Shutterfly 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

criteria for the fiscal year was met and the associated stock-based compensation has been

recognized.

(3) Also includes the PBRSUs issued to the Chief Executive Officer which are tied to multi-year

performance metrics and the Company’s stock performance relative to market measures. These

PBRSUs also have a three year service criteria. The Company valued the market criteria using a

Monte Carlo valuation model and took into consideration the likelihood of the market criteria

being achieved. Compensation cost associated with these PBRSUs is recognized on an accelerated

attribution model and ultimately based on whether or not satisfaction of the performance and

market criteria is probable. As of December 31, 2014, the performance criteria and market criteria

appear to be attainable and the Company recognized the associated stock-based compensation.

(4) Inducement awards are issued to newly hired officers and to certain new employees from acquired

companies. During 2014, inducement awards included time-based and performance based awards

issued to two newly hired officers and vest over four years.

During the years ended December 31, 2014 and 2013, the fair value of awards vested were

$56.8 million and $35.9 million, respectively.

At December 31, 2014, the Company had $97.9 million of total unrecognized stock-based

compensation expense, net of estimated forfeitures, related to stock options and RSUs that will be

recognized over a weighted-average period of approximately two years.

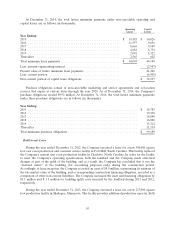

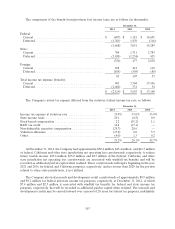

Note 9 — Income Taxes

Income before benefit from/(provision for) income taxes is as follows (in thousands):

Year Ended December 31,

2014 2013 2012

United States .................................... $ (10,317) $ 12,570 $ 40,024

Foreign ........................................ 338 350 134

Total .......................................... $ (9,979) $ 12,920 $ 40,158

102