Shutterfly 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the landlord and the Company incurred costs to construct the facility according to the Company’s

operating specifications, and as a result, the Company has concluded that it was the ‘‘deemed owner’’ of

the building (for accounting purposes only) during the construction period. Accordingly, the Company

recorded an asset and corresponding construction financing obligation, as a component of non-current

liabilities, of $13.7 million and 7.0 million for building uplift costs incurred by the landlord during 2014 and

2013, respectively.

Also during the year ended December 31, 2013 the Company executed a lease for a new 237,000

square foot production facility in Tempe, Arizona. This facility will consolidate all of the Company’s

locations in the greater Phoenix area as well as offer flexibility for future expansion, and is expected to

become operational during 2015. Both the landlord and the Company will incur costs to construct the

facility according to the Company’s operating specifications, and as a result, the Company has concluded

that it is the ‘‘deemed owner’’ of the building (for accounting purposes only) during the construction

period. As of December 31, 2014, the landlord incurred $9.1 million of building construction costs which

the Company has recorded as an asset, with a corresponding construction financing obligation, which is

recorded as a component of other non-current liabilities. The Company will increase the asset and

financing obligation as additional building uplift costs are incurred by the landlord during the construction

period.

Upon completion of construction of these facilities, the Company evaluates the de-recognition of the

asset and liability under the provisions of ASC 840.40 Leases — Sale-Leaseback Transactions. However, if

the Company does not comply with the provisions needed for sale-leaseback accounting, the lease will be

accounted for as a financing obligation and lease payments will be attributed to (1) a reduction of the

principal financing obligation; (2) imputed interest expense; and (3) land lease expense (which is

considered an operating lease and a component of cost of goods sold) representing an imputed cost to

lease the underlying land of the facility. In addition, the underlying building asset will be depreciated over

the building’s estimated useful life which is generally 30 years. And at the conclusion of the lease term, the

Company would de-recognize both the net book values of the asset and financing obligation.

Construction of the Fort Mill, South Carolina facility and the Shakopee, Minnesota facility were

completed in the second quarter of 2013 and 2014, respectfully, and at that time the Company concluded

that it had forms of continued economic involvement in the facility. As a result, the Company did not

comply with provisions for sale-leaseback accounting and the buildings are being accounted for as a

financing obligation.

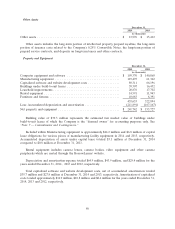

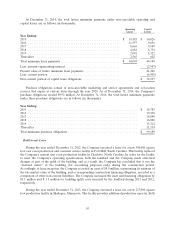

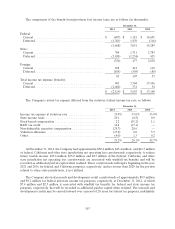

At December 31, 2014, the total future rent payments under these build-to-suit leases are as follows (in

thousands):

Year Ending:

2015 .............................................................. $ 4,798

2016 .............................................................. 6,088

2017 .............................................................. 6,224

2018 .............................................................. 6,364

2019 .............................................................. 6,507

Thereafter .......................................................... 33,127

Total future rent payments under build-to-suit leases ............................ $ 63,108

96