Samsung 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

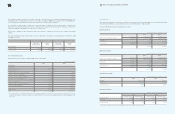

74 75 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

On February 5, 2010, the Company and Sharp Corporation announced that they agreed to enter into cross licensing agreement for

the use of crystal liquid panel patents. As part of the agreement, the related lawsuits and claims were withdrawn.

In addition to cases mentioned above, the Company has been involved in various claims and proceedings during the normal course

of business. The Company's management believes that, although the outcome of these matters is uncertain, the conclusion of

these matters will not have a material adverse effect on financial position of the Company.

(H)

As of December 31, 2009, Living Plaza has provided two notes amounting to

₩

30,000 million, to financial institutions as collaterals

for the fulfillment of certain contracts, which do not have a direct adverse effect on the operations or financial position of the

Company.

(I) On December 15, 2009, the Company announced it would acquire Samsung Digital Imaging Co., Ltd., with a planned closing

date of April 1, 2010. According to the terms of the transaction, the shareholders of Samsung Digital Imaging Co., Ltd. will receive

0.0577663 shares of the Company’s common stock for each share of Samsung Digital Imaging Co., Ltd, common stock owned on

the closing date.

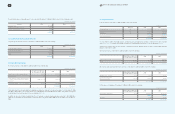

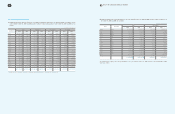

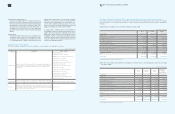

20. Financial assets transferred to third parties

As of December 31, 2009, SEA and five other overseas subsidiaries have agreements with financial institutions to sell certain eligible trade

accounts receivable under which, on an ongoing basis, a maximum of US$1,117 million can be sold. SEC and Living Plaza, one of SEC’s

domestic subsidiaries, have trade notes receivable discounting facilities with financial institutions, including Shinhan Bank with a combined

limit of up to

₩

785,000 million. SEC has trade financing agreement with 23 banks including Woori Bank for up to US$10,229 million and

an accounts receivable factoring agreement with Korea Exchange Bank for up to

₩

150,000 million. In addition, SEC has a credit sales

facility agreement with Woori Bank (up to

₩

70,000 million) and assumes recourse obligations on the receivables where the extensions have

been granted on the credit periods. The Company also has loan facilities with accounts receivable pledged as collaterals with four banks,

including Woori Bank, for up to

₩

1,049,200 million.

In addition, Samsung Mobile Display has trade financing agreement with Woori Bank for up to

₩

340 million, trade note receivable loan

facility with Korea Exchange Bank for up to

₩

10,000 million, and export bill negotiation agreement with four banks including Woori Bank for

up to US$ 185 million as of December 31, 2009.

As of December 31, 2009, Samsung Card and three other domestic subsidiaries has entered into a letter of credit facility agreement with 4

banks including Shinhan bank for up to US$ 48.5 million and

₩

56,600 million.

SEMES and two other domestic subsidiaries have credit purchase facility agreements of up to

₩

97,000 million with Korean banks, including

Hana Bank, and S-LCD and one other domestic subsidiaries have general term loan facilities of up to

₩

310,000 million with Kookmin Bank.

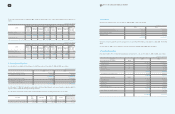

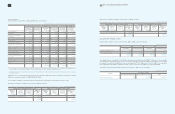

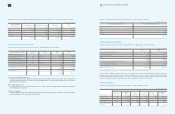

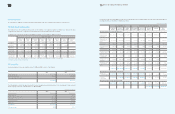

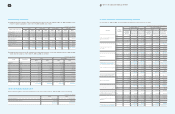

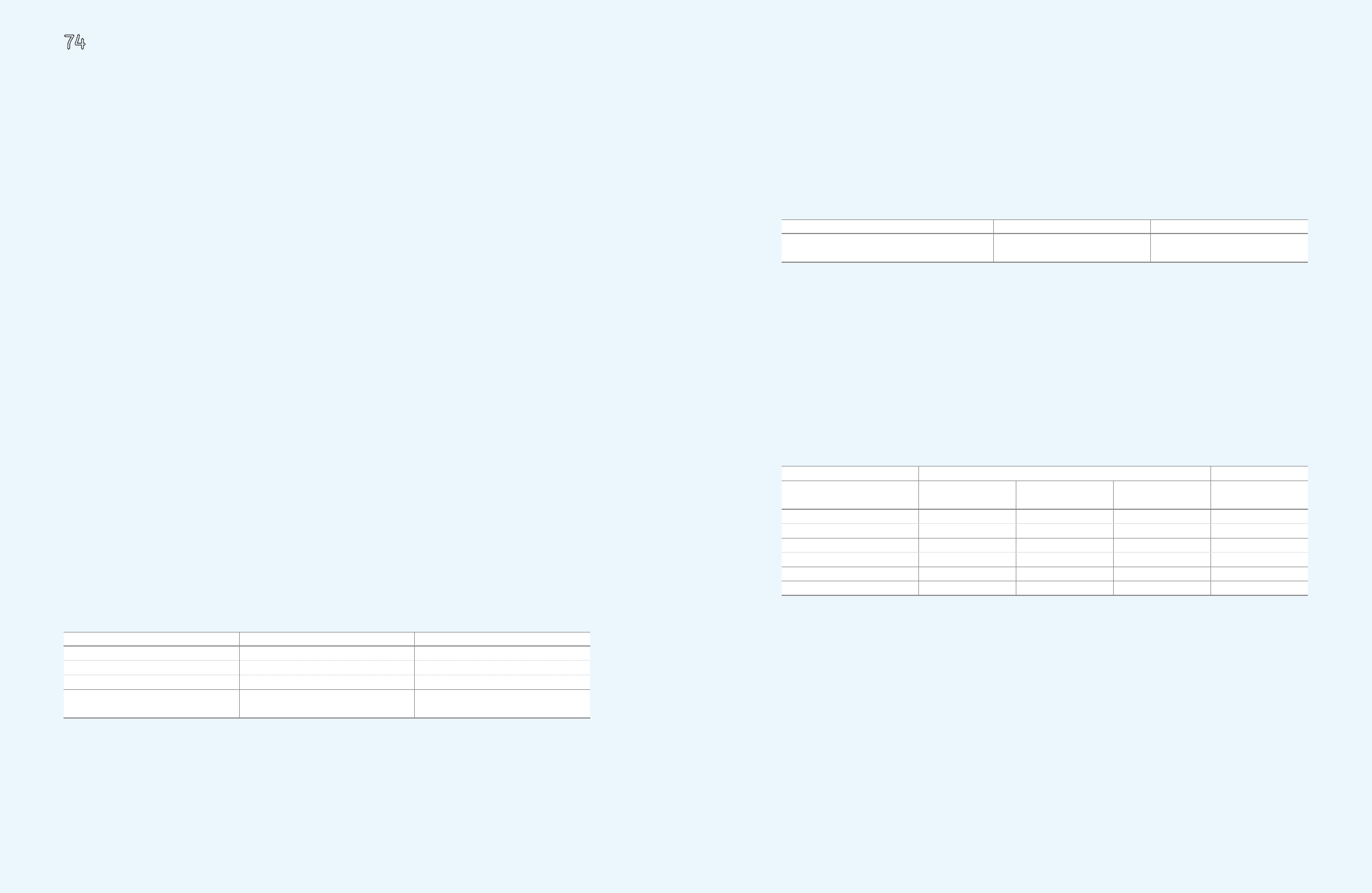

The outstanding balance of trade accounts and notes receivable sold to financial institutions as of December 31, 2009 and 2008, are as follows:

As a consolidation entry to account for the sale of subsidiaries’ receivables, the Company has recognized borrowings of

₩

3,532,133 million

and

₩

3,055,270 million as of December 31, 2009 and 2008, respectively.

A domestic subsidiary of the Company, Samsung Card transferred certain eligible financial assets in accordance with the Act on Asset

Backed Securitization of the Republic of Korea to several financial institutions (“FIs”). The transfer is with recourse and was completed

through a Special Purpose Entity (“SPE”) issued securities. In the event of non-performance of those transferred financial assets within

certain measurement criteria noted in the transfer agreement, the Samsung Card is obliged to redeem the issued securities.

A transfer of the financial assets has been recognized as a sale, and accordingly has been derecognized from the financial statements. Total

financial assets transferred amounted to

₩

440,000 million for the year ended December 31, 2009 (2008:

₩

1,575,061 million).

The outstanding balances of financing receivables sold to financial institutions as of December 31, 2009 and 2008, are as follows:

From 2003 to 2005, Samsung Card transferred credit card receivables and financial assets to SangRokSoo 1st Securitization Specialty,

Badbank Harmony and Badbank Heemang Moah Securitization Specialty in accordance with the “personal credit rehabilitation” program

in exchange for cash, preferred stock and subordinated bonds. The preferred stock is recorded as available-for-sale securities, while the

subordinated bonds are recorded as held-to-maturity securities.

21. Derivatives

In accordance with its risk management policy, the Company uses derivative instruments, primarily forward exchange contracts, foreign

currency swap and interest rate swap contracts to hedge foreign currency exchange rate risks and floating interest rate exposures. The

Company designates the forward exchange contracts as fair value hedges, and the foreign currency swap and interest rate swap contacts

as cash flow hedges.

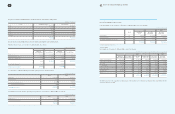

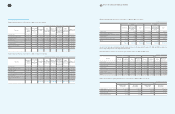

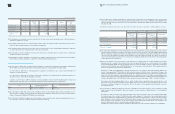

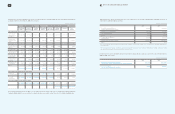

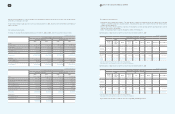

A summary of derivative transactions as of and for the year ended December 31, 2009 and 2008, follows:

Of the amounts charged to accumulated other comprehensive income in equity from the valuation of derivative instruments, a loss of

₩

3,937

million will be realized by December 31, 2010.

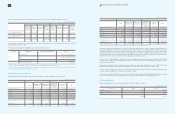

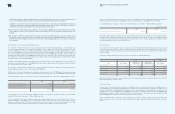

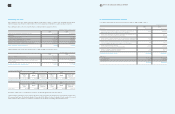

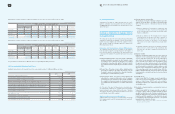

22. Capital Stock

Under its Articles of Incorporation, SEC is authorized to issue 500 million shares of capital stock with a par value of

₩

5,000 per share, of

which 100 million shares are cumulative, participating preferred stock that are non-voting and entitled to a minimum cash dividend at 9% of

par value. In addition, SEC is authorized to issue to investors, other than current shareholders, convertible debentures and debentures with

warrants with face values up to

₩

4,000 billion and

₩

2,000 billion, respectively. The convertible debentures amounting to

₩

3,000 billion and

₩

1,000 billion are assigned to common stock and preferred stock, respectively. While the debentures with warrants amounting to

₩

1,500

billion and

₩

500 billion are assigned to common stock and preferred stock, respectively.

SEC is also authorized, subject to the Board of Directors’ approval, to issue shares of common or preferred stock to investors other than

current shareholders for issuance of depository receipts, general public subscription, urgent financing with financial institutions, and strategic

alliance.

2009 2008

Asset-backed securities with recourse

₩

660,862

₩

1,380,735

Trade accounts receivable with recourse 256,059 567,121

Trade accounts receivable without recourse 681,401 843,032

₩

1,598,322

₩

2,790,888

2009 2008

Asset-backed securities with limited recourse

₩

3,486,704

₩

3,795,418

2009 2008

Type Asset (Liability) Gain (Loss)

on Valuation (I/S)

Gain (Loss)

on Valuation (Equity) Asset (Liability)

Forward exchange

₩

16,242

₩

18,318

₩

-

₩

59,105

(14,958) (15,153) - (62,942)

Interest rate swap

₩

481

₩

-

₩

-

₩

502

(13,934) - (13,453) (39,717)

Currency swap

₩

44,535

₩

-

₩

-

₩

122,385

- (20,228) (3,568) -

(In millions of Korean won)

(In millions of Korean won)

(In millions of Korean won)