Samsung 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

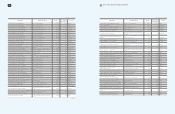

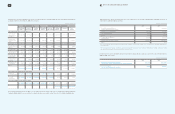

70 71 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

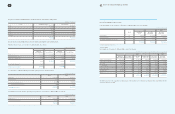

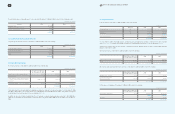

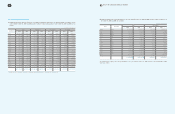

Maturities of foreign currency notes and bonds, outstanding as of December 31, 2009, are as follows:

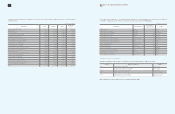

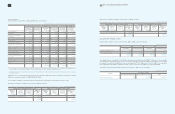

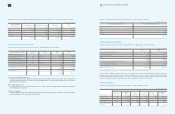

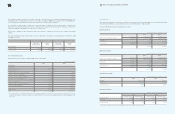

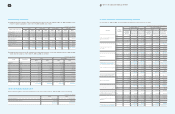

17. Accrued Severance Benefits

Change in accrued severance benefits for the years ended December 31, 2009 and 2008, consist of the following:

1. Others include amounts from changes in scope of consolidation and changes in foreign currency exchange rates.

As of December 31, 2009, the Company funded 66.5% of severance payable through severance insurance deposits with Samsung Life

Insurance and Samsung Fire & Marin Insurance. In addition, Samsung Card, one of SEC’s domestic subsidiaries, implemented a defined

benefit pension plan with Samsung Life Insurance in accordance with Employee Retirement Benefit Security Act. Retirement pension plan

assets as of December 31, 2009 consist primarily of cash and cash equivalents (95.2%) and securities (2.7%).

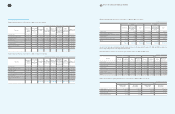

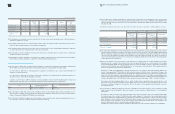

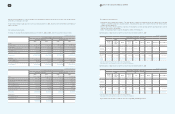

18. Accrued expense

Changes in main liability provisions for the years ended December 31, 2009 and 2008, are as follows:

(In millions of Korean won)

(In millions of Korean won)

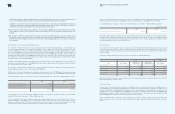

(In millions of Korean won)

For the Years Ending December 31 Foreign Currency Notes and Bonds

2010

₩

210,168

2011 5,838

2012 5,838

2013 5,838

Thereafter 110,922

₩

338,604

2009 2008

Balance at the beginning of the year

₩

2,313,423

₩

2,041,713

Provision for severance benefits 645,440 543,980

Actual severance payments (545,090) (286,875)

Others 180,757 14,605

2,494,530 2,313,423

Less: Cumulative deposits to the National Pension Fund (8,814) (10,190)

Severance insurance deposits (400,029) (1,391,194)

Retirement pension operating assets (1,257,882) (61,806)

Balance at the end of the year

₩

827,805

₩

850,233

2009

Reference January 1,

2009 Increase Decrease Others1December 31,

2009

Warranty reserves (A)

₩

1,343,692

₩

2,072,069

₩

1,911,825

₩

(61,848)

₩

1,442,088

Royalty expenses (B) 1,326,239 778,480 538,910 (4,854) 1,560,955

Long-term incentives (C) 176,887 132,200 64,644 - 244,443

Point reserves (D) 163,099 218,345 214,539 - 166,905

Allowance for undrawn

commitment (E) 232,880 5,716 - - 238,596

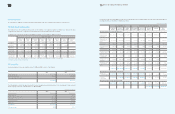

Maturities of long-term debts outstanding, excluding premiums and discounts on debentures, as of December 31, 2009, are as follows:

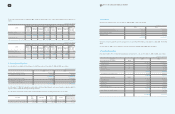

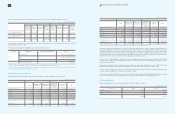

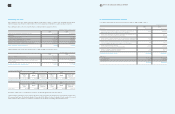

16. Foreign Currency Notes and Bonds

Unsecured foreign currency notes and bonds as of December 31, 2009 and 2008, consist of the following:

(A) US dollar denominated straight bonds

On October 2, 1997, SEC issued straight bonds in the amount of US$ 100 million at 99.85% of face value. The bonds bear interest

at 7.7% per annum and will mature on October 1, 2027, with repayments to be made annually for 20 years after a ten-year grace

period from the date of issuance.

(B) US dollar floating rate notes

US dollar floating rate notes issued by Samsung Card, one of SEC’s domestic subsidiaries, will be repaid at their maturities.

Interests will be paid every quarter.

(C) Overseas subsidiaries

Overseas subsidiaries' bonds will be repaid at maturities with the biannual interest payments over the terms of the bonds. SEC has

provided guarantees over the overseas subsidiaries' bonds.

(In millions of Korean won)

(In millions of Korean won)

For the Years Ending

December 31 Local Currency Loans Foreign Currency Loans Debentures Total

2010

₩

624,852

₩

193,834

₩

2,100,000

₩

2,918,686

2011 304,850 739,796 1,690,000 2,734,646

2012 2,430 36,549 480,000 518,979

2013 - 68,816 100,000 168,816

Thereafter - 93,946 30,000 123,946

₩

932,132

₩

1,132,941

₩

4,400,000

₩

6,465,073

SEC and domestic subsidiary Reference Due Date 2009 2008

SEC and domestic subsidiary

US dollar denominated straight bonds (A) October 1, 2027

₩

105,084

₩

119,463

US dollar floating rate notes (B) August 28, 2010 204,330 220,063

SEC and domestic subsidiary

US dollar denominated fixed rate notes (C) - - 31,438

US dollar denominated fixed rate notes (C) April 1, 2030 29,190 31,438

338,604 402,402

Less: Discounts (4,658) (5,700)

333,946 396,702

Current maturities (209,763) (6,009)

₩

124,183

₩

390,693