Shutterfly 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Warrant

Separately, in May 2013, the Company entered into warrant transactions (the ‘‘Warrant’’), whereby the

Company sold warrants to acquire shares of the Company’s common stock at a strike price of $83.18 per

share. The Company received aggregate proceeds of $43.6 million from the sale of the Warrant. If the

average market value per share of the Company’s common stock for the reporting period, as measured

under the Warrant, exceeds the strike price of the Warrant, the Warrant will have a dilutive effect on the

Company’s earnings per share. The Warrant is a separate transaction, entered into by the Company and is

not part of the Notes or the Note Hedge, and has been accounted for as part of additional paid-in capital.

Holders of the Notes and Note Hedge will not have any rights with respect to the Warrant.

Note 13 — Segment Reporting

The Company reports segment information based on the ‘‘management’’ approach. The management

approach designates the internal reporting used by management for making decisions and assessing

performance as the source of its reportable segments.

The Company’s Chief Operating Decision Maker (‘‘CODM’’) function is comprised of its chief

executive officer. Effective in the fourth quarter of 2014, the Company defined two reportable segments

based on factors such as how management manages the operations and how the chief operating decision

maker views results. Prior to the fourth quarter of 2014, the Company reported as a single operating and

reportable segment. Accordingly, the Company has recasted its financial information and disclosures for

prior periods to reflect the segment disclosures as if the current operating structure had been in effect

throughout all periods presented.

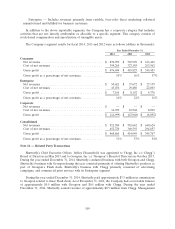

The CODM function uses gross profit to evaluate the performance of the segments and allocate

resources. Management considers gross margin to be the appropriate metric to evaluate and compare the

ongoing performance of each reportable segment as it is the level which direct costs associated with the

performance of the segment are monitored. Cost of revenue for the Consumer segment consists of costs

directly attributable to the production of personalized products for all of the Company’s brands, including

direct materials, shipping charges, and payroll and related expenses for direct labor; rent for production

facilities, and depreciation of production equipment and facilities where we are the deemed owner. Cost of

revenue for the Enterprise segment consists of costs which are direct and incremental to the Enterprise

business. These include production costs of Enterprise products, such as materials, labor and printing costs

and costs associated with third-party production of goods. They also include shipping costs and indirect

overhead.

Due to the nature of the Company’s operations, a majority of its assets are utilized across all segments.

In addition, segment assets are not reported to, or used by, the CODM to allocate resources or assess

performance of the Company’s segments. Accordingly, the Company has not disclosed asset information

by segment.

The Company’s segments are determined based on the products and services it provides and how the

CODM evaluates the business. The Company has the following reportable segments:

Consumer — Includes sales from the Company’s brands and are derived from the sale of photo-

based products, such as photo books, stationery and greeting cards, other photo-based merchandise,

photo prints, and the related shipping revenues as well as rental revenue from its BorrowLenses

brand.

108