Shutterfly 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

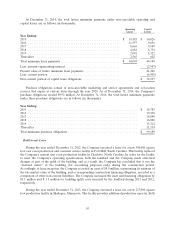

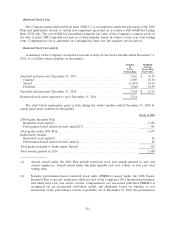

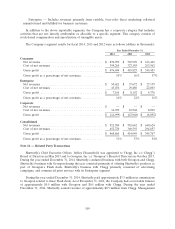

Stock Option Activity

A summary of the Company’s stock option activity at December 31, 2014 and changes during the

period are presented in the table below (share numbers and aggregate intrinsic values in thousands):

Weighted

Weighted Average

Number of Average Contractual Aggregate

Options Exercise Term Intrinsic

Outstanding Price (Years) Value

Balances, December 31, 2013 .............. 616 $ 23.10

Granted ............................ — —

Exercised ........................... (190) 17.09

Forfeited, canceled or expired ............ (24) 31.84

Balances, December 31, 2014 .............. 402 $ 25.42 4.5 $ 7,200

Options vested and expected to vest at

December 31, 2014 .................... 399 $ 25.39 4.5 $ 7,169

Options vested at December 31, 2014 ........ 356 $ 24.36 4.1 $ 6,746

As of December 31, 2013 and 2012, there were 462,000 and 1,677,000 options vested, respectively.

During the year ended December 31, 2014, the Company did not grant any stock options. In the fiscal

years ended December 31, 2013 and 2012, the Company granted stock options to purchase an aggregate of

2,000 and 139,000 shares of common stock, respectively, with a weighted average grant-date fair value of

$12.55 and $12.93 per share, respectively.

The total intrinsic value of options exercised during the twelve months ended December 31, 2014, 2013

and 2012 was $6.1 million, $41.5 million and $12.3 million, respectively. Net cash proceeds from the

exercise of stock options were $3.2 million for the twelve months ended December 31, 2014.

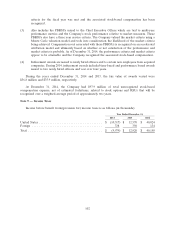

Valuation of Stock Options

The Company estimated the fair value of each option award on the date of grant using the Black-

Scholes option-pricing model and the assumptions noted in the following table. The Company calculated

volatility using an average of its historical and implied volatilities as it had sufficient public trading history

to cover the entire expected term. The expected term of options gave consideration to historical exercises,

post vest cancellations and the options contractual term. The risk-free rate for the expected term of the

option is based on the U.S. Treasury Constant Maturity at the time of grant. The assumptions used to value

options granted during 2013 and 2012 were as follows:

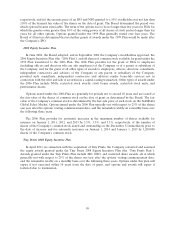

Year Ended December 31,

2013 2012

Dividend yield ............................................. — —

Annual risk free rate of return ................................. 0.8% 0.8%

Expected volatility .......................................... 47.0% 56.5%

Expected term (years) ........................................ 4.2 4.3

100