Shutterfly 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For information about our repurchases of shares of our common stock during the years ended

December 31, 2014 and 2013, see Part II, Item 8 of this annual report on Form 10-K ‘‘Financial Statements

and Supplementary Data — Notes to Consolidated Financial Statements — Note 11 — Share Repurchase

program.’’

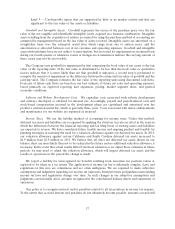

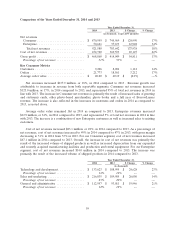

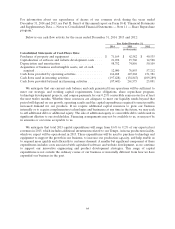

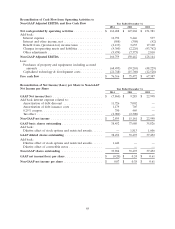

Below is our cash flow activity for the years ended December 31, 2014, 2013 and 2012:

Year Ended December 31,

2014 2013 2012

(in thousands)

Consolidated Statements of Cash Flows Data:

Purchases of property and equipment .................. $ 71,169 $ 62,582 $ 40,535

Capitalization of software and website development costs .... 21,032 15,760 12,528

Depreciation and amortization ....................... 98,752 74,856 50,109

Acquisition of business and intangible assets, net of cash

acquired ...................................... 12,000 76,893 57,212

Cash flows provided by operating activities ............... 166,488 147,268 151,381

Cash flows used in investing activities .................. (197,428) (154,847) (109,289)

Cash flows provided by/(used in) financing activities ........ (87,601) 261,575 23,081

We anticipate that our current cash balance and cash generated from operations will be sufficient to

meet our strategic and working capital requirements, lease obligations, share repurchase program,

technology development projects, and coupon payments for our 0.25% convertible senior notes for at least

the next twelve months. Whether these resources are adequate to meet our liquidity needs beyond that

period will depend on our growth, operating results and the capital expenditures required to meet possible

increased demand for our products. If we require additional capital resources to grow our business

internally or to acquire complementary technologies and businesses at any time in the future, we may seek

to sell additional debt or additional equity. The sale of additional equity or convertible debt could result in

significant dilution to our stockholders. Financing arrangements may not be available to us, or may not be

in amounts or on terms acceptable to us.

We anticipate that total 2015 capital expenditures will range from 8.6% to 9.2% of our expected net

revenues in 2015, which includes additional investments related to our Tempe, Arizona production facility,

which we expect will be operational in 2015. These expenditures will be used to purchase technology and

equipment to support the growth in our business, to increase our production capacity, and help enable us

to respond more quickly and efficiently to customer demand. A smaller but significant component of these

expenditures includes costs associated with capitalized software and website development, as we continue

to support our innovative engineering and product development strategies. This range of capital

expenditures is not outside the ordinary course of our business or materially different from how we have

expanded our business in the past.

64