 million to favorable

91