Shutterfly 2014 Annual Report Download - page 93

Download and view the complete annual report

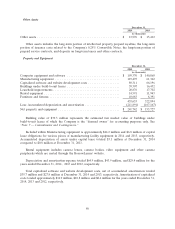

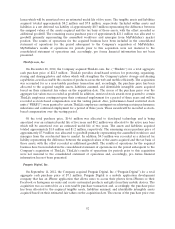

Please find page 93 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.leases which will be amortized over an estimated useful life of five years. The tangible assets and liabilities

acquired totaled approximately $8.2 million and $7.8 million, respectively. Included within assets and

liabilities is a net deferred tax liability of approximately $0.3 million representing the difference between

the assigned values of the assets acquired and the tax basis of those assets, with the offset recorded as

additional goodwill. The remaining excess purchase price of approximately $21.1 million was allocated to

goodwill primarily representing the assembled workforce and synergies from MyPublisher’s market

position. The results of operations for the acquired business have been included in the consolidated

statement of operations for the period subsequent to the Company’s acquisition of MyPublisher.

MyPublisher’s results of operations for periods prior to this acquisition were not material to the

consolidated statement of operations and, accordingly, pro forma financial information has not been

presented.

ThisLife.com, Inc.

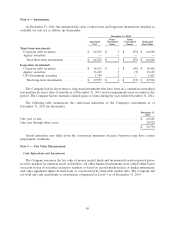

On December 28, 2012, the Company acquired ThisLife.com, Inc. (‘‘ThisLife’’) for a total aggregate

cash purchase price of $22.5 million . ThisLife provides cloud-based services for protecting, organizing,

storing and sharing photos and videos which will strengthen the Company’s photo storage and sharing

capabilities as well as enable the creation of products across the web and mobile efficiently. The acquisition

was accounted for as a non-taxable purchase transaction and, accordingly, the purchase price has been

allocated to the acquired tangible assets, liabilities assumed, and identifiable intangible assets acquired

based on their estimated fair values on the acquisition date. The excess of the purchase price over the

aggregate fair values was recorded as goodwill. In addition, restricted stock awards were granted to certain

ThisLife employees contingent upon their continued employment for a period of three years and will be

recorded as stock-based compensation over the vesting period. Also, performance-based restricted stock

units (‘‘PBRSU’’) were granted to certain ThisLife employees contingent on achieving certain performance

milestones and continued employment for a period of three years. These awards will be recorded as stock-

based compensation over the vesting period.

Of the total purchase price, $14.6 million was allocated to developed technology and is being

amortized over an estimated useful life of five years and $0.2 million was allocated to the active user base

which will be amortized over an estimated useful life of two years. The assets and liabilities acquired

totaled approximately $1.0 million and $1.2 million, respectively. The remaining excess purchase price of

approximately $7.9 million was allocated to goodwill primarily representing the assembled workforce and

synergies from the accelerated time to market. In addition, $4.3 million was recorded as a deferred tax

liability representing the difference between the assigned values of the assets acquired and the tax basis of

those assets, with the offset recorded as additional goodwill. The results of operations for the acquired

business have been included in the consolidated statement of operations for the period subsequent to the

Company’s acquisition of ThisLife. ThisLife’s results of operations for periods prior to this acquisition

were not material to the consolidated statement of operations and, accordingly, pro forma financial

information has not been presented.

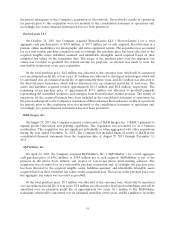

Penguin Digital, Inc.

On September 14, 2012, the Company acquired Penguin Digital, Inc. (‘‘Penguin Digital’’) for a total

aggregate cash purchase price of $7.1 million. Penguin Digital is a mobile application development

company that has an iPhone application that allows users to access their photos from iPhones or their

Facebook or Instagram accounts and create customized products and gifts from their mobile devices. The

acquisition was accounted for as a non-taxable purchase transaction and, accordingly, the purchase price

has been allocated to the acquired tangible assets, liabilities assumed, and identifiable intangible assets

acquired based on their estimated fair values on the acquisition date. The excess of the purchase price over

92