Shutterfly 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

for California tax purposes, and 15 years for Arizona purposes. The research and development tax credit

will expire starting in 2021 for federal and 2024 for Arizona.

Internal Revenue Code limits the use of net operating loss and tax credit carryforwards in the case of

an ‘‘ownership change’’ of a corporation. Any ownership changes, as defined, may restrict utilization of

carryforwards.

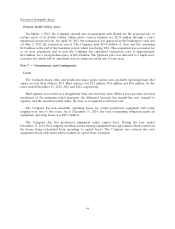

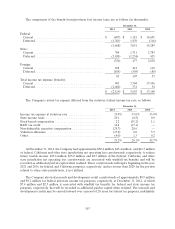

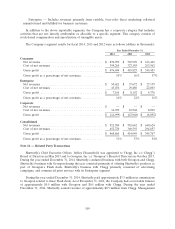

The components of the net deferred tax assets as of December 31, 2014 and 2013 are as follows

(in thousands):

December 31,

2014 2013

Deferred tax assets:

Net operating loss carryforwards .............................. $ 6,672 $ 4,994

Reserves and other tax benefits ............................... 41,549 30,704

Tax credits .............................................. 7,211 5,296

Deferred tax assets ....................................... 55,432 40,994

Valuation allowance ...................................... (4,850) (2,872)

Net deferred tax assets .................................. 50,582 38,122

Deferred tax liabilities:

Depreciation and amortization ................................ (63,478) (53,655)

Net deferred tax assets / (liabilities) ......................... $ (12,896) $ (15,533)

Realization of deferred tax assets is dependent upon the generation of future taxable income, if any,

the timing and amount of which are uncertain. The valuation allowance related to deferred income taxes

was $4.9 million as of December 31, 2014 and $2.9 million as of December 31, 2013. The increase in the

valuation allowance was attributed to the Company’s generation of certain California and South Carolina

deferred tax assets which it believes it will not be able to utilize.

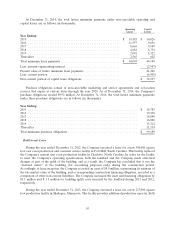

As of December 31, 2014, the Company had $8.6 million of unrecognized tax benefits. A reconciliation

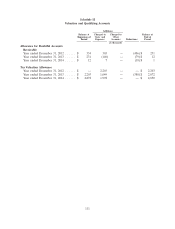

of the beginning and ending amounts of unrecognized income tax benefits is as follows (in thousands):

2014 2013 2012

Balance of unrecognized tax benefits at January 1 ......... $ 7,035 $ 5,445 $ 4,364

Additions for tax positions of prior years .............. 41 22 137

Additions for tax positions related to current year ........ 1,502 1,811 1,009

Reductions for tax positions of prior years ............. (12) (243) (65)

Balance of unrecognized tax benefits at December 31 ....... $ 8,566 $ 7,035 $ 5,445

If the $8.6 million of unrecognized tax benefits as of December 31, 2014 is recognized, approximately

$4.9 million would decrease the effective tax rate in the period in which each of the benefits is recognized.

The remaining amount would be offset by the reversal of related deferred tax assets on which a valuation

allowance is placed. The Company does not expect any material changes to its unrecognized tax benefits

within the next twelve months.

The Company provides for federal income taxes on the earnings of its foreign subsidiary, as such,

earnings are currently recognized as US taxable income.

104