Samsung 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

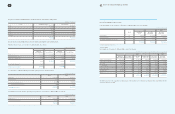

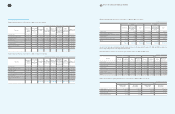

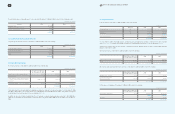

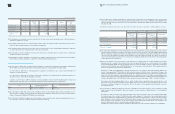

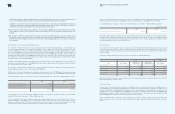

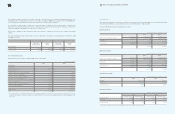

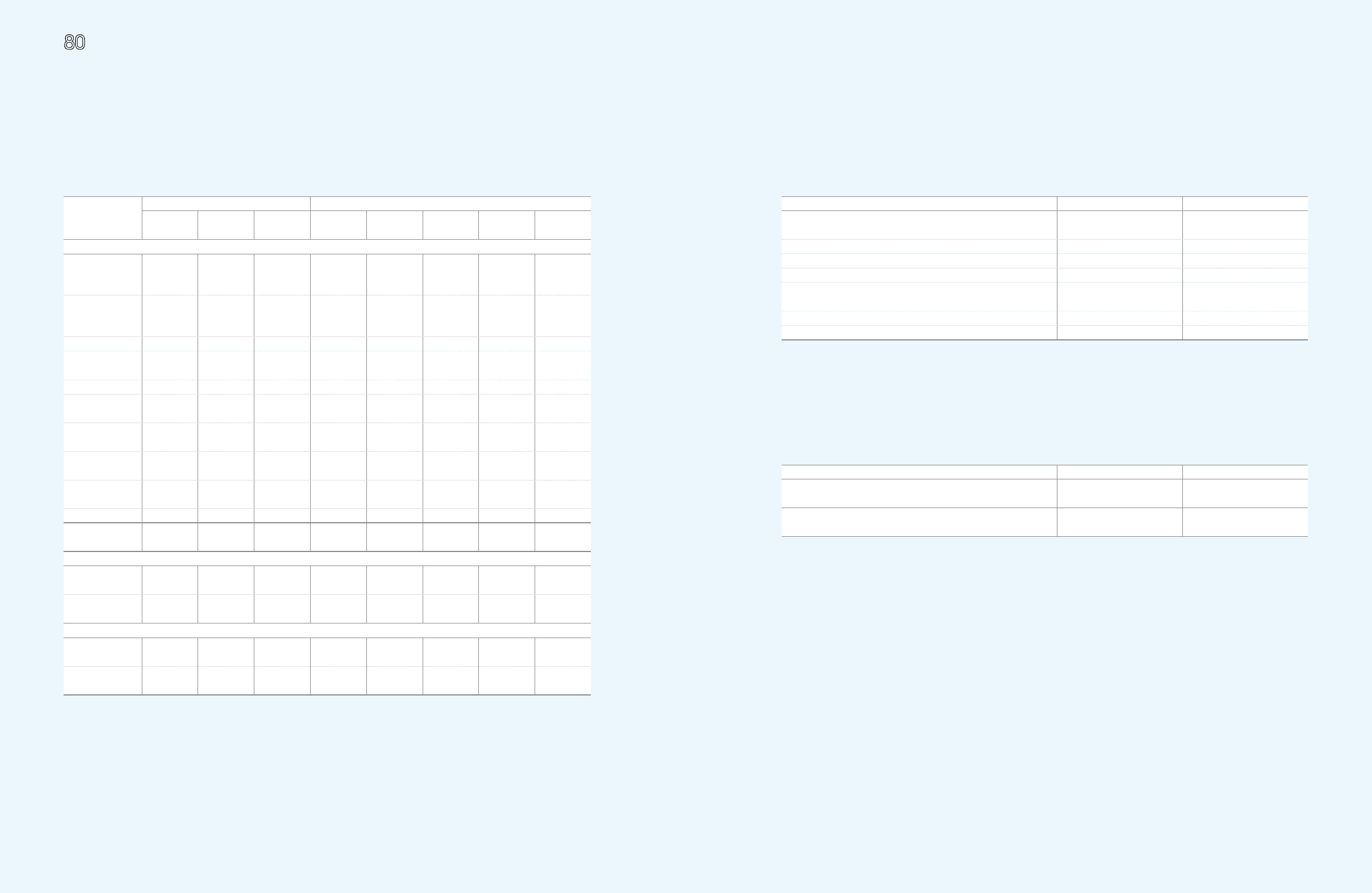

80 81 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Deferred income tax assets and liabilities from tax effect of temporary differences including available tax credit carryforwards and undisposed

accumulated deficit as of December 31, 2008, were as follows:

The Company periodically assesses its ability to recover deferred income tax assets. In the event of a significant uncertainty regarding the

Company's ultimate ability to recover such assets, a valuation allowance is recorded to reduce the assets to its estimated realizable value.

(In millions of Korea won)

Temporary Differences Deferred Income Tax Asset (Liabilities)

Beginning

Balance

Increase

(Decrease)

Ending

Balance

Beginning

Balance

Increase

(Decrease)

Ending

Balance Current Non-

Current

Deferred tax arising from temporary differences

Special reserves

appropriated for

tax purposes

₩ (

1,455,564)

₩

173,270

₩

(1,282,294)

₩

(400,280)

₩

104,151

₩

(296,129)

₩

(154,271)

₩

(141,858)

Equity-method

investments and

others

(4,097,827) (1,124,707) (5,222,534) (508,715) (87,415) (596,130) - (596,130)

Depreciation (369,242) 310,779 (58,463) (123,485) 68,982 (54,503) 15,995 (70,498)

Capitalized interest

Expense (49,718) 5,691 (44,027) (13,673) 3,988 (9,685) - (9,685)

Accrued income (209,713) (13,892) (223,605) (57,577) 3,513 (54,064) (54,064) -

Allowance(technical

expense, others) 2,485,219 841,039 3,326,258 691,150 154,903 846,053 754,929 91,124

Deferred foreign

exchange gains 20,959 7,443 28,402 5,840 1,680 7,520 5,630 1,890

Foreign currency

translation - 486,833 486,833 - 115,933 115,933 85,224 30,709

Impairment losses

on investments 508,150 8,808 516,958 139,541 (25,718) 113,823 - 113,823

Others 1,115,978 734,838 1,850,816 258,692 263,561 522,253 473,480 48,773

₩

(2,051,758)

₩

1,430,102

₩

(621,656)

₩

(8,507)

₩

603,578 595,071 1,126,923 (531,852)

Deferred tax assets arising from the carryforwards

Undisposed

accumulated deficit

₩

3,226,268

₩

(772,852)

₩

2,453,416

₩

306,323

₩

(127,372) 178,951 77,464 101,487

Tax credit

carryforwards

₩

1,240,611

₩

101,504

₩

1,342,115

₩

791,219

₩

142,325 933,544 931,120 2,424

Deferred tax relating to items charged to equity

₩

(3,562,501)

₩

(1,615,393)

₩

(5,177,894)

₩

(755,003)

₩

72,831 (682,172) (2,920) (679,252)

₩

1,025,394

₩

2,132,587

₩

(1,107,193)

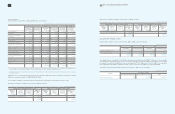

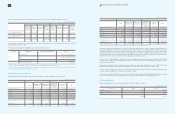

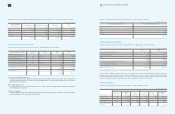

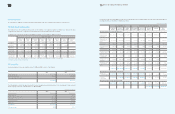

Temporary differences, whose deferred tax effects were not recognized due to the uncertainty regarding ultimate realizability such assets, as

of December 31, 2009 and 2008, are as follows:

1. It is uncertain that the temporary differences arising from the revaluation of the land are realizable as it is uncertain that the land will be disposed in the

foreseeable future.

2. The Company does not expect cash inflows, such as proceeds from the disposal of, or receipts of dividends from earnings arising from certain

subsidiaries and equity method investments within the foreseeable future.

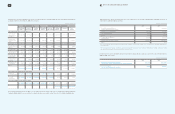

Deferred income tax assets and liabilities and income tax expense charged directly to equity as of and for the years ended December 31,

2009 and 2008, are as follows:

(In millions of Korean won)

2009 2008

Ⅰ

. Deductible temporary differences

Equity-method investments and others 2

₩

87,629

₩

588,783

Undisposed accumulated deficit 1,391,786 1,700,465

Tax credit carryforwards 381,534 305,227

Others 53,658 50,383

Ⅱ

. Taxable temporary differences

Land revaluation 1 (397,985) (397,985)

Equity-method investments and others 2 (3,668,470) (2,924,351)

Others (1) (201)

(In millions of Korean won)

2009 2008

Ⅰ

. Deferred income tax assets and liabilities

Gain (Loss) on valuation of available-for-sale securities and others

₩

(639,912)

₩

(682,172)

Ⅱ

. Income tax expense

Gain on sale of treasury stock and others

₩

2,994

₩

(2,622)