Samsung 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90 91 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

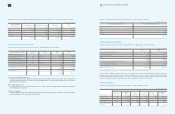

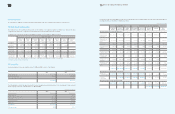

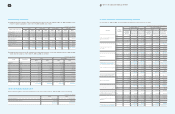

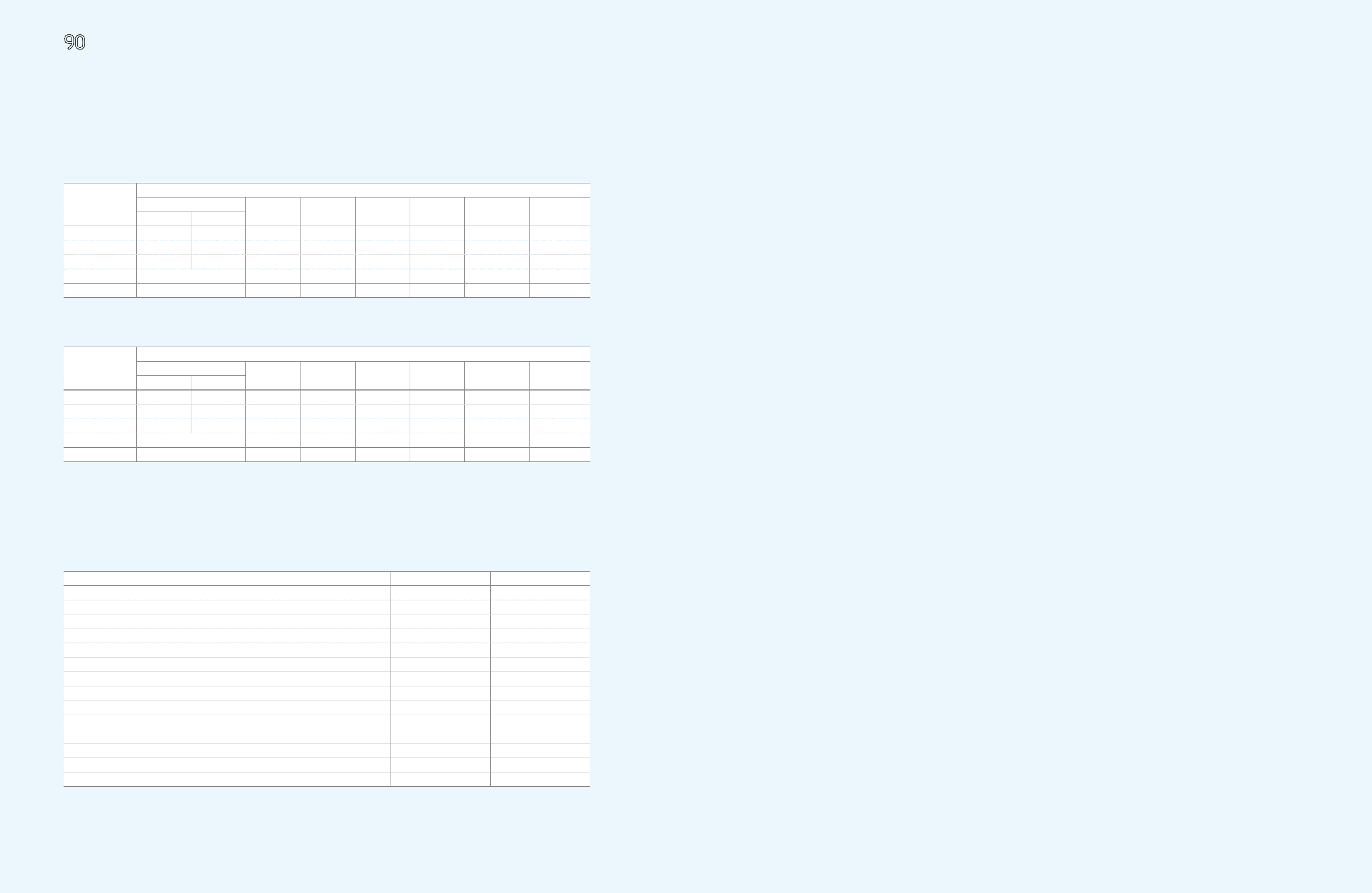

Operating data of entities classified according to geographic area as of and for the year ended December 31, 2009:

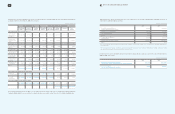

Operating data of entities classified according to geographic area as of and for the year ended December 31, 2008:

The presentation and classification of 2008 was revised for comparability with 2009 presentation.

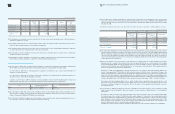

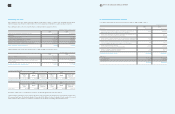

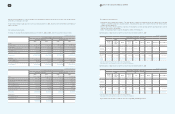

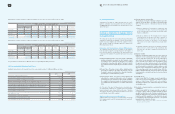

35. Transaction Not Affecting Cash Flows

Significant transactions not affecting cash flows for the years ended December 31, 2009 and 2008, are as follows:

(In millions of Korean won)

2009 Summary of Business by Geographic Area

Korea Americas Europe Asia China Elimination Consolidated

Domestic Export

Gross sales

₩

23,621,415

₩

89,803,515

₩

57,989,166

₩

61,858,546

₩

31,974,561

₩

57,906,677

₩

(184,160,209)

₩

138,993,671

Intersegment sales (7,675,455) (81,114,716) (24,280,566) (25,675,454) (11,267,712) (34,146,306) 184,160,209 -

Net sales

₩

15,945,960

₩

8,688,799

₩

33,708,600

₩

36,183,092

₩

20,706,849

₩

23,760,371 - 138,993,671

Operating profit

₩

7,159,467

₩

693,309

₩

1,519,223

₩

900,295

₩

1,372,120

₩

(66,763)

₩

11,577,651

Total assets

₩

107,984,087

₩

21,718,611

₩

17,188,362

₩

8,659,632

₩

13,744,617

₩

(51,013,821)

₩

118,281,488

(In millions of Korean won)

2008 Summary of Business by Geographic Area

Korea Americas Europe Asia China Elimination Consolidated

Domestic Export

Gross sales

₩

21,398,073

₩

69,074,728

₩

45,246,448

₩

54,416,816

₩

29,242,661

₩

46,674,677

₩

(144,759,084) 121,294,319

Intersegment sales (5,935,230) (60,976,594) (19,804,936) (20,186,680) (10,053,631) (27,802,013) 144,759,084 -

Net sales

₩

15,462,843

₩

8,098,134

₩

25,441,512

₩

34,230,136 19,189,030 18,872,664 - 121,294,319

Operating profit

₩

4,648,865

₩

90,559

₩

261,827

₩

301,440

₩

404,699

₩

324,473

₩

6,031,863

Total assets

₩

94,013,961

₩

18,887,777

₩

13,927,357

₩

7,218,168

₩

9,161,228

₩

(37,907,841)

₩

105,300,650

(In millions of Korean won)

2009 2008

Write-off of accounts receivables and others

₩

330,405

₩

502,243

Increase in gain on valuation of available-for-sale securities 195,045 656,703

Increase in loss on valuation of available-for-sale securities 673 28,656

Decrease in gain on valuation of available-for-sale securities due to disposal 9,147 3,983

Decrease in loss on valuation of available-for-sale-securities due to disposal - 143

Increase in share of equity-method investees’ accumulated other comprehensive income 104,588 7,111

Decrease in share of equity-method investees’ accumulated other comprehensive loss 4,152 6,309

Current maturities of long-term prepaid expenses 2,279,226 217,812

Current maturities of long-term debts 4,852 71,465

Reclassification of construction-in-progress and machinery-in-transit to other property, plant

and equipment accounts 8,697,452 10,297,439

Current maturities of other long-term liabilities 1,702,836 303,914

Current maturities of long-term advances received - 168,650

Current maturities of long-term accrued expenses 321,500 270,702

36. Subsequent Event

Subsequent to December 31, 2009, Samsung Card, one of SEC

domestic subsidiary issued unguaranteed bonds amounting to

₩

320,000 million (bond issue number 1831 through 1844) as of the

date of this report.

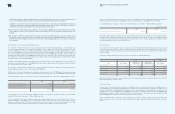

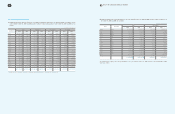

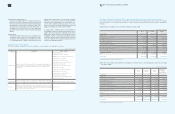

37. Transition to International Financial Reporting

Standards as Adopted by the Republic of Korea

from Generally Accepted Accounting Principle in

the Republic of Korea.

The Company will adopt the International Financial Reporting

Standards as Adopted by the Republic of Korea (“Korean IFRS”)

from the fiscal year 2010 (the date of first-time adoption to Korean

IFRS: January 1, 2010). The Company’s approach to adopt Korean

IFRS is illustrated as follows:

Preparation and implementation of Korean IFRS adoption

The Company formed a task force to prepare for its transition

from Generally Accepted Accounting Principle in the Republic of

Korea (“Korean GAAP”) to Korean IFRS. The three phases being

conducted for the transition to Korean IFRS by the task force are as

follows:

(1)

Analysis and Planning Phase : This phase includes a preliminary

analysis and impact assessments over the Company’s current

accounting policies, financial reporting process including

determination of reporting entity, and the IT systems to identify

key areas that would be impacted by the transition to Korean

IFRS.

(2) Design Phase: This phase includes further detailed analysis

and employee training on the impact assessments over the

Company’s current accounting policies, financial information

generating process and information systems.

(3) Implementation Phase: This phase includes applying and

embedding the changes identified above in the Company’s

operational processes and system. The Company anticipates

the completion of this phase enables the Company to provide

accountable financial information in accordance with Korean

IFRS.

As of the date of the report, all three phases as described above

are substantially completed. The Company has been preparing

financial statements under Korean IFRS from the date of transition

and onwards and expects that financial information for the fiscal

year 2010 will be Korean IFRS compliant.

Significant differences in accounting policies

Significant differences between the accounting policies chosen by

the Company under Korean IFRS and under previous Korean GAAP

are as follows:

(1) First time adoption of Korean IFRS

The Company elected the following exemptions upon the

adoption of Korean IFRS in accordance with Korean IFRS

1011, First-time adoption of international financial reporting

standards:

1) Business combination: Past business combinations that

occurred before the date of transition to Korean IFRS will

not be retrospectively restated under Korean IFRS 1103,

Business combinations.

2) Fair value as deemed cost: The Company elects to measure

certain land assets at fair value at the date of transition to

Korean IFRS and use the fair value as its deemed cost.

Valuations were made on the basis of recent market

transactions on the arm's length terms by independent

valuers.

3) Cumulative translation differences: All cumulative translation

gains and losses arising from foreign subsidiaries and

associates as of the date of transition to Korean IFRS are

reset to zero.

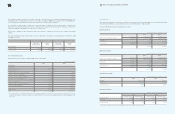

(2) Employee benefits

Employees and directors with at least one year of service are

entitled to receive a lump-sum payment upon termination

of their employment with SEC, its Korean subsidiaries

and certain foreign subsidiaries, based on their length of

service and rate of pay at the time of termination. Under

the previous severance policy pursuant to Korean GAAP,

Accrued severance benefits represented the amount which

would be payable assuming all eligible employees and

directors were to terminate their employment as of the end

of the reporting period. However, under Korean IFRS, the

liability is determined based on the present value of expected

future payments calculated and reported using actuarial

assumptions.

(3) Intangible assets

Under Korean GAAP the Company recorded expenditures

related to research and development activities as current

expense. Under Korean IFRS if such costs related to

development activities meet certain criteria they are recorded

as intangible assets.

(4) Goodwill or bargain purchase acquired by business

combinations

Under Korean GAAP, the Company amortizes goodwill or

recognizes a gain in relation to bargain purchase (negative

goodwill

1

) acquired as a result of business combinations on a

straight-line method over five years from the year of acquisition.

Under Korean IFRS, goodwill is not amortized but reviewed

for impairment annually. Bargain purchase is recognized

immediately in the statement of income.

1. Negative goodwill under Korean GAAP is referred to as bargain

purchase under Korean IFRS