Shutterfly 2014 Annual Report Download - page 84

Download and view the complete annual report

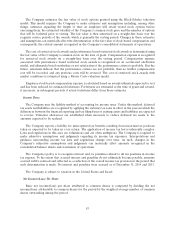

Please find page 84 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company estimates the fair value of stock options granted using the Black-Scholes valuation

model. This model requires the Company to make estimates and assumptions including, among other

things, estimates regarding the length of time an employee will retain vested stock options before

exercising them, the estimated volatility of the Company’s common stock price and the number of options

that will be forfeited prior to vesting. The fair value is then amortized on a straight-line basis over the

requisite service periods of the awards, which is generally the vesting period. Changes in these estimates

and assumptions can materially affect the determination of the fair value of stock-based compensation and

consequently, the related amount recognized in the Company’s consolidated statements of operations.

The cost of restricted stock awards and performance based restricted stock awards is determined using

the fair value of the Company’s common stock on the date of grant. Compensation expense is recognized

for restricted stock awards on a straight-line basis over the vesting period. Compensation expense

associated with performance based restricted stock awards is recognized on an accelerated attribution

model, and ultimately based on whether or not satisfaction of the performance criteria is probable. If in the

future, situations indicate that the performance criteria are not probable, then no further compensation

cost will be recorded, and any previous costs will be reversed. The cost of restricted stock awards with

market conditions is estimated using a Monte Carlo valuation model.

Employee stock-based compensation expense is calculated based on awards ultimately expected to vest

and has been reduced for estimated forfeitures. Forfeitures are estimated at the time of grant and revised,

if necessary, in subsequent periods if actual forfeitures differ from those estimates.

Income Taxes

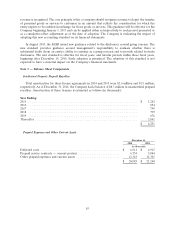

The Company uses the liability method of accounting for income taxes. Under this method, deferred

tax assets and liabilities are recognized by applying the statutory tax rates in effect in the years in which the

differences between the financial reporting and tax filing bases of existing assets and liabilities are expected

to reverse. Valuation allowances are established when necessary to reduce deferred tax assets to the

amounts expected to be realized.

The Company reports a liability for unrecognized tax benefits resulting from uncertain tax positions

taken or expected to be taken in a tax return. The application of income tax law is inherently complex.

Laws and regulations in this area are voluminous and are often ambiguous. The Company is required to

make subjective assumptions and judgments regarding its income tax exposures. Interpretations and

guidance surrounding income tax laws and regulations change over time. As such, changes in the

Company’s subjective assumptions and judgments can materially affect amounts recognized in the

consolidated balance sheets and statements of operations.

The Company’s policy is to recognize interest and /or penalties related to all tax positions in income

tax expense. To the extent that accrued interest and penalties do not ultimately become payable, amounts

accrued will be reduced and reflected as a reduction of the overall income tax provision in the period that

such determination is made. No interest and penalties were accrued as of December 31, 2014 and 2013.

The Company is subject to taxation in the United States and Israel.

Net Income/(Loss) Per Share

Basic net income/(loss) per share attributed to common shares is computed by dividing the net

income/(loss) attributable to common shares for the period by the weighted average number of common

shares outstanding during the period.

83