Shutterfly 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

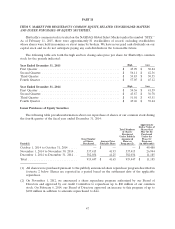

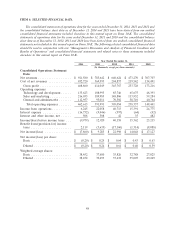

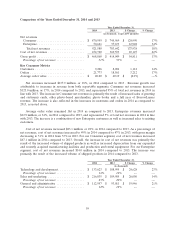

The chart above includes the following stock-based compensation amounts:

Year Ended December 31,

2014 2013 2012 2011 2010

(In thousands)

Cost of net revenues ............. $ 3,657 $ 2,485 $ 1,696 $ 2,138 $ 508

Technology and development ....... 9,236 9,477 8,635 8,201 3,069

Sales and marketing .............. 22,670 19,774 11,559 11,350 3,923

General and administration ........ 26,199 21,792 15,432 12,181 8,866

$ 61,762 $ 53,528 $ 37,322 $ 33,870 $ 16,366

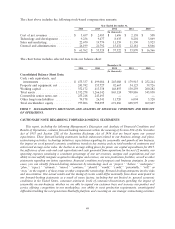

The chart below includes selected data from our balance sheet:

December 31,

2014 2013 2012 2011 2010

(In thousands)

Consolidated Balance Sheet Data:

Cash, cash equivalents, and

investments .................. $ 475,337 $ 499,084 $ 245,088 $ 179,915 $ 252,244

Property and equipment, net ....... 241,742 155,727 92,667 54,123 39,726

Working capital ................. 352,172 413,338 148,855 130,259 200,282

Total assets .................... 1,332,278 1,266,142 865,124 709,886 343,830

Convertible senior notes, net ....... 255,218 243,493 — — —

Other long-term liabilities ......... 74,178 26,341 11,720 6,094 3,320

Total stockholders’ equity .......... 757,806 788,095 691,286 608,997 269,607

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report, including the following Management’s Discussion and Analysis of Financial Condition and

Results of Operations, contains forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that are based upon our current

expectations. These forward-looking statements include statements related to our business strategy and plans,

restructuring activities, technology initiatives, expectations regarding the seasonality and growth of our business,

the impact on us of general economic conditions, trends in key metrics such as total number of customers and

orders and average order value, the decline in average selling prices for prints, our capital expenditures for 2015,

the sufficiency of our cash and cash equivalents and cash generated from operations for the next 12 months, our

operating expenses remaining a consistent percentage of our net revenues, mergers and acquisitions and our

ability to successfully integrate acquired technologies and services, our new production facilities, as well as other

statements regarding our future operations, financial condition and prospects and business strategies. In some

cases, you can identify forward-looking statements by terminology such as ‘‘project,’’ ‘‘believe,’’ ‘‘anticipate,’’

‘‘plan,’’ ‘‘expect,’’ ‘‘estimate,’’ ‘‘intend,’’ ‘‘continue,’’ ‘‘should,’’ ‘‘would,’’ ‘‘could,’’ ‘‘potentially,’’ ‘‘will,’’ or

‘‘may,’’ or the negative of these terms or other comparable terminology. Forward-looking statements involve risks

and uncertainties. Our actual results and the timing of events could differ materially from those anticipated in

our forward-looking statements as a result of many factors, including but not limited to, general economic

conditions in the United States, consumer sentiment, levels of consumer discretionary spending, the impact of

seasonality on our business, whether we are able to expand our customer base and increase our product and

service offering, competition in our marketplace, our ability to meet production requirements, unanticipated

difficulties building the next generation Shutterfly platform and executing on our strategic restructuring activities,

49