Shutterfly 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

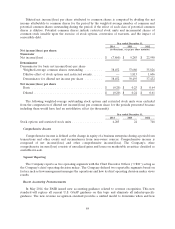

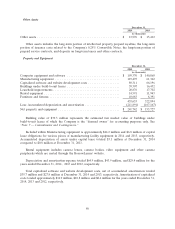

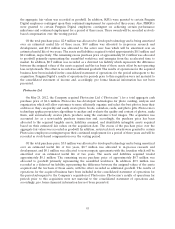

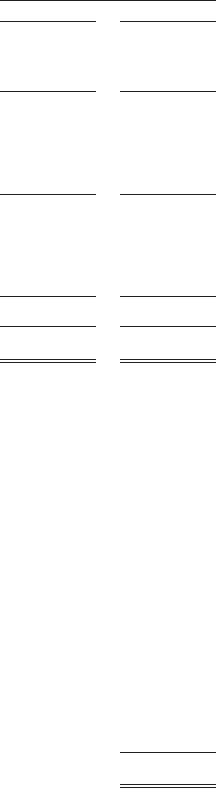

Intangible Assets

Intangible assets are comprised of the following:

Weighted Average December 31,

Useful Life

2014 2013

(in thousands)

Purchased technology ............................ 10 years $ 104,738 $ 104,553

Less: accumulated amortization ..................... (51,794) (35,653)

52,944 68,900

Customer relationships ........................... 5 years 75,146 74,576

Less: accumulated amortization ..................... (42,086) (27,452)

33,060 47,124

Licenses and other .............................. 3 years 7,202 6,692

Less: accumulated amortization ..................... (5,256) (4,095)

1,946 2,597

Total ........................................ $ 87,950 $ 118,621

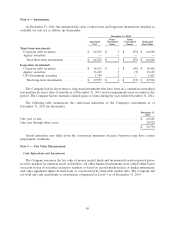

Purchased technology is amortized over a period ranging from one to sixteen years. Customer

relationships are amortized over a period ranging from one to seven years. Licenses and other is amortized

over a period ranging from two to five years.

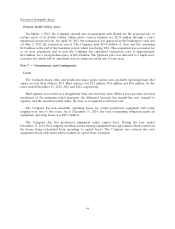

Intangible asset amortization expense for the years ended December 31, 2014, 2013 and 2012 was

$32.3 million, $29.5 million and $19.7 million, respectively. Amortization of existing intangible assets is

estimated to be as follows (in thousands):

Year Ending:

2015 .............................................................. $ 25,719

2016 .............................................................. 18,888

2017 .............................................................. 13,699

2018 .............................................................. 4,802

2019 .............................................................. 3,408

Thereafter .......................................................... 21,434

$ 87,950

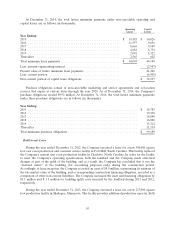

Goodwill

In the fourth quarter of 2014, the Company reassessed its reportable segments. As part of this review,

the Company determined that it had two reporting units; and that those two reporting units are also

reportable segments. Refer to Note 13 — Segment Reporting of the financial statements for discussion of

these two segments. In conjunction with the change to two reporting units, the Company allocated goodwill

to each reporting unit based on their relative fair values. The Company performed step one of the annual

goodwill impairment test for the years ended December 31, 2014 and 2013. The enterprise value exceeded

the carrying value for both periods and accordingly, no impairment was recorded.

87