Shutterfly 2014 Annual Report Download - page 106

Download and view the complete annual report

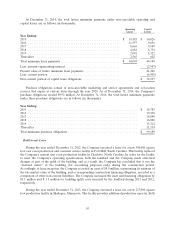

Please find page 106 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As of December 31, 2014, the Company is subject to taxation in the United States and Israel. The

Company is subject to examination for tax years including and after 2010 for federal income taxes. Certain

tax years outside the normal statute of limitation remain open to audit by tax authorities due to tax

attributes generated in those early years which have been carried forward and may be audited in

subsequent years when utilized.

The Company is currently under audit by the Internal Revenue Service (IRS) for the tax year ended

December 31, 2010. The Company is not aware of any proposed adjustments and it believes that the final

outcome of these examinations or agreements will not have a material effect on its results of operations as

of December 31, 2014.

Note 10 — Employee Benefit Plan

In 2000, the Company established a 401(k) plan under the provisions of which eligible employees may

contribute an amount up to 50% of their compensation on a pre-tax basis, subject to IRS limitations. The

Company matches employees’ contributions at the discretion of the Board.

In 2014 and 2013, there were no discretionary contributions.

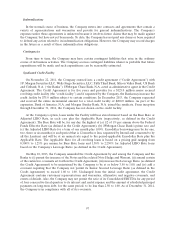

Note 11 — Share Repurchase Program

On October 24, 2012, the Company’s Board of Directors conditionally authorized and the Audit

Committee subsequently approved a share repurchase program for up to $60.0 million of the Company’s

common stock. On February 6, 2014, the Company’s Board of Directors approved an increase to the

program, authorizing the Company to repurchase up to $100.0 million of the Company’s common stock in

addition to any amounts repurchased as of that date. The share repurchase program is subject to prevailing

market conditions and other considerations; does not require the Company to repurchase any dollar

amount or number of shares; and may be suspended or discontinued at any time. The share repurchase

authorizations permit the Company to effect repurchases for cash from time to time through open market,

privately negotiated or other transactions, including pursuant to trading plans established in accordance

with Rules 10b5-1 and 10b-18 of the Securities Exchange Act of 1934, as amended, or by a combination of

such methods. As of December 31, 2014, the remaining authorized amount for stock repurchases under the

share repurchase program was $11.2 million.

In 2014, the Company repurchased 1,961,085 shares of its outstanding common stock at an average of

$45.29 per share pursuant to the share repurchase program.

In 2013, the Company repurchased 70,313 shares of its outstanding common stock at an average of

$31.87 per share pursuant to the share repurchase program.

In the second quarter of 2013, the Company repurchased 631,180 shares from purchasers of its 0.25%

senior convertible notes in privately negotiated transactions of outside the share repurchase program using

$30.0 million of the net proceeds of its issuance of the notes.

All repurchased shares of common stock have been retired.

105